We can do a lot, with just a little

By answering a couple of simple questions about you, we can

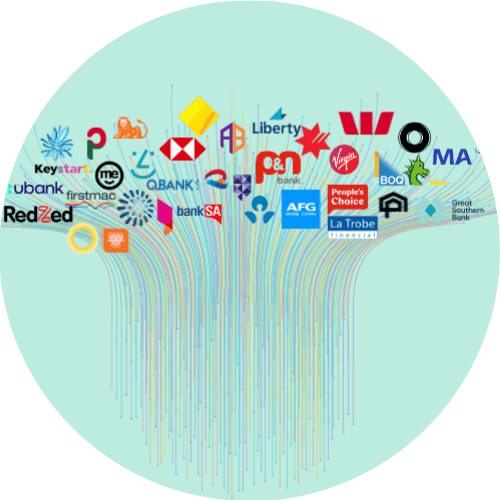

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Unlocking The Secrets Of Home Loan Rate Refinance With Craggle

Many Australians are keen on home loan rate refinance especially in recent years. It’s no wonder why: Our homes are our castles, and we’d like to keep them without diving headfirst into mortgage stress. A refinanced mortgage loan is one of the many ways to do so, but it can also be a complex process, especially for those unfamiliar with refinancing.

This is where Craggle can help.

Craggle uses the power of collective rate negotiation, known as Crowd Haggling, to bargain for lower monthly payments, more flexible repayment options, or other benefits of a refinanced mortgage. Craggle's crowd haggling event are timed so that you don’t have to wait too long while also giving banks or mortgage lenders ample time to offer fair deals.

With Craggle, you’re not alone in your search for fair and reasonable refinancing options.

Frequently Asked Questions (FAQ)

How do I know if I’m eligible for a home loan rate refinance?

A home loan rate refinance could be a good way to restructure your mortgage. However, there are a variety of factors that can affect refinancing eligibility. Here are some things to consider:

- Personal information: You will need to provide proof of eligibility when you apply for a mortgage refinance. You will typically be required to present certain documents, such as government-issued IDs, tax returns, utility bills, and similar documentation.

- Reason for refinancing: Some people opt to refinance for debt consolidation or to get a more favourable repayment option on their mortgage.

- Credit factors: Lenders and banks will want to know if you’re capable of repaying the new refinanced loan, so it’s best to anticipate requirements along these lines when you apply for a home loan rate refinance. These criteria often include your credit score, your home’s equity value, and your employment history or current income.

Mortgage stress can negatively affect people’s financial and emotional health, and it makes sense to seek a home loan rate refinance to alleviate some of this stress.

You can speak with your bank or lender about refinancing, consult with a financial advisor or mortgage broker for help with the refinancing process, or sign up for Craggle and let us help mediate for you through collective refinancing negotiations.

Craggle makes sure that everyone gets a Fair Go when it comes to competitive refinance rates, whether you’re renegotiating the interest rate with your existing lender or refinancing your home loan.

What documents do I need for a refinance application?

Mortgage lenders and banks will have a list of refinance eligibility criteria for a refinanced mortgage application. These requirements will help loan refinance lenders assess your eligibility for refinance on mortgage loans and any refinancing options they could offer. Typical requirements include documentation or information on your current mortgage, credit score, employment status, and other financial metrics.

Specifically, you will likely be asked for proof of identity, such as a driver’s licence or passport; proof of income or financial capacity, such as bank statements, payslips, and tax returns; updated credit history or credit score reports; and details on your current mortgage.

If you’re not confident in undergoing the home loan rate refinance process, why not consider signing up for Craggle? Craggle keeps your information private by utilising AWS Well-Architected best practices, so you can feel secure sharing your details with us for collective negotiation purposes.

How long does the home loan rate refinance process take?

The duration of the home loan rate refinance process can vary depending on several factors, such as your chosen loan refinance lenders, your financial situation, and the necessary documentation you can provide. Generally, your timeline may look like the following:

- Research and comparison: Ideally, you’ll spend some time researching different mortgage lenders, refinance rates, and the best refinance deals available that you may be eligible for. A refinance calculator or financial advisor could give you an idea of the potential savings and help you understand how to lower your mortgage rate.

- Application submission: If you're confident that you meet the eligibility criteria and have identified the best refinancing options for your needs, you can formally submit an application for a home loan rate refinance.

- Property valuation: Your chosen lender will conduct a property valuation to confirm the value of the home or property. This information can influence your eligibility and the low mortgage rates you may be offered.

Once the application review process is underway, it may take some time for your chosen lender or bank to determine whether they can offer adjusted refinance rates on your home loan. Loan refinance guidelines vary between lenders as well, meaning the entire process could take anywhere from a few days to a few weeks.

The key to a smooth home loan rate refinance process is to understand the refinance eligibility criteria, be aware of the best refinancing options for your situation, and adhere to the lender’s refinance guidelines.

Alternatively, you could sign up for Craggle and join a Craggle Event.

You could be offered a retention offer from your bank or lender through us, with your new rate taking effect within five business days. Feel free to get in touch with us if you have any questions about signing up; we’ll be more than happy to walk you through the process.

Discover Craggle: Harnessing the Power of Crowd Haggle for Home Loans

Traditional means might leave you wondering how to navigate the complexities of the home loan refinance process, but with Craggle, you’re not taking on the journey alone. At Craggle, we believe in a clever approach to home loans that puts you back in the driver’s seat, thanks to the innovative concept of the Crowd Haggle.

We believe that everyone deserves a Fair Go on their home loan. If you’ve ever felt that there are options for a better mortgage refinance rate on your home loan, then Craggle could help you.

The principle is simple: Why struggle to get a fair offer on a home loan rate refinance when you can collectively negotiate your refinance rates with other Australians? Through Craggle, we pool together like-minded customers, bolstering your bargaining strength.

With Craggle bridging the gap, banks or mortgage lenders get an opportunity to present a refinance home loan offer that could include benefits like a lower interest rate, a different loan term, or greater repayment flexibility. This way, Australians like you could receive a home loan rate refinance deal that genuinely works for your situation.

We’re on a constant mission to ensure you always have a simple route to an ideal mortgage rate refinance deal. By taking as little as five minutes to answer our questionnaire about yourself and your home loan, you could be well on your way to a Craggle Event sooner than you might expect.

With Craggle, everyone gets a fair shot at the best home loan refinance rates they could be eligible for. So what are you waiting for? Sign up with Craggle today!

Disclaimer: All opinions expressed in this article are strictly for informational and entertainment purposes only and should not be taken as financial advice. The views expressed may change at any time and without notice.