Home Of Fair Facts & Tips

Busting Home Loan Myths: Facts vs. Fiction

Explore the truth behind common home loan myths and understand the facts to make informed decisions on your mortgage journey. Get clarity today.

Join us as we explore the truths behind these myths, offering insights and expert advice to help you understand what truly matters in your home loan journey. From the implications of a HELP debt to the realities of mortgage insurance and the flexibility of loan terms, we're here to ensure that you're equipped with the information necessary to make choices that are right for you. Let's dive into the world of home loans, debunk the myths, and pave the way for informed, confident homeownership.

The Top 17 Home Loan Myths

Embarking on the journey to homeownership is an exciting yet daunting venture, fraught with complex decisions and a plethora of information that can sometimes lead to more confusion than clarity. Among the most significant hurdles for prospective homeowners are the pervasive myths surrounding home loans — misconceptions that can drastically affect one's approach to securing a mortgage. From the necessity of a hefty down payment to the misbelief that you're locked in with a single lender for the duration of your loan, these myths can deter, mislead, and even cost potential homeowners both time and money.

Understanding the nuances of home loans is crucial in making informed decisions that align with your financial goals and circumstances. This article aims to shed light on the most common home loan myths, providing you with the facts you need to navigate the complex landscape of homeownership. Whether you're contemplating the size of your down payment, the impact of your credit history, or the intricacies of interest rates, our comprehensive guide is here to arm you with knowledge, debunk the myths, and set you on the path to securing your dream home.

Myth 1: You Need a 20% Deposit

The notion that a 20% down payment is a strict requirement to secure a home loan is one of the most pervasive myths in the housing market. This misconception can deter many potential buyers from pursuing their dream of homeownership, under the false belief that they must save a substantial amount before even considering a home purchase. Let's debunk this myth and explore the options available to prospective homeowners.

The Reality of Lower Down Payment Options

In reality, many lenders offer home loan products that require much less than a 20% down payment. Some loans allow for a down payment as low as 5% of the purchase price. This significant reduction in upfront costs opens the door to homeownership for a broader range of buyers, particularly first-time homeowners who may not have substantial savings yet.

Lenders Mortgage Insurance (LMI)

One key factor to consider when opting for a lower down payment is Lenders Mortgage Insurance (LMI). LMI is a type of insurance that lenders require borrowers to purchase when the down payment is less than 20% of the home's purchase price. Its purpose is to protect the lender in the event of a loan default. While this does add an additional cost to the borrower's expenses, it facilitates access to homeownership sooner than might otherwise be possible.

Government Schemes and Support

The Australian Government offers several schemes to support first-time homebuyers and reduce the burden of a down payment. One such program is the First Home Loan Deposit Scheme (FHLDS), which allows eligible first-time buyers to secure a loan with as little as a 5% deposit without paying LMI. Another initiative is the Family Home Guarantee, designed to help single parents with dependants purchase a home with a deposit of as little as 2%.

Navigating Your Way to Homeownership

Understanding the true requirements for a down payment in Australia is crucial in planning your path to homeownership. By debunking the myth that a 20% down payment is necessary, prospective buyers can explore a variety of options that may better suit their financial situation. Consulting with a mortgage broker or financial advisor can provide personalized advice and help identify the most suitable home loan products, taking into account the availability of government assistance and the potential impact of LMI.

Myth 2: The Lowest Interest Rate Is Always the Best Option

When shopping for a home loan, it's easy to be swayed by advertisements boasting the lowest interest rates. However, this approach can overlook essential aspects that significantly affect the overall cost and suitability of the loan.

Total Cost Considerations Beyond the Interest Rate

The interest rate is just one component of a home loan's cost. Other factors, such as application fees, ongoing fees, and features like redraw facilities or offset accounts, can influence the total cost of the loan. It's crucial to consider the comparison rate, which combines the interest rate with most of these fees and charges, providing a more accurate representation of the loan's overall cost.

The Role of Comparison Rates

The comparison rate helps borrowers compare the true cost of loans more effectively. By law, lenders in Australia must display the comparison rate alongside the advertised interest rate for home loans. This rate incorporates both the interest rate and fees and charges related to the loan, offering a more comprehensive view of what you'll actually pay.

Myth 3: Pre-Approval Guarantees Your Home Loan

Obtaining pre-approval for a home loan is an essential step in the home-buying process, giving you a clear idea of your borrowing capacity. However, it's a common misconception that pre-approval is a guarantee of final loan approval.

Pre-Approval vs. Full Approval Distinctions

Pre-approval is conditional and based on a preliminary assessment of your financial situation. It is not a final approval or a guarantee that you will receive the loan. Final approval is granted only after a comprehensive evaluation of your financial situation and the property in question, ensuring it meets the lender's criteria.

Variables Affecting Final Loan Approval

Several factors can influence the final approval of your home loan, even after you've received pre-approval. Changes in your financial situation, such as a new job, a change in income, or additional debts, can affect your borrowing capacity. Additionally, the property's valuation must satisfy the lender's requirements. It's crucial to maintain a stable financial situation and choose a property that meets your lender's criteria.

Navigating Interest Rates and Loan Approval

Understanding the nuances behind interest rates and the loan approval process is vital for prospective homeowners. It’s essential to look beyond the headline interest rates and consider the loan's total cost. Similarly, while pre-approval is an important step, it's crucial to be aware of its limitations and ensure you meet all conditions for final approval. Seeking advice from financial advisors and mortgage brokers can provide valuable insights and guidance tailored to your personal financial situation.

Myth 4: Refinancing Is Too Costly and Complicated

Refinancing cost can seem daunting due to perceived high costs and the complexity of switching lenders. However, refinancing your home loan can lead to significant savings over the life of your loan, especially if your circumstances have changed since you first secured your mortgage.

The Potential Long-term Savings of Refinancing

Refinancing offers the opportunity to secure a lower interest rate, reduce monthly payments, or change loan terms to better suit your current financial situation. While there are costs involved in refinancing, such as exit fees from your current loan or application fees for the new loan, the long-term savings can far outweigh these initial expenses.

Government and Regulatory Changes Making Refinancing Easier in Australia

Recent regulatory changes and government initiatives have made it easier and more appealing for homeowners to refinance their mortgages. These changes aim to increase competition among lenders, leading to better rates and terms for borrowers. By shopping around and comparing offers, you can find a refinancing option that offers significant financial benefits.

Myth 5: Fixed-Rate Loans Are Always Preferable to Variable Rate Loans

Choosing between a fixed-rate and a variable-rate loan is a significant decision for borrowers. While fixed-rate loans offer stability and predictability, they're not always the best choice for every borrower.Pros and Cons of Fixed-Rate vs. Variable Rate Loans``

Fixed-rate loans protect borrowers from interest rate rises, ensuring consistent repayment amounts for the fixed period. However, they often come with higher rates than variable loans and can incur significant break costs if you decide to switch loans or pay off your loan early during the fixed period.

Variable-rate loans offer more flexibility, including the ability to make extra repayments without penalty and benefit from rate cuts. However, they also mean your repayments could increase if interest rates rise.

Choosing the Right Loan Type Based on Your Financial Situation

Home Loan Comparison is the best approach to determine the best loan type for you which depends on your financial situation, risk tolerance, and future plans. For those who value predictability in their budget, a fixed-rate loan might be preferable. Those who prefer flexibility and are prepared to handle potential rate increases may find a variable-rate loan more suitable.

Myth 6: You Can Never Pay Your Mortgage Off Early

Many believe that home loans are designed to last the full term, but most loans allow for early repayment. Paying off your mortgage early can save you thousands in interest payments, but it's essential to understand the potential costs involved.

Early Repayment Options and Potential Penalties

While variable-rate loans typically allow for early repayment without significant penalties, fixed-rate loans may have break costs associated with early repayment. These costs can be substantial, so it's important to weigh the potential savings against the penalties. Check out our guide on How to Pay Off your Home Loan Sooner for more simple saving tips.

Navigating Refinancing, Loan Types, and Early Repayment

Understanding the truths about refinancing, the differences between loan types, and the possibility of paying off your mortgage early can empower homeowners to make informed decisions that align with their financial goals. Whether considering refinancing, choosing between a fixed or variable rate loan, or exploring early repayment options, it's crucial to do your research and seek professional advice tailored to your unique situation.

Myth 7: You Can't Get a Home Loan If You Have a HELP (or HECS) Debt

The presence of a Higher Education Loan Program (HELP) debt is often thought to be a significant barrier to securing a home loan. However, having a HELP debt does not automatically disqualify you from getting a mortgage.

Impact of HELP Debt on Borrowing Capacity

While it's true that lenders will consider your HELP debt when assessing your borrowing capacity, it's just one part of your overall financial picture. Lenders primarily look at your ability to service the loan, taking into account your income, expenses, debts, and credit history. A HELP debt may slightly reduce the amount you can borrow, but it doesn't make obtaining a loan impossible.

Myth 8: You Should Always Have an Offset Account

The value of Offset accounts are often marketed as a must-have feature for home loan borrowers, promising significant interest savings. However, they're not the perfect solution for everyone.

Offset Accounts: Not Suitable for Every Borrower

Offset accounts can be highly beneficial, especially for those who can maintain a substantial balance, effectively reducing the interest payable on the home loan. Yet, for borrowers who cannot keep a significant amount in their offset account, the benefits may be minimal. Additionally, basic home loans without an offset feature may come with lower interest rates or fees, proving more economical for these borrowers.

Myth 9: Mortgage Insurance (LMI) Protects You, the Borrower

Lenders Mortgage Insurance (LMI) is often misunderstood as a policy that protects the borrower in the event of default. The truth about LMI's purpose and beneficiary is quite different.

The Real Beneficiary of LMI

LMI is designed to protect the lender, not the borrower, in case of loan default. It allows lenders to recover their losses if the sale of the property doesn't cover the outstanding loan balance. While LMI enables borrowers to access loans with smaller deposits, it's important to understand that this insurance does not offer borrowers any protection.

Navigating HELP Debt, Offset Accounts, and LMI

Understanding the implications of HELP debt, the suitability of offset accounts, and the real purpose of Lenders Mortgage Insurance are crucial steps in demystifying aspects of the home loan process. Armed with this knowledge, potential homeowners can make more informed decisions that align with their financial situations and goals.

By addressing these myths, we aim to empower Australians with the confidence to navigate the home loan landscape, making homeownership more accessible and understandable for all.

Myth 10: You Are Locked in With the Lender for the Duration You Have the Loan

Many borrowers believe once they've secured a home loan with a lender, they must stick with them for the entire loan term. This myth can discourage borrowers from seeking better deals that could save them money.

Flexibility and Options for Changing Lenders

In reality, borrowers are not bound to their lender for the life of their loan. It's possible to refinance your mortgage to take advantage of better interest rates, loan features, or customer service elsewhere. While there may be costs involved in refinancing, such as discharge and application fees, the long-term savings or benefits can outweigh these expenses.

Myth 11: Interest Rates Are Set by the Reserve Bank of Australia (RBA)

It's a common misconception that the Reserve Bank of Australia (RBA) directly sets the interest rates borrowers pay on their home loans. Understanding the RBA's role can help borrowers better anticipate changes in their loan repayments.

How RBA Rates Influence Lender Rates

While the RBA's cash rate influences lenders' interest rates, banks and other financial institutions independently set the rates charged on home loans. The RBA rate is a benchmark that influences the cost of borrowing money in Australia, but other factors, such as funding costs and competitive pressures, also play a significant role.

Myth 12: A 30-Year Mortgage Is Cheaper Than a Shorter Term

Choosing the term of your mortgage is a significant decision that impacts your monthly payments and the total interest paid over the life of the loan. A longer term isn't always the better choice.

Comparing Mortgage Terms and Overall Interest Payments

While a 30-year mortgage can offer lower monthly payments, it also means paying more interest over the life of the loan compared to shorter terms. Borrowers should consider their financial situation and long-term goals when deciding on the loan term, potentially saving thousands in interest with a shorter term.

Myth 13: Credit Cards Don't Impact Borrowing Power

Your credit card limits and balances can indeed affect your home loan application. Lenders consider your credit card debt when assessing your borrowing capacity.

The Effect of Credit Card Debt on Loan Eligibility

Lenders look at the credit limits of your cards, not just what you owe, when calculating your borrowing power. Even if you don't owe anything on your cards, their total credit limit can reduce the amount you're eligible to borrow because these are potential debts you could incur.

Myth 14: You Only Need to Save for a Deposit When Buying

Saving for a home involves more than just accumulating a deposit. Many potential buyers underestimate the additional costs associated with purchasing a property.

Additional Costs in the Home Buying Process

Buyers need to budget for various additional costs, including stamp duty, legal fees, inspection costs, property valuation, loan application fee, and lenders mortgage insurance (if applicable). These can add up to a significant amount, so it's important to consider these expenses in your overall budget.

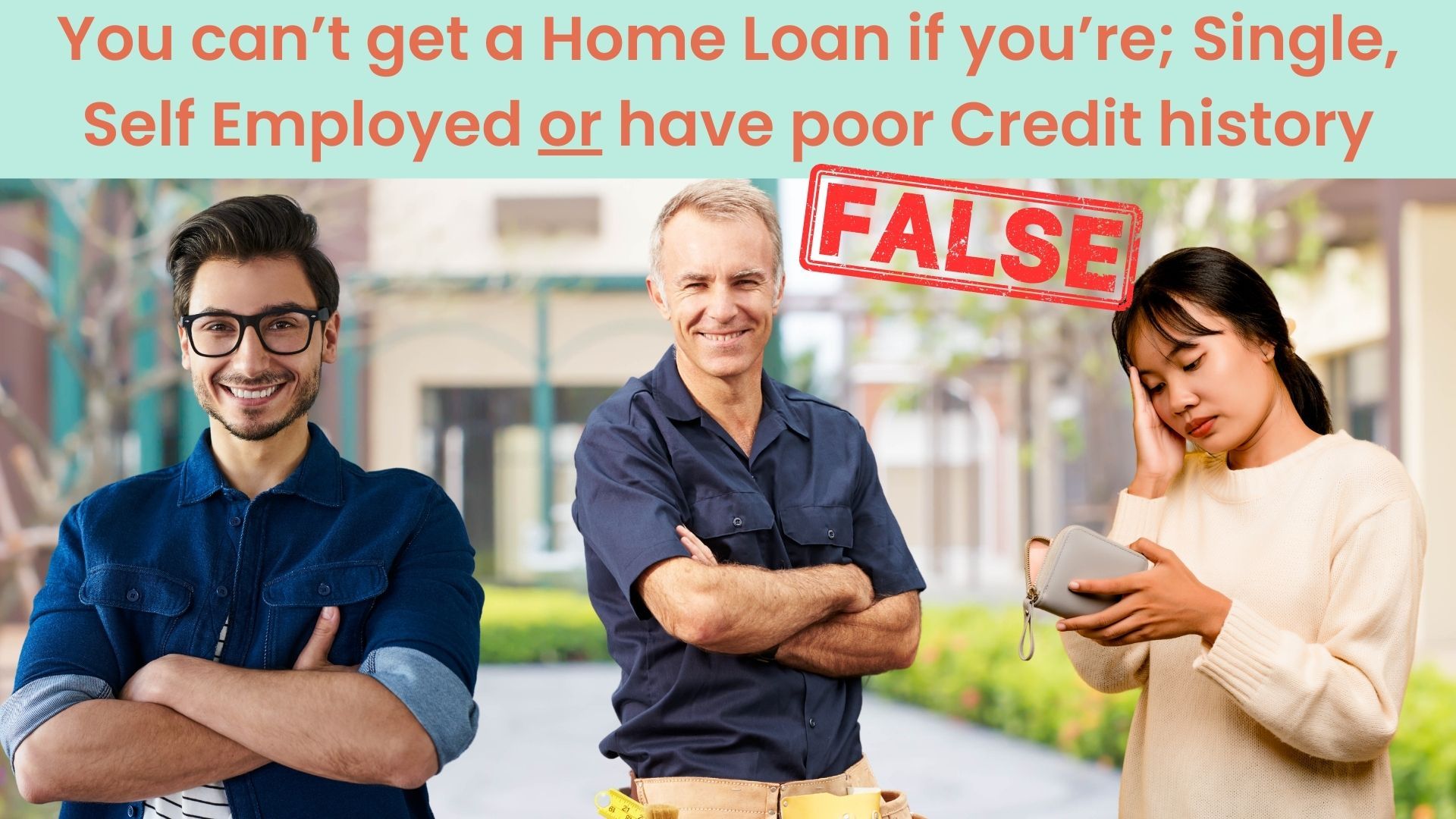

Myth 15: You Can’t Get a Home Loan if You Are Single

The misconception that single applicants cannot secure a home loan is widespread, yet entirely unfounded. Single homebuyers, in fact, represent a significant portion of the market.

Overcoming the Single Applicant Stigma

Lenders assess applications based on financial stability, income, creditworthiness, and the ability to repay the loan, rather than marital status. Single applicants can enhance their loan approval chances by having a solid savings record, stable employment, and a clean credit history. It's also beneficial to demonstrate a responsible financial behaviour pattern and possibly consider a guarantor if needed.

Myth 16: You Can't Get a Home Loan If You Are Self-Employed

Self-employed individuals often worry their fluctuating income disqualifies them from obtaining a home loan. However, lenders have grown increasingly accustomed to accommodating the self-employed.Navigating Home Loans as a Self-Employed Individual

The key for self-employed applicants is thorough and accurate financial documentation. Presenting two or more years of tax returns, financial statements, and evidence of consistent income can prove your reliability to lenders. Some lenders even offer specialized loan products tailored for the self-employed, recognizing the value and stability of self-employment in many sectors.

Myth 17: You Can't Get a Home Loan If You Have Poor Credit History

While a poor credit history can make the home loan process more challenging, it doesn't render it impossible. Understanding your credit position and actively working to improve it can make a significant difference.Understanding Your Credit Report

Before applying for a home loan, it's wise to obtain a copy of your credit report from credit reporting agencies such as Equifax or Illion. These agencies are required to provide individuals with a free copy of their credit report once a year. This report is invaluable as it offers a clear view of how potential lenders perceive your creditworthiness.

Benefits of Reviewing Your Credit Report

- Identify and Close Old Accounts: Reviewing your credit report can reveal credit facilities, including credit cards that you might have thought were closed. Identifying and officially closing unused accounts can tidy up your credit profile.

- Highlight and Address Errors: The report can highlight discrepancies or errors, such as debts wrongly attributed to you or outdated information. Rectifying these errors with the credit reporting agency can improve your credit score.

- Resolve Marked Credit Issues: If there are defaults or missed payments marked on your profile, knowing about them allows you to work proactively with credit providers to potentially remove or resolve these marks. In some cases, if the debt is paid or settled, the lender may agree to mark the issue as resolved, improving your credit standing.

Strategies for Overcoming Poor Credit History

- Credit Score Improvement: Actively work on improving your credit score by addressing any issues found in your credit report, making timely payments, and reducing your overall debt levels.

- Demonstrate Financial Stability: Evidence of stable income and a solid savings record can reassure lenders of your ability to manage a home loan.

- Consider Specialist Lenders: Some lenders specialize in servicing individuals with adverse credit histories. While these loans may carry higher interest rates, they offer a path to homeownership.

- Offer a Larger Deposit: A larger deposit can offset the perceived risk to lenders posed by your poor credit history, making them more inclined to approve your loan application.

Armed with a detailed understanding of your credit report and a proactive approach to managing your financial health, navigating the path to securing a home loan with a poor credit history becomes significantly more achievable.

Empowering Your Homeownership Journey with Facts

The path to homeownership is often paved with questions, uncertainties, and, unfortunately, misconceptions. As we've explored throughout this article, many widely held beliefs about home loans in Australia simply don't hold up under scrutiny. By challenging these myths and replacing them with factual, actionable insights, prospective homeowners can navigate the mortgage landscape more effectively and confidently.

Key Takeaways:

- Understand the Full Picture: Interest rates, loan terms, and borrowing options are nuanced. Look beyond surface-level figures and understand the terms, conditions, and long-term implications of any loan.

- Stay Informed: Regulations, policies, and financial products evolve. Staying informed about changes in the home loan market can unveil opportunities to save money or find better suited financial products.

- Seek Professional Advice: Each individual's financial situation is unique. Professional advice from financial advisors or mortgage brokers can tailor strategies to your personal circumstances, helping you make informed choices.

- Preparation Is Key: Whether it's saving for a deposit, improving your credit score, or understanding your borrowing capacity, thorough preparation is vital. It not only enhances your loan application's attractiveness but also positions you for a more stable financial future.

- Empowerment Through Education: Knowledge is power. Understanding the realities of the home loan process empowers you to make decisions that align with your financial goals and homeownership dreams.

The Path Forward

Dispelling myths and embracing the facts about home loans paves the way for a more informed, confident approach to buying a home. Whether you're a first-time buyer, considering refinancing, or exploring your options, remember that knowledge, preparation, and professional advice are your best allies.

As you step forward on your journey to homeownership, take these insights as tools to navigate the complexities of the home loan market. With the right information and guidance, achieving the dream of owning your home is not just possible—it's within reach.

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.

Written By

The Craggle Team