We can do a lot, with just a little

By answering a couple of simple questions about you, we can

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

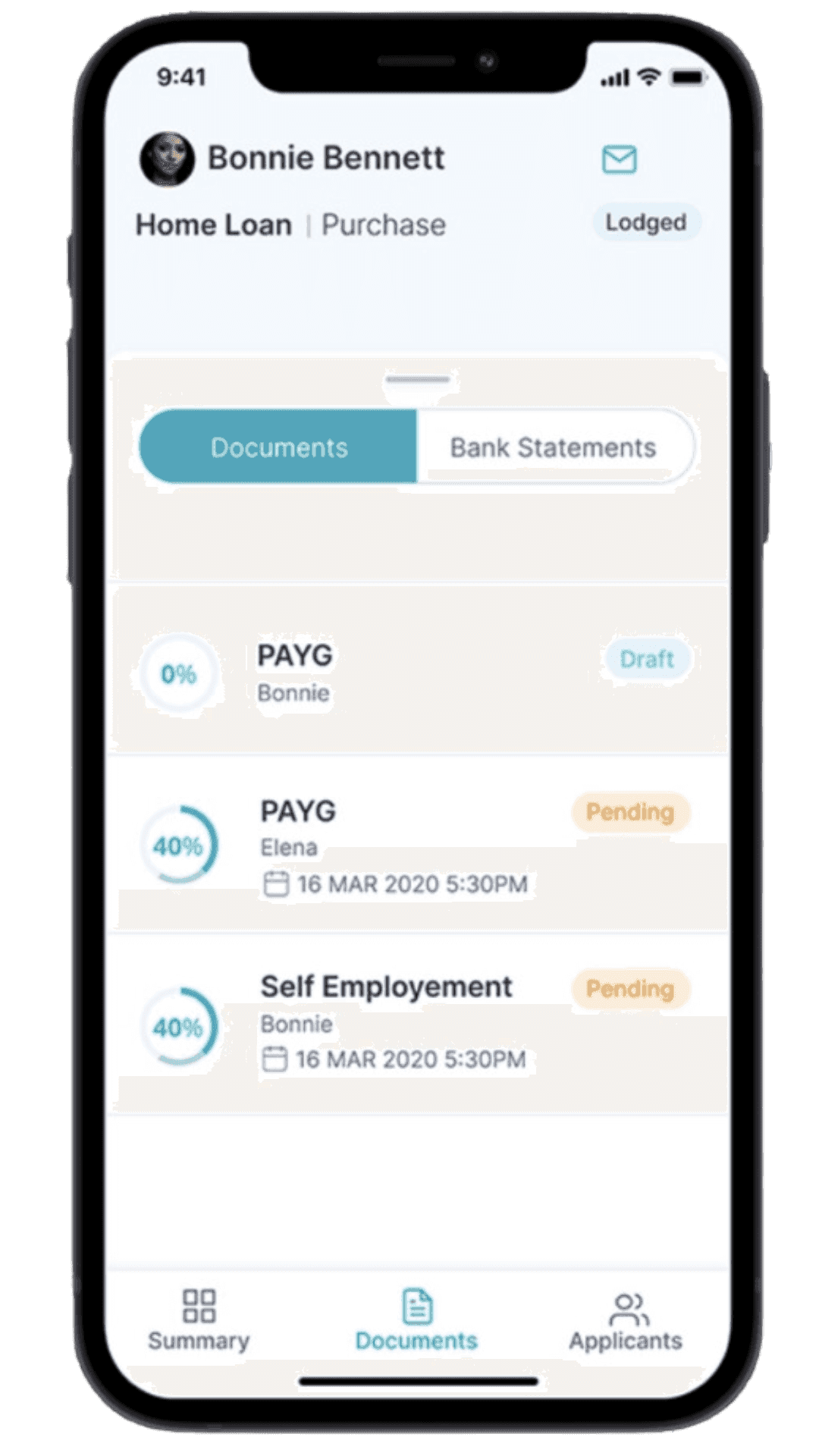

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Macquarie Bank

Macquarie Bank, commonly known as Macquarie, is a leading global financial services provider headquartered in Sydney, New South Wales. Founded in 1969, Macquarie has grown to become one of Australia's most prominent financial institutions, offering a wide array of specialised financial products and services across the globe.

Key Features

Access

Macquarie Bank offers extensive access through a sophisticated digital banking platform, providing customers with easy online and mobile banking services. While Macquarie may not have as many physical branches as some traditional banks, their digital-first approach ensures customers can access and manage their finances efficiently from anywhere, at any time.

Security

Macquarie Bank is committed to the highest standards of security, employing cutting-edge technologies to protect customer data and financial transactions. Their advanced security protocols, including strong encryption and multi-factor authentication, ensure that customers’ accounts and personal information remain secure.

Customer Service

Macquarie Bank is known for its high-quality customer service, offering personalized support tailored to individual needs. With dedicated relationship managers, 24/7 phone support, and responsive digital channels, Macquarie provides a premium service experience that prioritizes customer satisfaction.

Community and Environmental Initiatives

Macquarie Bank is deeply involved in community and environmental initiatives, with a strong focus on sustainability and social impact. The bank supports numerous programs aimed at driving positive change, including investments in renewable energy projects and community development initiatives, reflecting its commitment to corporate social responsibility and ethical business practices.

Key Services

Home Loans: Macquarie offers a comprehensive range of home loan solutions tailored to meet various customer needs, including fixed-rate, variable-rate, and split home loans. These products cater to first-time buyers, property investors, and individuals seeking refinancing options.

Credit Cards: Macquarie provides a selection of credit cards with features such as rewards programs, low-interest rates, and balance transfer options. These cards are designed to suit diverse spending habits and financial objectives.

Personal Loans: Macquarie's personal loans are crafted to assist customers with a variety of financial needs, including debt consolidation, major purchases, or funding significant life events. They offer both secured and unsecured loan options to accommodate different circumstances.

Term Deposits: Macquarie offers term deposits with competitive fixed interest rates over varying terms, enabling customers to grow their savings securely and predictably.

Bank Accounts (Transaction and Savings): Macquarie provides a variety of banking solutions, including everyday transaction accounts for seamless daily banking and high-interest savings accounts to help customers achieve their financial aspirations.

Macquarie's diverse service offerings, combined with its strong presence in the global and Australian financial markets, underscore its position as a significant and innovative player in the industry. The bank is known for its commitment to delivering tailored financial solutions, exceptional customer service, and ongoing support to its clients and communities.

Major Bank Alternatives

Australia's 'Big 4' banks with extensive branch networks across the country that provide a comprehensive range of services.

|  |  |  |

|---|

Non-Major Alternatives

Regional and Digital banking institutions that offer financial services.

|  |  |

|---|---|---|

|  |  |

|  |  |