We can do a lot, with just a little

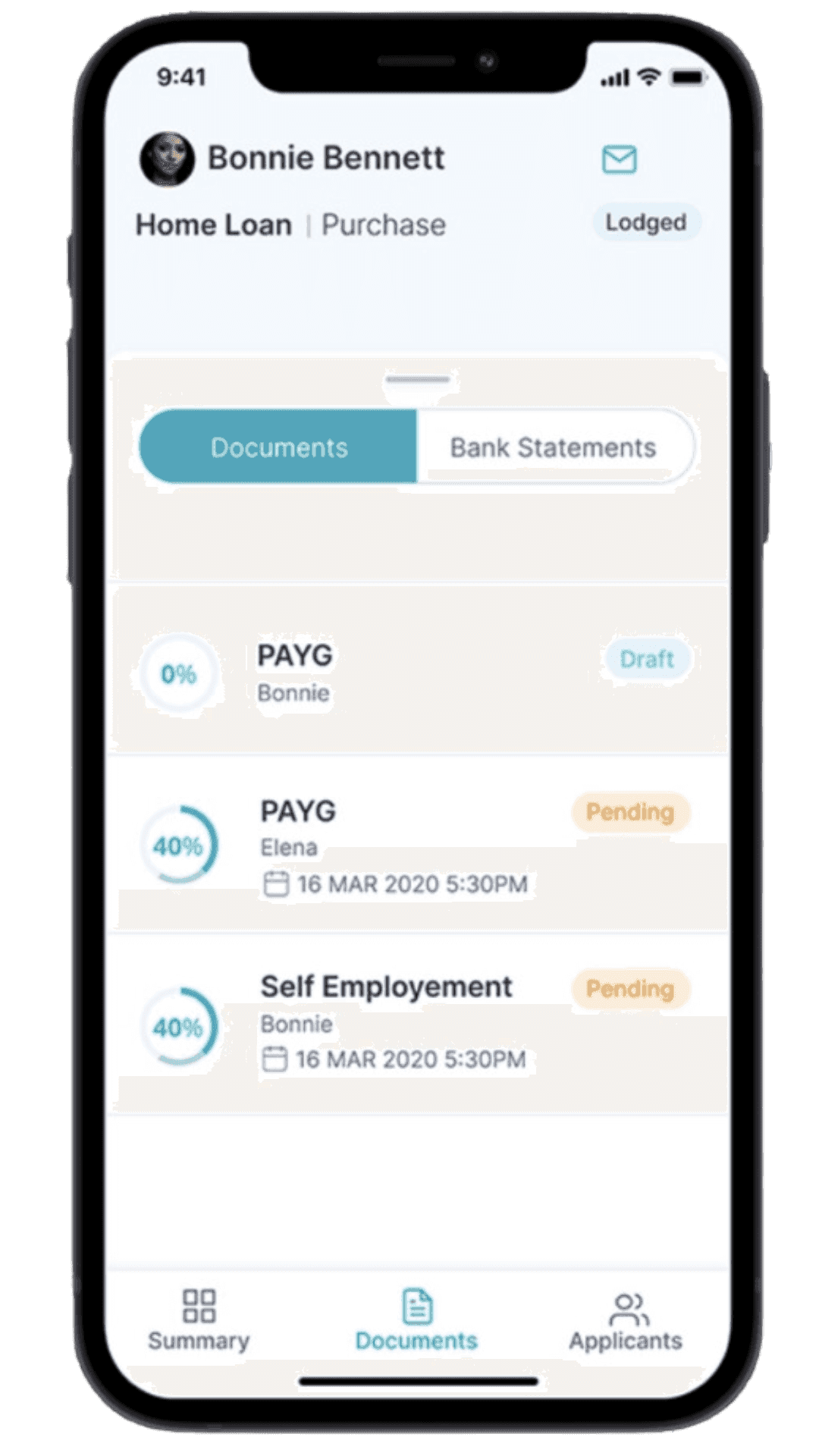

By answering a couple of simple questions about you, we can

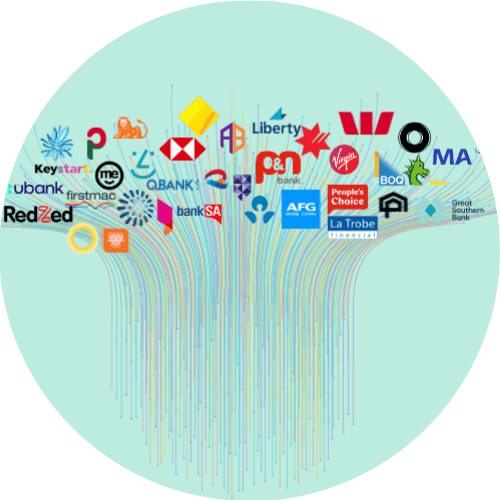

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

The Ultimate Power: Choose From Home Loan Refinance Deals

Deciding whether or not to get a mortgage was an important choice, but so is choosing from different home loan refinance deals.

Here at Craggle, we’ll discuss the importance of mortgage refinance, what factors to watch out for, and why people may want to look into it. What’s more, we’ll talk about savings calculations, switching lenders, and keeping a rate that works for you.

Join us today and learn more about how we can get you suitable home loan refinance deals through our Craggle Event and crowd haggling approach.

Home loan refinancing considerations

The way this type of loan works

Home loan refinancing deals allow a borrower to take out and replace their mortgage with a new offer, ideally with a lower mortgage rate for refinance, a different loan term, and more repayment flexibility. This gives them the opportunity to save funds and use them in other endeavours.

Various reasons behind the refinancing

Having a property to call your own is a dream for most Australians, but it typically doesn’t end there since most people also have other goals and aspirations in mind. For instance, others may also want to save for exciting renovations or repairs, while others would be eager to upgrade their beloved vehicle.

Frequently Asked Questions (FAQ)

How can I calculate the potential savings from a refinance?

If you’re looking for the best home loan refinance rates or home loan refinance deals, you probably want to calculate the potential savings you can receive through a refinance. Nowadays, there are a number of online calculators you can find that can help you figure out an estimate. This tool allows you to consider the key aspects involved – your interest rate, the new one, possible refinance costs, and the loan durations.

You can also manually calculate how much you could potentially save with home loan refinance deals. Simply compare your fortnightly, monthly, quarterly, or yearly payments (including interest) with the new one you’re vying for. You can then add up all the savings compared to the old rate and factor in deductions like refinance costs.

However, it’s crucial to figure out how to get refinance options in the first place. Rather than looking for multiple refinance quotes from various lenders, you can join us at Craggle.

Here, you can amplify your voice and bargaining power with other like-minded people in a similar situation. This ‘crowd haggling’ will allow refinance lenders to see the collective value of multiple borrowers and come back with a fair deal.

You can then pick a suitable option based on your specific needs, and a bank representative will reach out to you within forty-eight hours about your new rate.

Can I switch lenders when refinancing?

When it comes to the home loan refinance process, borrowers don’t have to stick with their current lender. Just keep in mind that different home loan refinance lenders might have different requirements, which might have you wondering how to qualify for home loan refinance deals again or maybe, ‘What do other lenders consider if I want to opt for their refinance mortgage deal?’

At Craggle, not only can we help you find an offer with a lower interest rate, a different loan term, more repayment flexibility, and even additional features, but we can also give you the opportunity to experience the luxury of choice.

When your voice gets amplified by other Cragglers just like you and your bargaining power increases with everyone’s collective value, you can have a fair go and select from different options. With us, you can choose whether or not you want to stay with your current lender or try out another refinance home loan offer from another lender.

This way you can get a chance to save money and perhaps work on other endeavours like upgrading the family car, repairs, renovations, or even debt consolidation.

How can I lock in a favourable interest rate during refinancing?

Say you found a suitable option after looking up some of the best refinance rates for your home loan. In that case, you may want to check if this offer has a rate lock. This allows borrowers to ensure that the favourable interest rate they want is maintained during an agreed-upon timeframe. With this feature, you won’t have to think about the rate fluctuating during the duration of the refinance.

However, what if you end up finding even better rates or home loan refinance deals down the line? A mortgage rate lock may tie you down for longer than you’d like or come with hefty closing costs.

For this reason, we at Craggle have our regular, timed Craggle Event. Instead of putting up with the same rate for months or even years, we allow you to join other homeowners who want the same thing – fairer home loan refinance deals. Through everyone’s collective value, you can be better positioned to negotiate with banks and enjoy the rates you prefer.

Embrace the power of the crowd with Craggle

Gone are the days when people would look for home loan refinance deals all by themselves, ultimately attempting to secure a better rate. Enter Craggle, an innovative service that’s helping borrowers and lenders interact on an even playing field.

By bringing multiple borrowers together and combining their bargaining power, everyone has a unique opportunity to extend fair offers to a vast audience. It’s a win-win approach that shakes up the conventional system, giving institutions a chance to renew bonds or serve new clients. Sign up now!

Disclaimer: Unless explicitly specified otherwise, the opinions presented on this page are strictly for general informational and entertainment purposes only. Furthermore, they should not be taken as any form of personalised financial advice or recommendation. The views expressed in this article are also subject to change at any time without prior notice.