Home Of Fair Facts & Tips

Best Hacks to Pay Off your Home Loan Faster

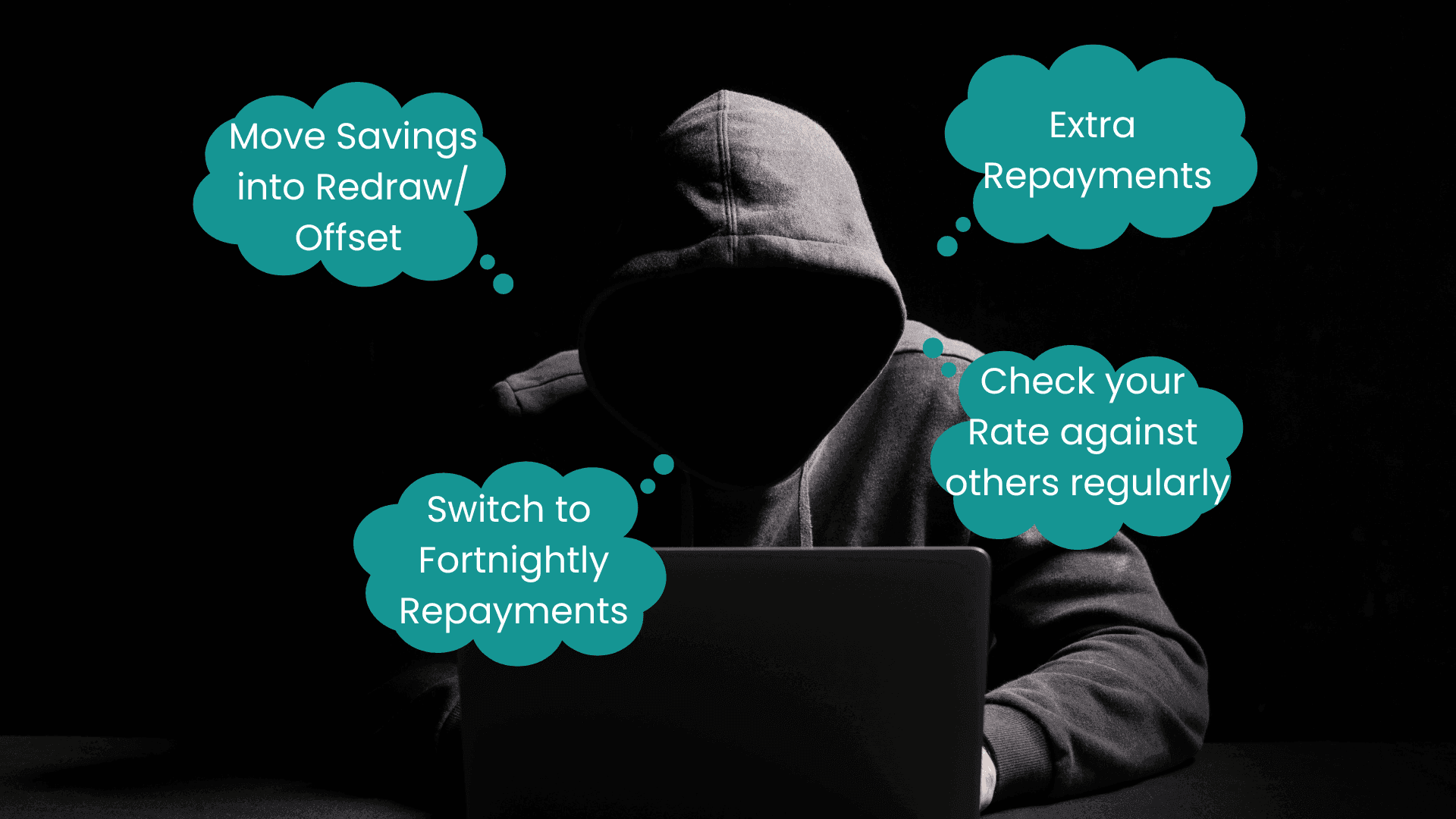

Discover 7 simple mortgage hacks to save money and pay off your home loan faster. Learn strategies like extra repayments, refinancing, and more.

What is a Mortgage Hack?

A mortgage hack is a simple strategy, that anyone can do, that delivers a mortgage saving.

Table of Contents

Introduction

In today's fluctuating economic landscape, mastering the strategies to pay off mortgage early is pivotal for Australian homeowners. As interest rates change and the property market evolves, understanding how to pay your mortgage off faster is essential. This guide offers insightful ways to not only manage but accelerate your mortgage payments.

This article will explore five key hacks that can help in paying off mortgage early, providing you with significant savings on your home loan. Whether you are acquiring your first home or seeking to optimise an existing mortgage, these strategies, including refinancing and smart payment options, are tailored to help you reduce your loan term and cut down on interest costs. By implementing these methods, you will not only enhance your financial well-being but also progress towards full homeownership more swiftly and efficiently.

Hack 1: Making Extra Repayments

One of the simplest yet most effective ways to accelerate your journey to mortgage freedom is by making extra repayments on your home loan. This strategy not only shortens the loan term but can also significantly decrease the total amount of interest you pay over the life of the loan.

Even small regular extra repayments will have a big impact over the life of your home loan.

The Impact of Extra Repayments

Extra repayments reduce the principal balance of your loan faster than scheduled. Since interest is calculated on the outstanding balance, a reduced principal means you'll be charged less interest. Over time, these savings can be substantial, offering not just financial benefits but also peace of mind from being debt-free sooner.

Strategies for Extra Repayments

- Utilise Bonuses: Use unexpected income, such as tax returns, bonuses, or gifts, to make additional payments. Even occasional lump-sum payments can have a significant impact.

- Regular Extra Payments: Consider setting up a regular extra payment, no matter how small. Consistency is key, and even an additional $50 or $100 per month can make a difference.

- Round Up Payments: Rounding up your regular repayments to the nearest hundred can simplify your budgeting while silently boosting your repayment efforts.

- Review Your Budget: Occasionally reassess your budget for areas to cut back on, reallocating those savings towards your home loan.

Real-life Impact

Imagine you have a $600,000 home loan with a 30-year term at an interest rate of 6.15%. By paying an extra $200 per month, you could reduce the loan term by approximately 3 years and 8 months, saving ~$102,000 in interest payments. These numbers illustrate the power of extra repayments.

Getting Started

Before making extra repayments, check with your lender about any potential fees or restrictions, especially if you have a fixed-rate loan. Some lenders may charge fees for early repayments or have a cap on how much extra you can pay annually.

Implementing a strategy for extra repayments requires discipline and occasionally, sacrifice. However, the long-term benefits far outweigh these short-term adjustments. By making an extra effort now, you're investing in your financial future, reducing the life of your loan, and saving on interest.

Hack 2: Maximise Benefits from Offset Accounts and Redraw Facilities

Offset accounts and redraw facilities offer strategic ways to reduce the interest payable on your home loan without altering your regular repayment amount. Understanding how to use these features can lead to significant savings over the life of your loan.

How Offset Accounts Work

An offset account is a savings or transaction account linked to your home loan. The balance in the offset account is 'offset' against the loan amount, reducing the interest calculated. For example, if you have a $500,000 home loan and $80,000 in your offset account, you'll only be charged interest on $420,000.

Benefits of Redraw Facilities

A redraw facility allows you to make extra payments on your loan that can be 'redrawn' later if needed. This flexibility is perfect for borrowers who want to pay off their loan faster but worry about tying up their funds too rigidly. Like with offset accounts, the extra payments reduce the loan's principal amount, thereby decreasing the interest charged.

Utilising Home Loans with Redraw for Those Without an Offset Account

For homeowners who do not have an offset account, utilising a loan with a redraw facility can be equally effective. Making extra repayments decreases the loan balance, and thus the interest, with the added benefit of being able to access these extra funds if necessary.

Moving Funds for Financial Efficiency

Transferring savings from a regular interest-bearing account to your mortgage via an offset or redraw can be financially advantageous. Given the typically higher interest rates on home loans compared to savings accounts, using your savings to offset your mortgage can result in better net financial gain.

Strategy Insight

Homeowners should periodically assess their use of offset accounts and redraw facilities. Optimising the use of these tools can lead to substantial savings, particularly for those disciplined about making regular extra repayments. It's also crucial to consider the potential impacts on accessibility and flexibility of your funds when choosing between these options.

Hack 3: Switch to Fortnightly Repayments

Adopting a fortnightly repayment schedule is a smart hack that can significantly cut down both the term of your loan and the amount of interest you pay. This section explains how making the switch can lead to substantial savings over the life of your mortgage.

Understanding the Basics

When you switch from monthly to fortnightly repayments, you're essentially making one extra month's payment each year. Here's why: By splitting your monthly payment in half and paying every two weeks, you end up making 26 half-payments—or 13 full payments—each year, instead of the standard 12.

The Impact of Fortnightly Repayments

This additional payment directly reduces the principal balance of your loan faster than a monthly schedule. Since interest is calculated on the outstanding balance, reducing the principal sooner leads to lower interest charges over time. The beauty of this strategy lies in its simplicity and the minimal impact it has on your monthly budget, while still delivering significant long-term savings.

Practical Example

Let's say you have a $600,000 loan with a 30-year term at a 6% interest rate. By switching to fortnightly repayments, you could reduce the loan term by 5 years and 6 months, saving ~$148,000 in interest payments.

The exact savings will depend on your loan's specifics, but the principle remains consistent across different scenarios.

How to Make the Switch

- Check with Your Lender: Some lenders may not offer fortnightly repayment options or might charge fees for changing your repayment schedule. It's essential to discuss the possibilities and implications with your lender.

- Adjust Your Budget: Review your financial planning to accommodate the slight increase in the frequency of payments. For many, this adjustment is barely noticeable but requires some initial planning.

- Automate Your Payments: To make the process seamless, set up automatic deductions from your bank account. This ensures you never miss a payment and stick to your new schedule without hassle.

Considerations

While switching to fortnightly repayments is generally beneficial, it's important to ensure this strategy aligns with your financial situation. For some, the flexibility of monthly payments may be necessary for budgeting reasons. Always weigh the benefits against your personal financial needs and goals.

Hack 4: Regularly Compare Your Home Loan Interest Rate with Others in the Market

In an ever-changing financial landscape, maintaining a competitive edge on your home loan interest rate is key to optimising your mortgage payments and overall interest. Regularly comparing your current rate with available market rates can uncover opportunities to reduce costs significantly.

The Importance of Staying Competitive

Interest rates fluctuate based on various factors, including economic conditions, central bank policies, and market competition. What was a competitive rate a few years ago might not be as attractive today. Staying vigilant ensures you're not paying more than necessary.

How Often to Compare

- Annual Check: A yearly review of your home loan interest rate against the market is a good rule of thumb. This frequency ensures you're up-to-date with current trends without being overwhelmed by the market's normal fluctuations.

- Interest Rate Movements: Significant economic events, like changes in the official cash rate by the Reserve Bank of Australia, can affect interest rates across the board. Following such shifts, it's wise to review your mortgage arrangements.

Steps for Effective Comparison

- Research Current Rates: Utilise online comparison tools and websites to gather information on the latest home loan rates offered by various lenders.

- Consider the Full Package: Interest rates are crucial, but don't overlook other factors such as fees, loan features (like offset accounts or redraw facilities), and flexibility.

- Negotiate with Your Lender: Armed with current market information, approach your lender to discuss the possibility of lowering your rate. Lenders are often willing to negotiate to retain customers.

- Seek Professional Advice: Consulting with a financial advisor or mortgage broker can provide insights into whether switching lenders or refinancing offers a genuinely better deal.

- Consider Craggle: We’re an impartial mediator helping Aussies assess their current rate against what Craggle has been able to negotiate for others with similar home loans. This service is completely free for you and, only takes a couple of minutes for our platform to complete a Fairness Check on your current home loan.

Realising Potential Savings

By periodically reassessing the competitiveness of your home loan interest rate, you position yourself to take advantage of lower rates, which can translate into considerable savings over time. This proactive approach not only ensures that you're not overpaying but can also significantly reduce the overall cost of your mortgage.

Hack 5: Evaluate your Home Loan Package

Evaluating your home loan package periodically is crucial in ensuring that you're not paying for features you don't need or use. This proactive approach can lead to significant savings, especially when you discover that certain inclusions in your package may no longer serve your best interests.

The Value of Regular Loan Package Reviews

Over time, your financial situation and needs can change, making it essential to reassess the components of your home loan package. Some packages come bundled with features like free credit cards, discounted insurance products, or waived account fees, which may sound beneficial initially but can become redundant if you find better deals elsewhere or no longer use the services.

Customer Scenario: The Story of John and Lisa

John and Lisa had a home loan that came with a premium loan package, offering a free credit card and discounted contents insurance, to name a few features. Initially, this seemed like a good deal. However, upon reviewing their financial arrangements, they realised they were not using the credit card due to its high-interest rate compared to their other cards. Additionally, they found more affordable contents insurance through a different provider.

After a detailed evaluation, they decided to switch to a basic loan without these extras. This switch saved them hundreds of dollars each in package fees plus, the interest rate was lower on a basic home loan which saved them even more. Additionally, they redirected their savings into their offset account, maximising the interest savings on their home loan. John and Lisa's experience highlights the importance of regularly reviewing your loan package to ensure it aligns with your current needs and financial goals.

Steps for Effective Loan Package Evaluation

- List Your Package Features: Identify all the features and benefits included in your home loan package.

- Assess Usage and Value: Determine which features you actively use and compare their value against available alternatives in the market.

- Consider Alternatives: If you find that certain package features are no longer competitive or necessary, research alternative loan packages or negotiate with your lender for a package adjustment.

- Make Informed Decisions: Based on your evaluation, decide whether sticking with your current package, switching to a different one, or even changing lenders will offer the best financial benefits.

Why Regular Reviews Matter

John and Lisa's scenario underscores the potential for savings that lies in diligent, informed financial management. By taking the time to assess the relevance and value of your home loan package features, you can make choices that significantly reduce your costs without compromising the quality of your financial products.

Hack 6: Mastering Interest Rates

Navigating the landscape of interest rates is crucial for any homeowner looking to save on their mortgage. Interest rates directly influence the total amount you'll pay for your home over the life of your loan, making it essential to understand how they work and how you can use them to your advantage.

Fixed vs. Variable Rates: Pros and Cons

When it comes to choosing between fixed and variable interest rates, each option comes with its set of benefits and drawbacks:

Fixed-Rate Mortgages offer the security of knowing exactly what your payments will be for a set period, typically ranging from one to five years. This predictability is invaluable during times of economic uncertainty or when interest rates are expected to rise. However, fixed rates often come with higher initial costs and less flexibility in making extra repayments.

Variable-Rate Mortgages, on the other hand, provide more flexibility but with an added risk. Your interest rate can fluctuate based on the market, meaning your repayments could increase or decrease. This option is ideal for those who can manage the uncertainty and may benefit from lower rates when the market is favourable.

Securing the Best Possible Interest Rate

To secure the best interest rate for your mortgage, consider the following tips:

- Maintain a Strong Credit Score: Your credit history is a key factor lenders consider when determining your interest rate. A higher credit score can lead to better rates.

- Shop Around: Don't settle for the first offer. Compare rates from multiple lenders to ensure you're getting the best deal.

- Consider the Loan-to-Value Ratio (LVR): A lower LVR generally results in a lower interest rate. Aim for an LVR of 80% or less to avoid the additional cost of Lenders Mortgage Insurance (LMI).

Too understand more about LVR, check out our article on how LVR impacts a mortgage. - Negotiate: Armed with offers from various lenders, don't hesitate to negotiate with your preferred lender for a better rate.

Tools to Calculate Impact on Payments

Utilising online mortgage calculators can be a game-changer in understanding how different interest rates affect your monthly payments and the total interest paid over the life of the loan. These tools allow you to input various rates, loan amounts, and terms to compare outcomes and make informed decisions.

By mastering the nuances of interest rates and making educated choices between fixed and variable options, homeowners can significantly impact their mortgage costs. It's about finding the right balance between risk and reward to suit your financial situation and long-term goals.

Hack 7: Low your Costs Through Refinancing

In the quest to save on your home loan, refinancing stands out as a powerful tool. By seeking a new mortgage to replace the original, homeowners can benefit from lower interest rates, reduced monthly payments, or alter the loan's terms. It's a strategy that can save you thousands over the life of your loan, but it requires careful consideration and a strategic approach.

How Refinancing Works

Refinancing involves taking out a new loan with different terms to pay off your existing mortgage. This new loan can come from your current lender or a different financial institution. The aim is to secure a lower interest rate, change the loan term, or switch from a variable rate to a fixed-rate mortgage (or vice versa), depending on your financial goals and market conditions.

Real Customer Example

Sam is investigating whether the savings from refinancing to another bank is worth it. Sam's outstanding home loan balance is ~$600,000 with 25 years remaining on their loan term. Sam's current rate is 6.58% and is considering the savings opportunity if they refinance to another bank whose standard rate is 6.0%.

Using a Refinance Calculator, Sam discovered that if they refinanced they would be able to reduce their monthly repayments by ~$220/month and save over $79,000 in interest costs over their remaining home loan term.

Sam's current loan repayments are not causing any financial stress, even with the recent rise in interest rates, and so if Sam refinances to the other bank with a lower rate AND does not reduce their monthly repayment, not only will Sam's interest savings over the remaining home loan term increases to over $194,000 in interest savings, Sam will also oay off their home loan approximately 4 years and 2 months early!

Sam's Scenario

The above scenario assumes there is no Introductory Rate applied by the new Bank

The above scenario assumes there is no Introductory Rate applied by the new Bank

Benefits of Refinancing

- Lower Interest Rates: Perhaps the most compelling reason to refinance is the opportunity to lock in a lower interest rate. Even a small reduction can lead to significant savings over the life of the loan.

- Reduced Monthly Payments: Lowering your interest rate often results in lower monthly payments, freeing up cash for other financial goals or necessities.

- Loan Term Adjustments: Refinancing can also shorten or extend the length of your loan. Shortening your loan term can save you money on interest, while lengthening it can lower monthly payments.

- Access Equity: For homeowners with substantial equity in their property, refinancing can provide access to this equity for renovations, investments, or consolidating debts.

Tips for Comparing Home Loan Offers

- Do Your Homework: Research current interest rates and compare them with what you're currently paying. Tools and calculators available online can help estimate potential savings.

- Consider Fees and Costs: Refinancing can come with fees such as application fees, valuation fees, and settlement fees. Ensure these costs don't outweigh the benefits.

- Check Your Credit Score: Your credit score significantly impacts the interest rate you can secure. Before applying, check your credit report and address any issues.

- Seek Professional Advice: Consulting with a financial advisor or mortgage broker can provide personalised insights and help you navigate the refinancing process.

By understanding and strategically applying these refinancing principles, homeowners can make informed decisions that lead to substantial savings. Remember, the best refinancing decision is one that aligns with your overall financial goals and current market conditions.

Conclusion

Navigating the path to mortgage freedom, or raining in that mortgage monster, is a journey that requires vigilance, strategy, and a proactive mindset. Throughout this article, we've explored five essential hacks that can significantly reduce the term and overall cost of your home loan. From refinancing to making extra repayments, utilising offset accounts and redraw facilities, switching to fortnightly repayments, and regularly comparing your home loan interest rate with the market, each strategy offers a unique avenue for savings.

The journey to optimising your home loan doesn't end here. It's a continuous process of assessment, adjustment, and action. Real-life scenarios like John and Lisa's serve as a testament to the potential savings that diligent homeowners can achieve. By periodically evaluating your loan package, making informed decisions based on current market rates, and utilising the financial tools at your disposal, you can not only save significant amounts on your home loan but also fast-track your way to financial freedom.

Remember, every step taken towards reducing your mortgage, no matter how small, is a step closer to owning your home outright and achieving the financial peace of mind you deserve. We encourage you to review your current home loan arrangements, consider the strategies outlined, and take action where you see opportunities for savings. Your dream of mortgage freedom is not just a possibility—it's within reach with the right approach and determination.

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.

Written By

The Craggle Team