We can do a lot, with just a little

By answering a couple of simple questions about you, we can

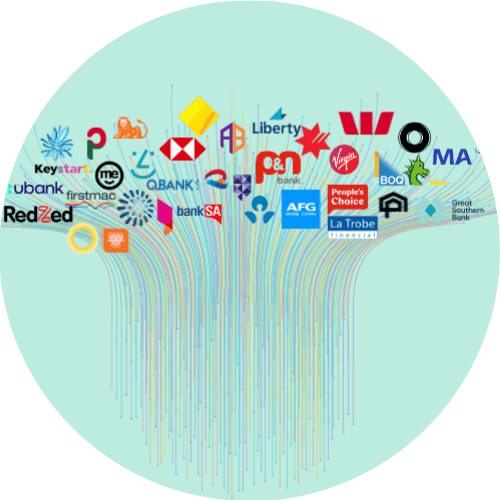

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

A Simple Guide To Finding The Best Home Loan Refinance Rates

As you begin looking for the best home loan refinance rates, you’ll soon notice that mortgages can often feel like a puzzle. Each piece of this puzzle slowly reveals the complexity of interest rates, terms, and endless jargon that you have to sort through yourself. Understandably, this can get a tad bit overwhelming.

So, what if you had a way to easily find the best home loan refinance rates for you? Read on – we’ve got some delightful discoveries ahead with Craggle!

Craggle’s edge: making mortgages marvellous

Getting started with Craggle

At Craggle, we firmly believe in the strength of unity. Why navigate the complex world of refinance mortgage rates on your own? Beginning your journey with Craggle is a user-friendly process.

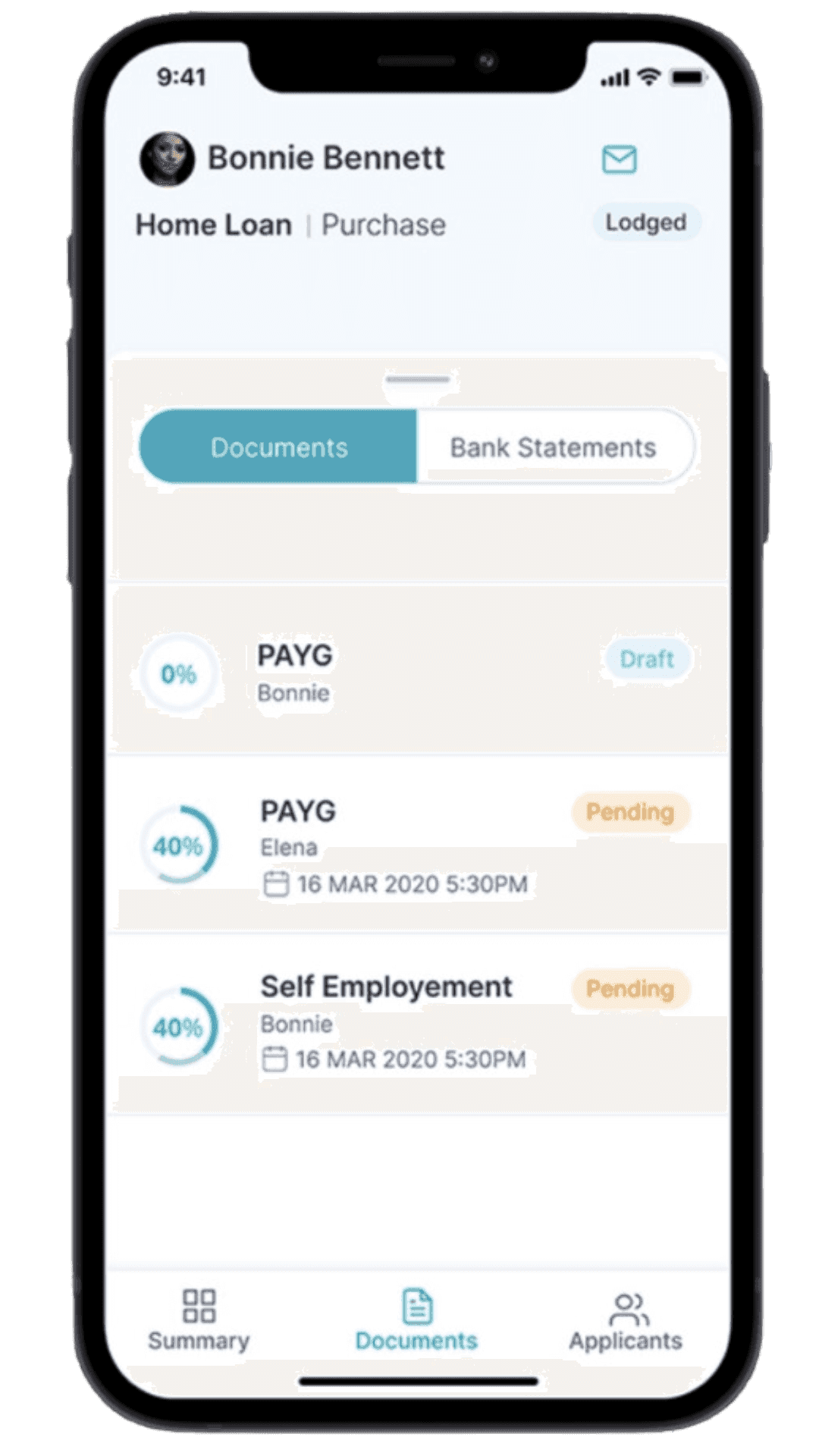

It starts with customers sharing a little about them, followed by specifics about their loan, the associated property, and their income. All of this information is used to get you closer to the best home loan refinance rates for you, as we use Cragglers’ combined loan values to negotiate a fair and personalised offer for you.

How Crowd Haggle works

Once you become a member of the Craggle community, you’ll join forces with others who share similar loan values, forming what we call a ‘Craggle Event’. This event is a coordinated effort where we leverage the combined information of participants to negotiate better terms on your home loan.

Craggle harnesses the collective bargaining power of your group at these events to help existing mortgage holders secure the best home loan refinance rates. Our platform brings together multiple lenders, and we present the offers they’ve tailored for you. Through this approach, the savings you make can turn into a substantial benefit over the life of your home loan.

Frequently Asked Questions (FAQ)

How can I benefit from refinancing my home loan?

Curious about the advantages of home loan refinance? First and foremost, many folks opt for refinancing to get a better home loan rate, which can lighten their financial load. Others may have their eyes on adjusting the duration of their loan, seeking more or less time to repay their debts, or they might be yearning for enhanced flexibility in their repayment terms.

Now, here’s an essential tidbit to consider: the amount of equity you’ve built up in your home plays a crucial role in getting the best home loan refinance rates for you. The more equity you’ve got, the more negotiating power you wield when striving to secure those favourable interest rates.

If you’ve amassed at least 20% equity in your home, you can sidestep the extra cost of Lender’s Mortgage Insurance (LMI) for your refinancing!

Will my credit score affect my refinance rate?

Yes, credit score requirements typically play a vital role in determining your refinance rate. A high credit score often leads to lower interest rates, potentially saving you money over the loan’s duration.

Conversely, a lower or fluctuating credit score may result in slightly higher home loan rates, as lenders for home loan refinance assess your creditworthiness based on this factor on top of others, like your loan-to-value ratio and debt-to-income ratio.

You can sign up for an independent mediator like Craggle so that you can compare options for a better interest rate, whether it’s a renegotiated rate with your current lender or a refinance rate with a new provider.

At Craggle, we understand the significance of your financial and personal data when securing the best home loan refinance rates for you. We maintain strict measures to ensure your data’s safety and have accreditation under the Australian Credit Licence (via ASIC) as a testament to our adherence to regulatory standards and commitment to transparency.

Our robust privacy policy guarantees uncompromising data security, allowing you to embark on this journey with confidence. Choose Craggle, where your trust is paramount as we get you your refinance home loan offer.

Can I refinance with the same lender, or do I have to switch?

Ultimately, the choice of refinancing with the same lender or switching lenders is up to you. The thing you can trust is that whether you wish to renegotiate with your current lender or venture into new territory with refinance options, Craggle is your trusted partner.

Our mission is to ensure that everyone receives fair and competitive rates. With Craggle by your side, you can effortlessly shop and compare, gaining a clear view of potential home loan refinance deals, rates, terms, and fees without drowning in complex terminology. It’s a transparent way to assess and fully grasp your options before making a final decision.

Unite with Craggle for your home loan needs

Ready for a fair go on your home loan refinance? Meet Craggle, the tool designed to secure you the best deal with the least hassle. Utilising the groundbreaking Crowd Haggle method, we pool like-minded Aussies to bolster your bargaining power in the home loan rate refinance game, mediating between you and lenders to ensure everyone gets a fair go.

Whether it’s to renegotiate with your existing provider or to explore a myriad of mortgage refinance opportunities with new ones, Craggle stands as your trusted ally in achieving a fair mortgage rate for refinance – all while keeping your details secure.

Join us on a journey towards convenience and a potentially lower refinance home loan cost. It’s more than a service; it’s Craggle, where you could find the best home loan refinance rates for your situation. Sign up now!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.