Home Of Fair Facts & Tips

Refinance Rate Comparison: AI Unlocking Your Best Options

Compare refinance home loan rates with Craggle AI. Find tailored home loan options that fit your finances and goals from thousands of loans.

Guide to this Article

Refinancing your home loan is often touted as a great way to save money by securing a better interest rate or adjusting the loan terms to fit your current financial goals. While many websites make it easy to find the best home loan rates and offer quick comparisons, there's much more beneath the surface than just low numbers. The truth is that home mortgage refinance rates come with terms and conditions that may not be suited to your specific circumstances, making the process more complicated than it seems.

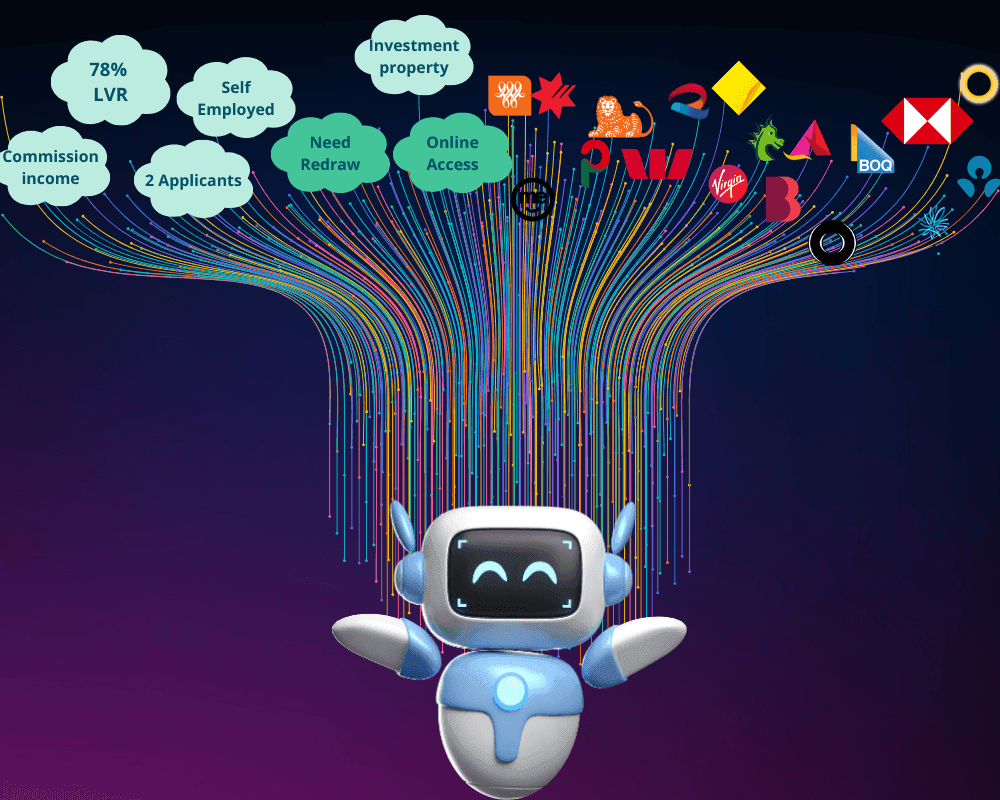

At Craggle, we recognise this complexity and believe that one-size-fits-all solutions don’t work when it comes to finding the perfect mortgage. Using our innovative Generative AI technology, we assess your unique financial picture and match you with home loan lenders that offer not just great rates but a high likelihood of approval based on your profile. This article dives into the nuances of refi home loans and explains why Craggle is the best partner to help you find the right option.

Understanding Refinance Home Loan Rate Comparison

When you're comparing home loan mortgage rates, it's easy to get lured by the top home loan rates advertised online. These often boast extremely low interest rates, which at first glance seem too good to pass up. But before you get too excited, it's crucial to understand that these offers typically come with strict conditions, like a low Loan-to-Value Ratio (LVR), a specific property type, or stringent repayment schedules.The Impact of Loan-to-Value Ratio (LVR) on Rates

One of the most common conditions tied to home loan interest rates is the LVR, which measures how much you're borrowing against the value of your home. If your LVR on the higher end such as 80%+ (meaning you have a smaller deposit or less equity in your property), you could face higher interest rates. In contrast, the best house mortgage rates are often reserved for those with a lower LVR, sometimes as low as 60% or less.

This means that while you might find a competitive rate, you may not qualify unless your financial circumstances line up perfectly.

Click here to find out more about LVR

How Property Type and Repayment Structure Affect Rates

Another factor that can affect your ability to secure the best housing loan rates is the type of property you're financing. Owner-occupied homes typically enjoy lower rates compared to investment properties. In addition, lenders may offer lower rates for principal and interest repayment structures compared to interest-only loans.

For many home buyers, these conditions can be stumbling blocks, leaving them frustrated and unable to access the top home loan rates that seem so readily available.

Bank Policy and Serviceability Standards

It’s not just the loan terms that can complicate matters. Even if your financial situation appears to meet a bank’s advertised rate criteria, their internal policies may not align with your unique needs. Banks have different serviceability standards, meaning they assess your income, expenses, and overall financial stability differently.

You may have found a rate that looks ideal, but the bank's criteria might not align with your financial profile, leading to a potential rejection. This is where Craggle steps in to save you from wasted effort.

How Generative AI Makes a Difference

At Craggle, we take the complexity out of the home loan comparison process by using cutting-edge Generative AI to dig deeper into your personal financial situation. Our technology doesn’t just find you the best home loan mortgage rates—it understands the nuances of your finances, your goals, and your needs.A Personalised Approach to Refinancing

Our Generative AI is designed to learn about you. Unlike traditional comparison tools that simply present you with the lowest house loan percentage rate without context, Craggle assesses how well each loan option aligns with your unique financial situation. By taking into account factors such as your LVR, property type, and even your income patterns, we can offer options that not only feature competitive rates but also improve your likelihood of approval.

Compare Thousands of Loans from Over 80 Lenders

Our AI agent can analyse thousands of loan products from over 80 lenders in the market. This exhaustive database enables us to present you with not only the best home loan rates, but also loans with terms that are customised to your needs. Whether you’re looking for the lowest home loan percentage rates or a solution that offers flexible repayment terms, Craggle has you covered.Reduce Stress, Frustration, and Time

Refinancing a home loan can be an overwhelming and stressful process. Traditional methods require you to sift through various websites, cross-checking home lending rates and worrying about your eligibility or speaking with multiple lenders (and feel like they only want to sell something to you..). With Craggle’s AI, we take on that burden for you, finding loans that give you the best chance of success. So, stop searching for “top home loan rates” and let Craggle find tailored options that are right for you. Oh, and you don’t have to talk with anyone if you don’t want to!

What to Consider Beyond Interest Rates

While securing the best home loan rates is undoubtedly important, it’s not the only factor to consider. A loan that offers a great interest rate but doesn’t suit your long-term goals, property type, or repayment capabilities can end up being more expensive in the long run.Fixed vs. Variable Rates

One critical decision in your refinance journey is choosing between a fixed or variable interest rate. Fixed rates provide stability, allowing you to budget with confidence as your payments remain constant. However, fixed-rate loans can come with restrictions, such as limited options for making extra repayments or exiting the loan early.

On the other hand, variable-rate loans may offer lower home loan percentage rates initially, but your payments could fluctuate as market conditions change. A variable loan might be beneficial if you plan to make extra repayments or pay off your loan quickly.

Click here to find out more about Fixed and Variable Rates

Loan Features and Flexibility

A low interest rate might seem attractive, but it’s essential to ensure the loan offers features that suit your needs. Some of the best loans offer features like offset accounts, redraw facilities, and flexibility in repayment schedules. These can make a significant difference in how you manage your mortgage over time.

At Craggle, we don't just focus on rates; we help you find loans that strike the right balance between affordability and flexibility, ensuring your loan serves its purpose in the long run. Check out our Comprehensive Guide to Loan Features to know more.

Why Loan Fit Matters as Much as Rate

One of the most common mistakes people make when refinancing their home loans is focusing solely on the best rates for mortgage loans without considering whether the loan is the right fit for their financial goals. For instance, while a loan might offer a competitive rate, it could come with high exit fees, limited repayment options, or other terms that don’t align with your needs. At Craggle, we understand that the loan with the lowest rate might not always be the best option for you. By using AI to assess your overall financial health, we recommend loans that fit both your short-term and long-term financial goals.Frequently Asked Questions

What is the difference between fixed and variable home loan rates?

A fixed rate remains constant for a set period, providing stability, while a variable rate can fluctuate with market conditions, offering potential savings but also more risk.

How does Loan-to-Value Ratio (LVR) affect my home loan interest rates?

A higher LVR usually results in higher interest rates because lenders see it as a riskier loan. A lower LVR, such as 60%, can help you secure the best home loan rates.

Why is Craggle’s Generative AI better than traditional comparison tools?

Craggle’s AI evaluates your entire financial situation, not just the interest rates. We help you find loans that fit your unique circumstances and offer the best chance of approval.

Do banks have different policies for owner-occupied homes versus investment properties?

Yes, banks often offer lower rates for owner-occupied properties and have stricter terms for investment properties.

How can I ensure I’m getting the best loan for my needs?

Beyond looking for low home loan percentage rates, consider loan features, fees, and flexibility. Craggle helps you assess all these factors to find a loan that suits your goals.

Is refinancing worth it if my rate only drops a little?

Even a small reduction in interest rates can save you thousands over the life of your loan. Craggle helps you assess if refinancing is worth it for your unique financial situation.

Try our Quick Rate Check to help you decide if Refinancing is worth it

Key Takeaways

Refinancing a home loan doesn’t have to be a stressful process filled with unknowns. At Craggle, we simplify the process using Generative AI to match you with loans that not only feature competitive rates but also fit your unique financial needs. With access to thousands of loans from over 80 lenders, we help you find options that work for you. So, stop searching “top home loan rates” and let Craggle take the stress out of your refinance journey.Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.

Written By

The Craggle Team