We can do a lot, with just a little

By answering a couple of simple questions about you, we can

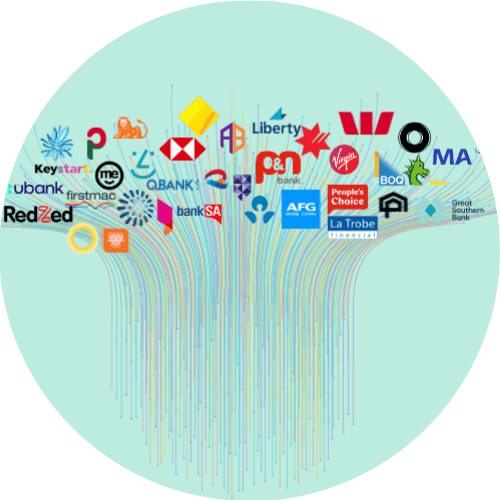

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Increase your property’s return with Hometime and Craggle

In the dynamic world of property management and homeownership, strategic partnerships can significantly enhance the value delivered to clients. A prime example of such a beneficial collaboration is between Hometime, a leading property management company, and Craggle, an innovative Australian business revolutionising the home loan market. This partnership primarily focuses on providing homeowners with robust solutions in refinancing and managing their property investments.

The Strategic Benefits of Refinancing Through Hometime and Craggle

Refinancing a home loan is a strategic move many homeowners consider to improve their financial standing. By refinancing, homeowners can potentially secure lower interest rates, reduce monthly mortgage payments, or adjust the term length of their loans. This financial manoeuvre can lead to substantial savings over time, more disposable income, and increased property equity, which are crucial benefits in today’s economic climate.

Access to Better Loan Rates

Through the partnership with Craggle, Hometime customers gain exclusive access to negotiated home loan rates that might not be publicly available. This can be particularly advantageous for property owners looking to refinance in order to invest further in their properties or manage other financial obligations more comfortably.

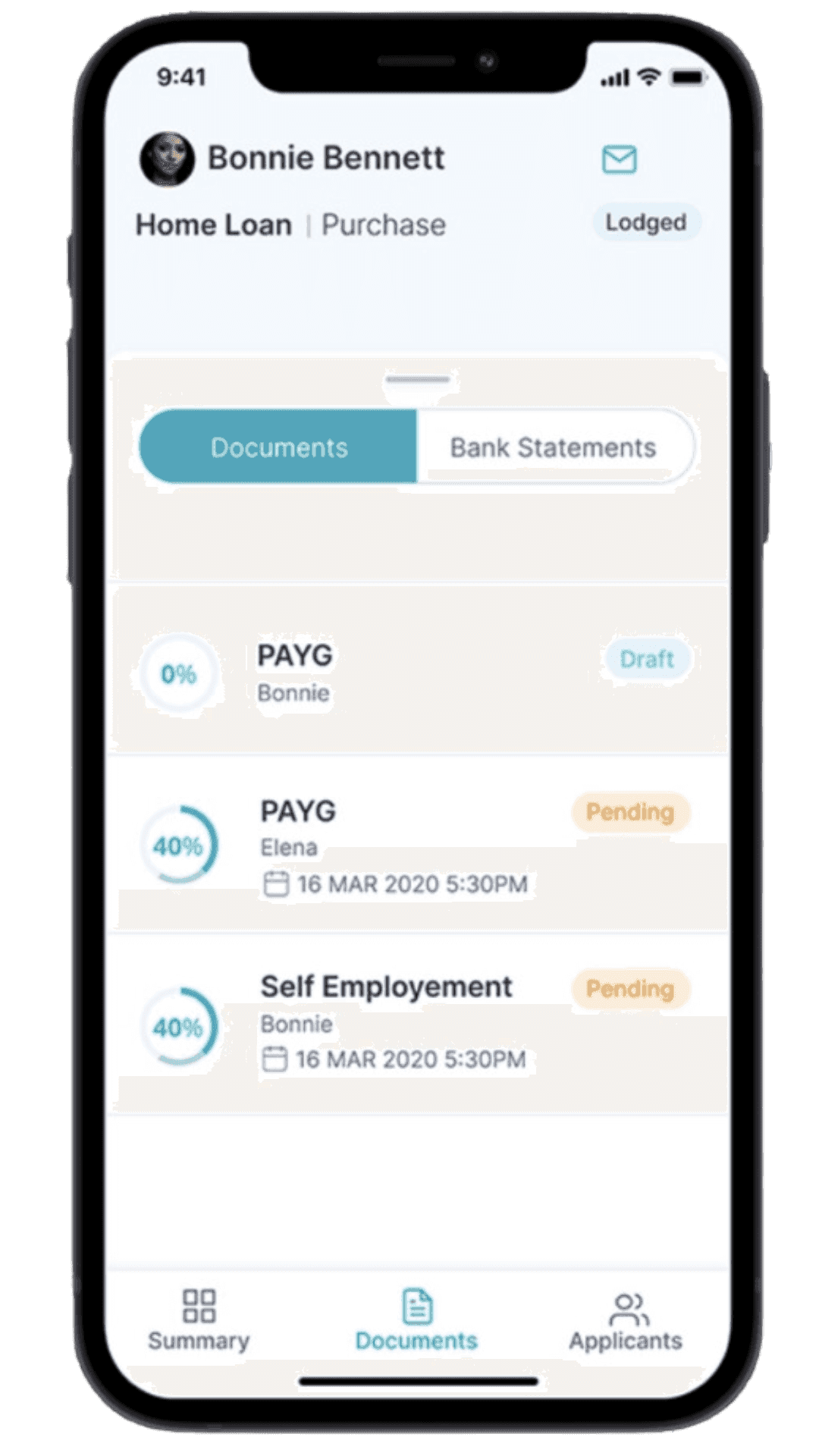

Streamlined Refinancing Process

Craggle’s expertise in the home loan industry complements Hometime’s property management solutions by simplifying the refinancing process. This integration allows homeowners to manage both their property and finance through a single streamlined service, reducing the usual hassle associated with refinancing home loans.

Enhanced Property Investment Returns

Refinancing can free up additional capital which can be reinvested into the property to enhance its value or expand one's real estate portfolio. Hometime’s proficiency in maximising property returns aligns perfectly with Craggle’s financial acumen, providing homeowners with a potent combination to amplify their investment outcomes.

Tailored Financial Advice

Both Hometime and Craggle understand that every homeowner’s situation is unique. The partnership ensures that clients receive personalised financial advice, focusing on optimal strategies for loan refinancing that suit individual long-term property management and financial goals.

Increased Financial Security and Flexibility

With the fluctuating interest rates and changing market conditions, securing a more favourable loan term through refinancing can offer greater financial security and flexibility. This is especially important for those managing multiple properties, as it helps stabilise cash flows and reduce financial risk.

Conclusion

The collaboration between Hometime and Craggle represents a forward-thinking approach to property management and financial planning. By combining expertise in property management with innovative loan negotiation tactics, the partnership not only simplifies the refinancing process but also enhances the economic well-being of homeowners. For those looking to refine their property investment strategies or improve their financial health through refinancing, exploring the benefits of this partnership is a promising step forward.

This partnership marks a milestone in providing comprehensive solutions that cater to the evolving needs of modern homeowners, making it an exemplary model in the property management and financial services industries.

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.