Home Of Fair Facts & Tips

Typical Refinance Fees Unveiled: Saving Money on Your Mortgage

Explore the breakdown of typical refinance fees to understand closing costs, application fees, and more. Navigate your refinancing with ease.

Refinancing your mortgage can be a pathway to significant savings, whether you're looking to lower your interest rate, reduce your monthly payments, or tap into your home equity for large expenses. However, the process isn't without its costs. Understanding the typical refinance costs involved is crucial for any homeowner considering this financial move. These fees, ranging from loan establishment charges to property valuation fees and even potential break costs, can add up, impacting the overall benefit of refinancing. This article aims to demystify the common refinance costs, providing you with the knowledge to navigate the process more effectively. With strategic planning and negotiation, it's possible to minimize these costs, ensuring that your decision to refinance is as beneficial as possible.

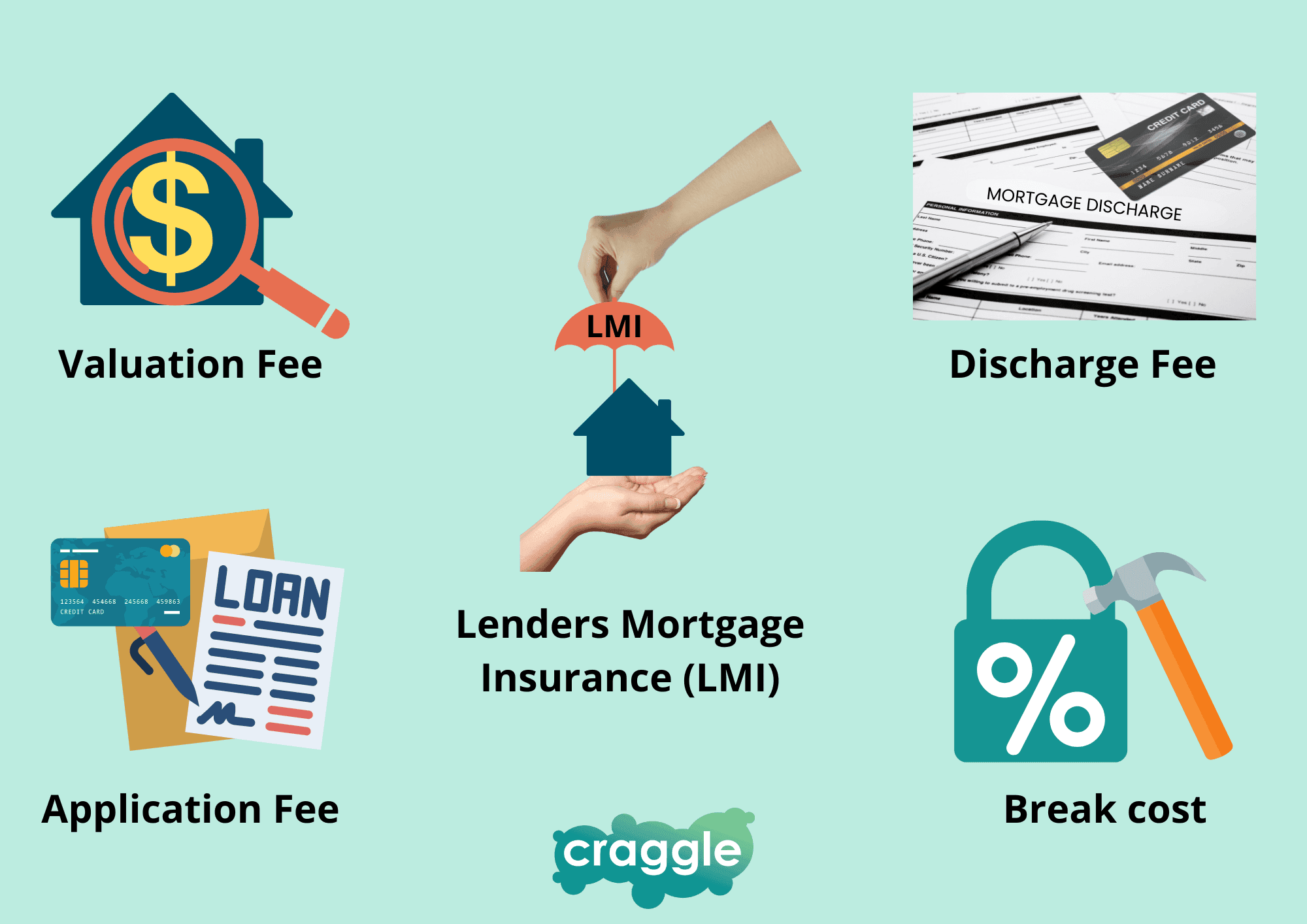

Common Refinance costs

Application or Loan Establishment Fee

When you decide to refinance your mortgage, one of the first fees you're likely to encounter is the application or loan establishment fee. This charge covers the lender's costs of processing your new loan application, from administrative expenses to the initial setup. Typically, this fee can range anywhere from a few hundred to over a thousand dollars, depending on your lender and the complexity of your refinancing deal.

Tips on Negotiating or Potentially Waiving This Fee:

- Shop Around: Before settling on a lender, compare the refinancing options available. Some lenders may offer to waive the application fee as an incentive to choose their services.

- Negotiate: If you have a good credit history and a strong relationship with your lender, you may have some leverage to negotiate the waiver or reduction of this fee.

- Consider Package Deals: Some financial institutions offer refinancing as part of a package deal that includes other products, such as a transaction account or credit card, where they might waive the establishment fee.

Property Valuation Fee

A critical part of the refinancing process involves assessing the current value of your property. This valuation determines how much the lender is willing to offer you in your new loan. The fee for this service can vary, often depending on the size and location of your property, but it generally falls between $200 and $600.

Cost Range and Factors Affecting Valuation Fees:

- Location: Properties located in remote or less accessible areas might incur higher valuation fees due to the added travel and time costs for the valuer.

- Property Size: Larger properties or those with unique features may require more extensive evaluation, leading to higher fees.

Discharge or Mortgage Exit Fees

Exiting your current mortgage can attract a discharge or mortgage exit fee. This fee covers the legal costs associated with terminating your existing mortgage and removing the lender's interest from your property title. While discharge fees are relatively common, they're typically not exorbitant, ranging from $150 to $400.

Lenders Mortgage Insurance (LMI)

If you're refinancing and your equity in the home is less than 20% of its value, you may be required to pay Lenders Mortgage Insurance (LMI). This insurance protects the lender in case you default on the loan. LMI can be a significant expense, so it's essential to understand when it applies and how you can potentially avoid it.

Break Costs

For homeowners with a fixed-rate mortgage looking to refinance home loan before the end of their fixed term, break costs may apply. These costs can vary greatly depending on the amount of time left on your fixed term and the current interest rates compared to when you locked in your rate.

How to Calculate and Consider These Costs When Refinancing:

- Consult Your Current Lender: They can provide you with a breakdown of any applicable break costs based on your specific situation.

- Consider the Long-Term Savings: While break costs can be high, the long-term savings from a lower interest rate might outweigh these initial expenses.

Evaluating Your Refinance Costs

Refinancing your mortgage can lead to significant savings over the life of your loan, but it's crucial to thoroughly evaluate the costs involved to ensure it's the right decision for your financial situation. Here's how you can effectively compare refinance offers and navigate the process.

How to Compare Refinance Offers Effectively

The first step in evaluating your refinance options is to compare offers from multiple lenders. While the interest rate is an important factor, it's not the only one to consider. The comparison rate, which includes both the interest rate and most fees and charges associated with the loan, provides a more accurate reflection of the total cost of the loan.

- Understand the Comparison Rate: The comparison rate helps you understand the true cost of the loan, making it easier to compare different lenders' offers.

- Read the Fine Print: Be sure to review all terms and conditions, paying close attention to fees and charges that could affect your savings in the long run.

The Role of a Mortgage Broker in the Refinancing Process

A mortgage broker can be a valuable asset when refinancing your mortgage. They have in-depth knowledge of the market and can offer advice tailored to your financial situation. Additionally, brokers often have access to deals not directly available to the public.

- Access to a Wide Range of Lenders: Mortgage brokers can compare rates from a variety of lenders, including those you may not have considered.

- Personalized Advice: They can help you understand the nuances of each offer, ensuring that you choose the best option for your needs.

Tips for Negotiating with Lenders

Don't be afraid to negotiate with lenders. Whether it's reducing the interest rate or waiving certain fees, there's often room for negotiation, especially if you have a good credit history and solid financial standing.

- Highlight Your Creditworthiness: Use your good credit score and loan repayment history as leverage in negotiations.

- Ask About Special Offers: Some lenders offer promotional rates or fee waivers for new customers or those willing to switch from another lender. Practical Strategies for Reducing Overall Refinance Costs

- Consolidate Debts: If you have multiple debts, consider consolidating them into your mortgage. This could result in lower overall interest payments.

- Additional Repayments: If possible, make additional repayments on your new loan. This can significantly reduce the amount of interest you pay over the life of the loan.

Refinancing your mortgage is a significant financial decision that requires careful consideration of the costs involved. By comparing offers, considering the assistance of a mortgage broker, and negotiating with lenders, you can ensure that you find the best possible deal for your situation.

Customer Scenarios: Navigating Refinance

Refinancing a mortgage can seem daunting, but many homeowners have navigated this process successfully. By examining real-life scenarios, we can uncover valuable insights and strategies that may help you in your refinancing journey.

Scenario 1: The High-Value Negotiator

John and Sarah's Story:

John and Sarah, a couple from Melbourne, were keen to refinance their mortgage to capitalize on lower interest rates. With a strong credit history and substantial equity in their home, they approached several lenders for quotes. Not content with the initial offers, they used these quotes as leverage in negotiations, emphasizing their creditworthiness and the competitive offers they had received. Their persistence paid off, resulting in a deal that significantly reduced their interest rate and waived several upfront fees, saving them thousands of dollars over the life of their loan.

Key Takeaways:

- Leverage Competing Offers: Use quotes from multiple lenders as a bargaining chip.

- Emphasize Your Strengths: A strong credit history and home equity are powerful negotiation tools.

Scenario 2: The First-Time Refinance

Alex's Story:

Alex, a first-time refinance in Sydney, was overwhelmed by the variety of refinance options available. Unsure where to start, Alex sought the advice of a mortgage broker. The broker helped Alex understand the different offers, focusing on long-term savings rather than just the initial interest rate. With the broker's guidance, Alex chose a loan that offered a competitive rate with lower ongoing fees, making it an excellent match for Alex's financial goals.

Key Takeaways:

- Seek Professional Advice: A mortgage broker can demystify the refinancing process and help you find the best deal.

- Look Beyond the Interest Rate: Consider all aspects of the loan, including fees and features, to ensure it aligns with your financial goals.

Scenario 3: Overcoming the Break Cost Barrier

Priya's Story:

Priya, living in Adelaide, was initially deterred from refinancing her fixed-rate mortgage due to potential break costs. However, after calculating the long-term savings from a lower interest rate, she realized that the benefits outweighed the initial expense. Priya negotiated with her new lender to absorb some of the break costs as part of the refinancing deal, making the switch financially viable and ultimately saving on her monthly repayments.

Key Takeaways:

- Calculate Long-Term Savings: Break costs can be daunting, but the long-term savings might make refinancing worthwhile.

- Negotiate Break Costs: Some lenders may be willing to negotiate or offset break costs to secure your business.

These scenarios illustrate the diverse paths homeowners can take to successfully refinance their mortgage. Whether through negotiation, seeking professional advice, or carefully weighing the costs and benefits, there are multiple strategies to navigate the refinancing process effectively.

Conclusion

Refinancing your mortgage presents a promising opportunity to improve your financial situation, whether by lowering your interest rate, reducing your monthly repayments, or accessing better loan features. However, the process is accompanied by various fees that can impact the overall benefits of refinancing. From application and valuation fees to potential break costs and lenders mortgage insurance, being well-informed about these charges is crucial.

The journey of refinancing requires careful consideration and strategic planning. As illustrated through the real-life scenarios of John and Sarah, Alex, and Priya, success in refinancing often involves leveraging competitive offers, seeking professional advice, and thoroughly evaluating the long-term benefits against the costs.

Remember, the goal of refinancing is not just to secure a lower interest rate but to ensure that the move aligns with your broader financial goals and circumstances. Negotiating fees, understanding the fine print of loan offers, and consulting with a mortgage broker can significantly enhance the outcome of your refinancing process.

In conclusion, embarking on the refinancing journey with a clear understanding of the typical refinance costs and a strategic approach can lead to substantial savings and a more favourable financial future. Take the time to research, compare, and negotiate to make the most out of your refinancing decision. Your path to financial betterment through refinancing is well within reach, armed with the insights and strategies outlined in this guide.

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.

Written By

The Craggle Team