We can do a lot, with just a little

By answering a couple of simple questions about you, we can

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Everything You Need to Know About Self-Employed Home Loans

Self-employed Australians often enjoy the flexibility and independence of running their own businesses, but qualifying for a home loan can sometimes feel more challenging than it is for salaried employees. By preparing the right documentation, understanding how lenders view self-employed income, and exploring the right loan products, you can position yourself for success. Below is a guide that breaks down the essentials and provides practical tips for securing a self-employed home loan.

Navigate this Article

Why Self-Employed Home Loans Can Feel Different

- Income variation: Lenders often consider self-employed earnings less predictable than regular wages, leading them to scrutinise business income and cash flow.

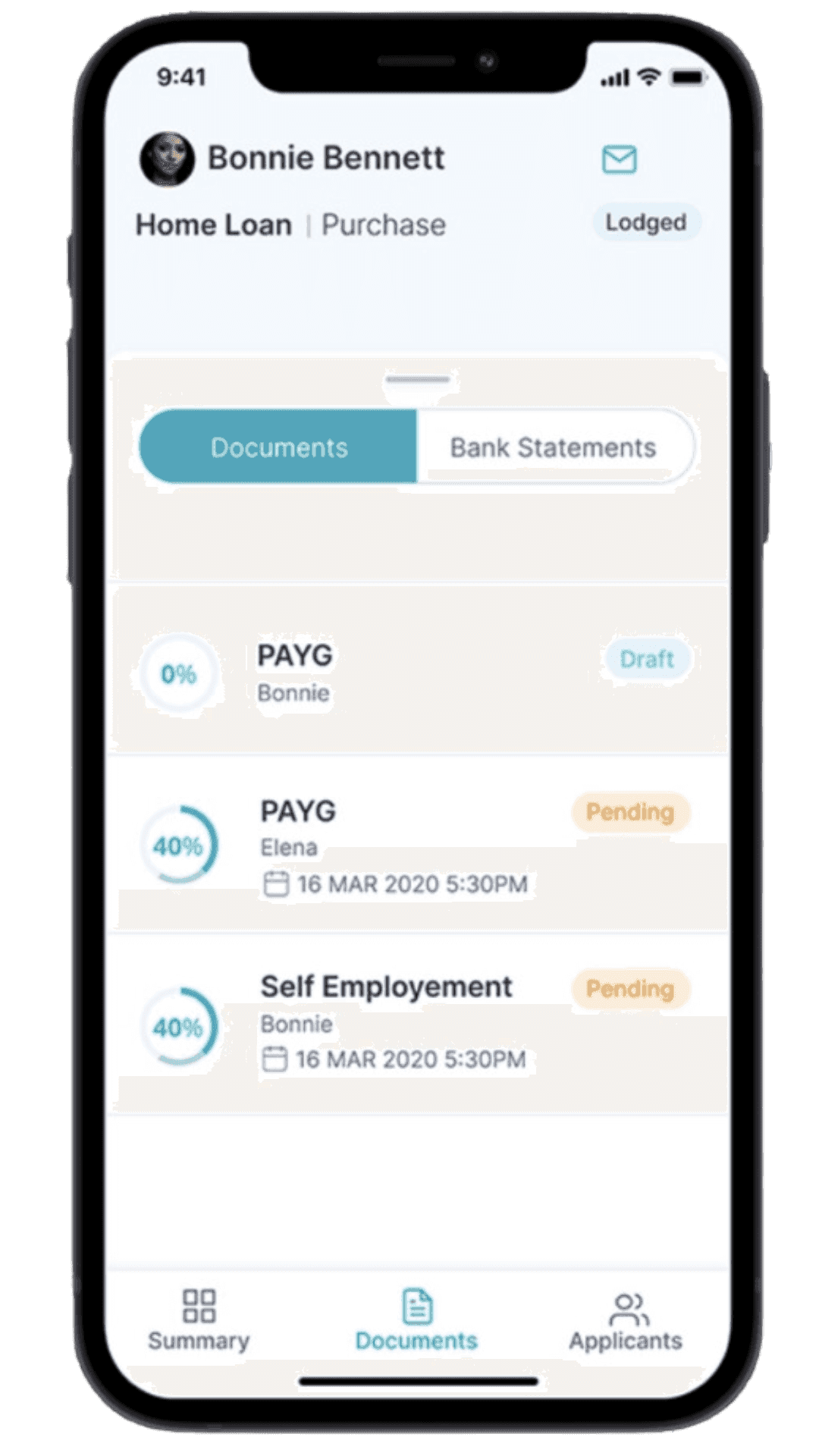

- More documentation: Beyond your personal financial details, lenders may also ask for business financial statements and proof of ABN and GST registration.

- Higher perceived risk: Self-employed borrowers sometimes pay higher interest rates or need a larger deposit because lenders want to offset the risk of irregular income.

Despite these hurdles, many Australians who work for themselves successfully obtain a mortgage. The key is putting together a strong application that highlights your financial stability.

What You Will Need

1. ABN and GST Registration

- Prove that your business is established.

- Many lenders require at least 1–2 years of ABN registration and GST registration (if applicable) to show trading continuity.

2. Financial Statements

- Commonly includes two years of tax returns, profit and loss statements, and balance sheets.

- Demonstrate consistent earnings and the ongoing viability of your business.

3. Personal Financial Records

- Show how you manage personal debt (credit cards, personal loans, etc.).

- Provide evidence of assets (property, savings, shares, or motor vehicles).

4. Business Activity Statements (BAS)

- For low-doc loans, these may replace or supplement lodged tax returns.

- The lender uses your BAS to verify your income over recent months or years.

How Long Do You Need to Be Self-Employed?

- Under 1 year: It’s more difficult to secure approval from many lenders, but it’s not impossible. Some lenders may accept your previous employment history in the same industry as proof of future earning capacity.

- Between 1 and 2 years: You may qualify for certain home loans as long as you have at least one year of business financials and can show prior experience in the same line of work.

- 2 years or more: You’re better positioned with a track record of lodged tax returns and full financial statements.

Improving Your Chances of Approval

- Keep Accurate Records Maintain up-to-date business records. Lenders take confidence in well-organised financial statements and tax returns.

- Separate Your Business and Personal Finances When lenders see clear cash flow, it’s easier to assess your application.

- Strengthen Your Credit Score Manage personal debts, avoid late payments, and ensure you stay on top of bills. This helps reinforce your reliability as a borrower.

- Maintain a Healthy Deposit A sizeable down payment not only reduces what you owe but also lowers the perceived lending risk, potentially unlocking better interest rates.

Self Employed for <2 years Considering Low Doc Loans

If you haven’t been self-employed long enough to provide two full years of tax returns or business financial statements, a low doc loan can offer a flexible path toward homeownership. Low doc loans typically allow self-declared income (with supporting documents such as BAS or bank statements), but:- You might face higher interest rates compared to full-doc loans.

- Many lenders require a larger deposit or may charge additional fees (like a risk fee).

- Lenders Mortgage Insurance (LMI) can apply if you borrow more than a certain percentage of the property’s value.

Even though low doc loans can appear more expensive, they can be a lifeline if your business is still maturing and you haven’t built up multiple years of comprehensive financial data.

Steps to Get Started

-

Review Your Finances Compile your recent tax returns, BAS, profit and loss statements, and bank records.

-

Assess Your Borrowing Power Use an online borrowing power calculator or consult with a lending professional to see what you might be eligible for, so you can shortlist the properties in your price range.

-

Explore Different Lenders Some lenders specialise in self-employed home loans or low doc products. Research or seek guidance to find a lender that appreciates the nuances of your situation.

-

Chat With an Expert Professional insights can help narrow your options. Click here to speak with one of our lenders today and discover tailored solutions that match your financial profile.

The Bottom Line

Securing a self-employed home loan in Australia doesn’t need to be daunting. Staying organised with your paperwork, showcasing stable business performance, and choosing a lender experienced with self-employed or low doc loans can make all the difference. If you’re ready to take the next step, click here to speak with one of our lenders today.Disclaimer: The opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations. While every effort is made to ensure the listed offers are accurate, we make no guarantee regarding their accuracy, completeness, or availability.