Home Loan Calculator

Discover essential tools like the Home Loan Calculator, Borrowing Power Calculator, and more to navigate your home loan journey with confidence and clarity.

When embarking on the journey to home ownership, understanding your financial situation is crucial. Various calculators can assist in this process, ensuring you make informed decisions. This article explores the key tools: the Home Loan Calculator, Borrowing Power Calculator, Borrowing Capacity Calculator, Mortgage Calculator, and Home Loan Repayment Calculator.

Home Loan Calculator: Your Starting Point

A Home Loan Cal is an invaluable tool for prospective home buyers. It provides a snapshot of how much you can borrow based on your income, expenses, and other financial commitments. By inputting your details, you can quickly see the loan amount you might qualify for, helping you set realistic expectations and narrow down your property search.

Understanding Your Financial Strength with the Borrowing Power Calculator

The Borrowing Power Calculator is designed to give you a clear picture of your borrowing capacity. It takes into account your income, debts, and other financial obligations to determine how much a lender might be willing to offer you. This calculator is essential for anyone looking to gauge their financial strength before applying for a home loan.

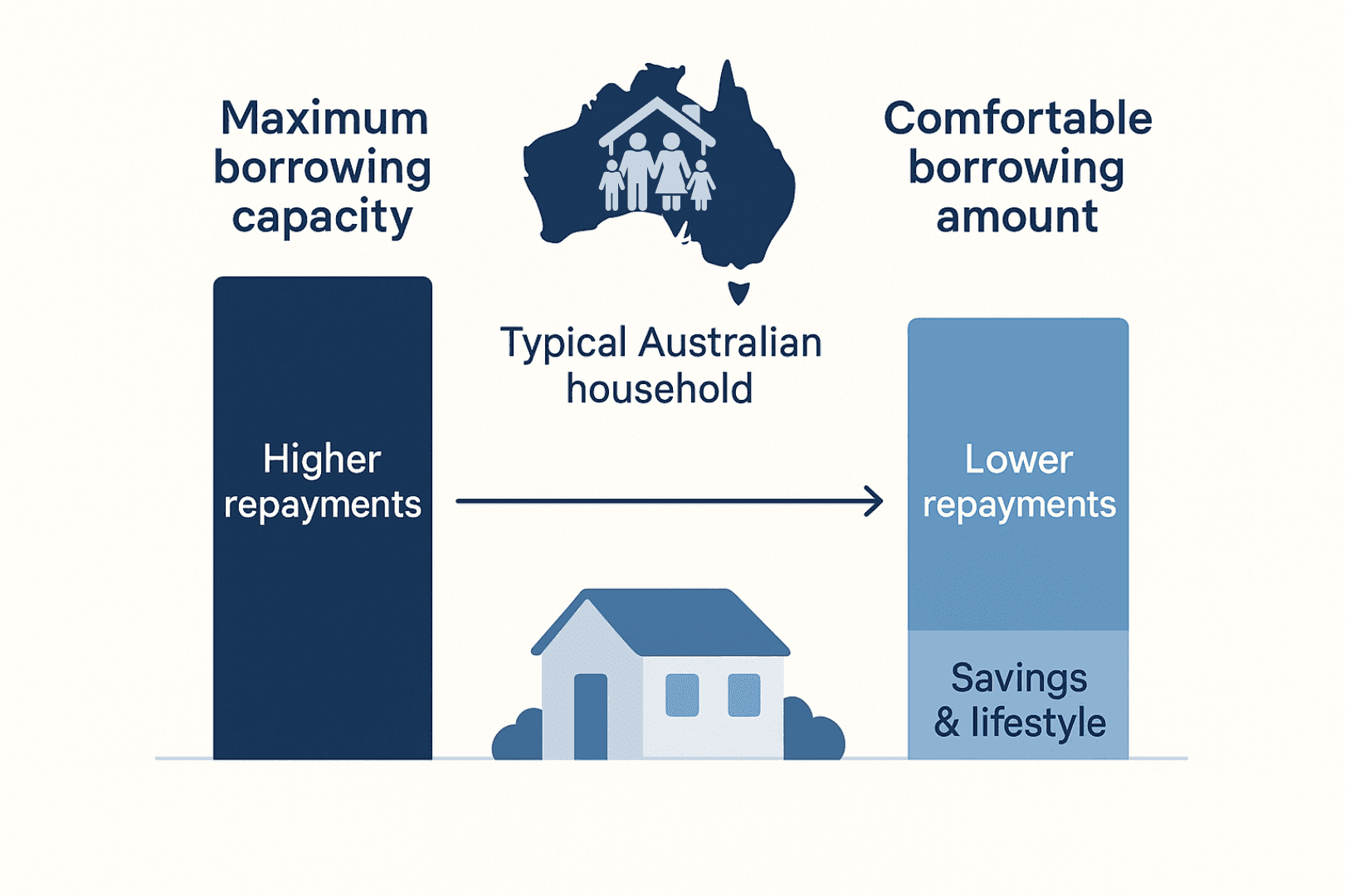

Know Your Limits with the Borrowing Capacity Calculator

While similar to the Borrowing Power Calculator, the Borrowing Capacity Calculator focuses more on your overall financial situation, including long-term financial commitments and lifestyle expenses. This tool helps you understand the maximum loan amount you can afford, ensuring you don’t overstretch your finances and remain comfortable with your repayments.

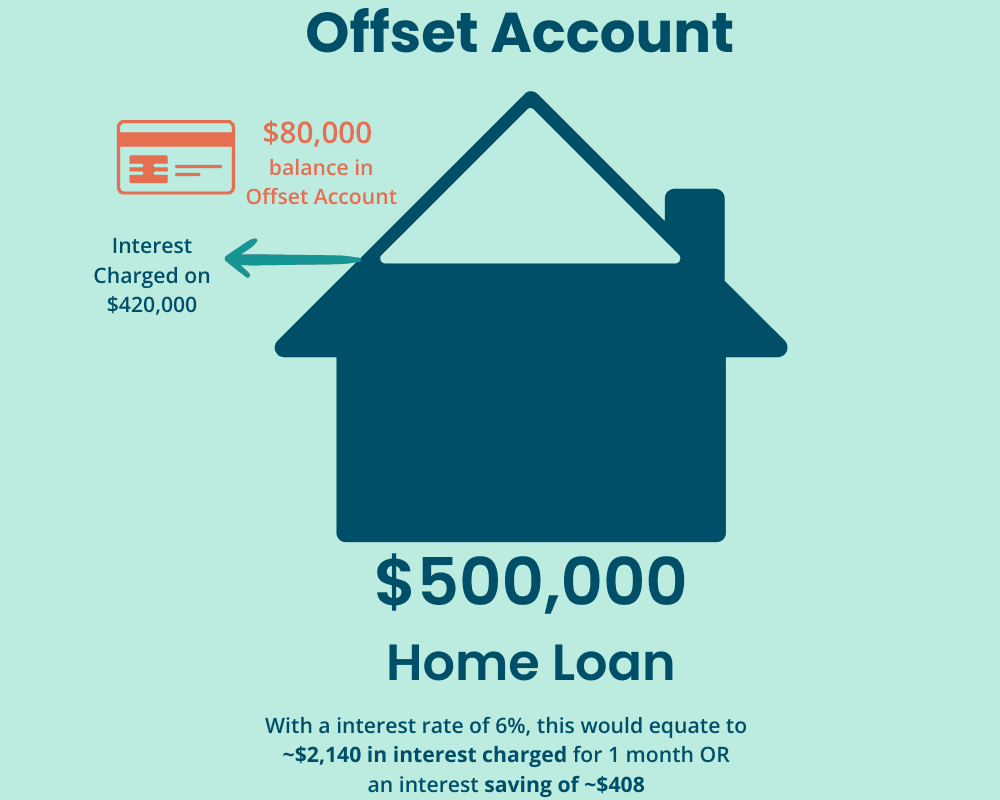

Planning Ahead with the Mortgage Calculator

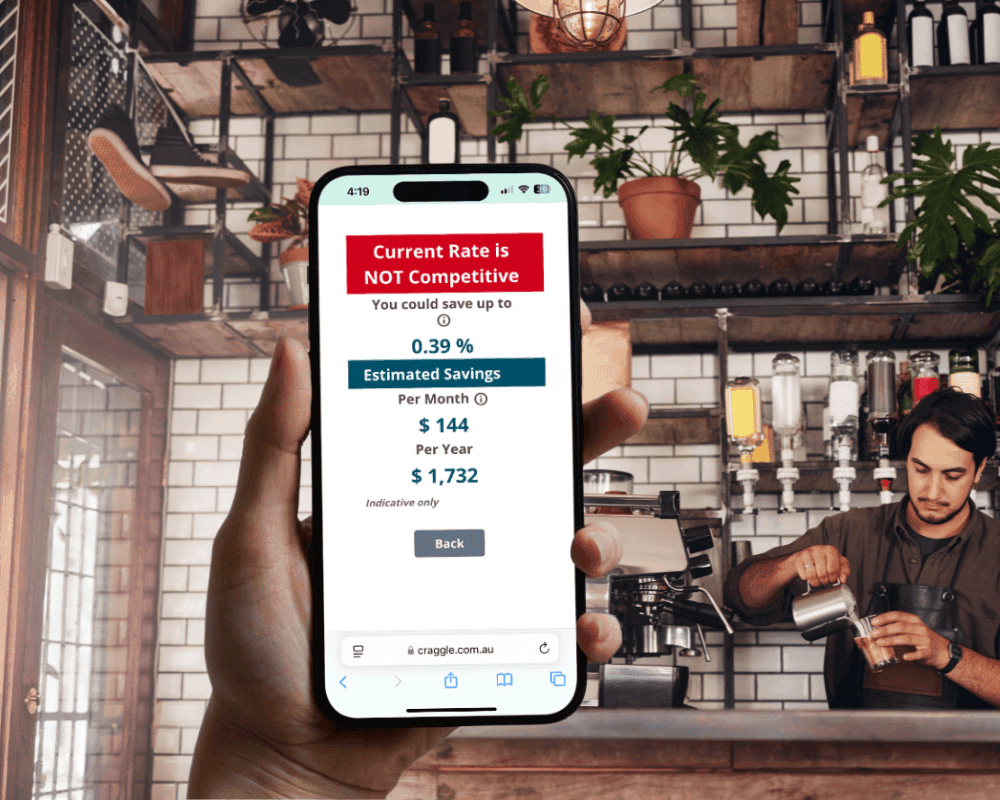

The Mortgage Calculator is a comprehensive tool that helps you estimate your monthly mortgage repayments based on different loan amounts, interest rates, and loan terms. By adjusting these variables, you can see how changes in interest rates or loan duration affect your monthly payments. This calculator is perfect for planning your budget and ensuring you can comfortably manage your mortgage.

Managing Repayments with the Home Loan Repayment Calculator

Finally, the Home Loan Repayment Calculator is designed to help you plan your repayments in detail. By inputting your loan amount, interest rate, and repayment frequency, this tool provides a clear breakdown of your repayment schedule. It helps you understand how much you need to pay each month and how different repayment strategies can impact the total interest paid over the life of the loan.

Conclusion

In the complex world of home loans, these calculators are your best allies. The Home Loan Calculator sets your expectations, the Borrowing Power Calculator and Borrowing Capacity Calculator assess your financial strength, the Mortgage Calculator helps you plan your budget, and the Home Loan Repayment Calculator ensures you stay on track with your repayments. By leveraging these tools, you can navigate the home loan process with confidence and clarity making your dream of home ownership a reality.

Disclaimer: The opinions expressed in this article are strictly for general informational purposes only and should not be taken as financial advice or recommendations.