We can do a lot, with just a little

By answering a couple of simple questions about you, we can

Compare 7,500+ Loans in Minutes

Best Rates, Matched to You

Skip the Hassle (and the Paperwork)

Expert Advice, On Your Terms

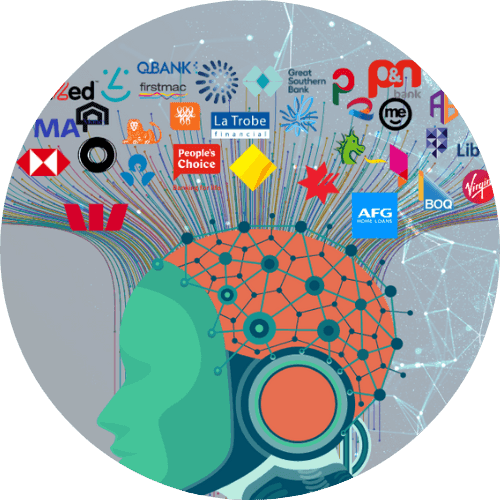

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Mortgage Rate For Refinance: The Ultimate Application Foundation

You’re not using a time machine, but it could sure feel like one if you get the best refinance rates for your housing situation.

Here at Craggle, our guide will first show you how to refinance a mortgage in Australia, but more than that, we’ll also discuss the importance of this type of loan as well as how you can find fair terms such as a mortgage rate for refinance loans.

A play-by-play on mortgage refinancing

Understanding your interest

Starting off, it might seem like there’s a lot to unpack, but everything becomes less daunting if you focus on the mortgage rate for refinance loans and the other charges. For instance, this could be the monthly repayments and fees associated with your current mortgage.

Ultimately, knowing your mortgage inside and out gives you a better idea of what you want to change through a refinance home loan offer.

Punching numbers

After taking a look at your prospective offer and its mortgage refinance rates and conditions, you’re going to want to know how much this refinance decision is going to help overall. It’s a bit like planning a road trip; you’ll want to map out points along the way, from more suitable terms to the odd repayment penalty speed bump.

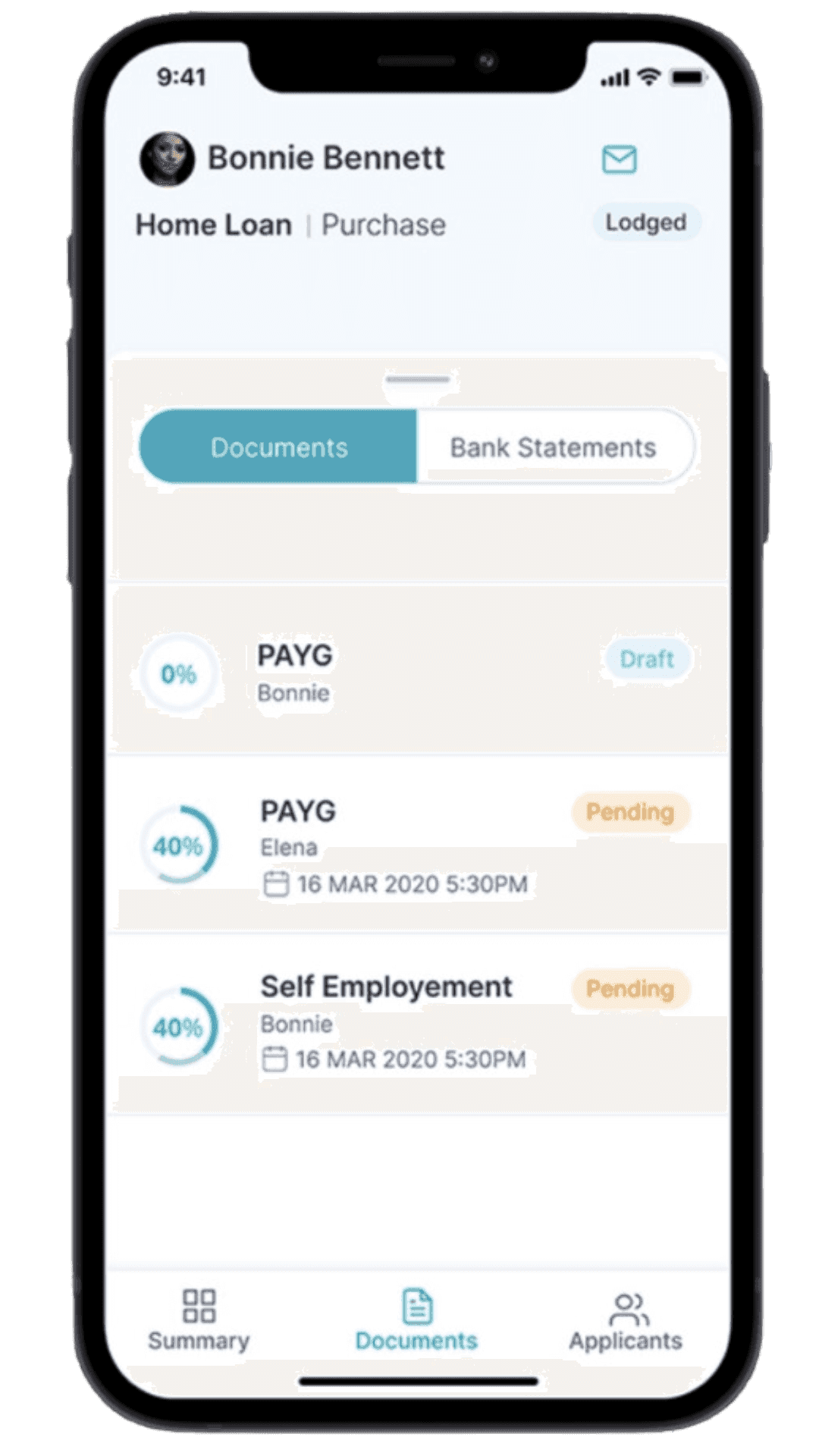

Setting the stage

Now that everything’s accounted for, start by going through the refinance application process. You’ll need to be ready with your financial details, including your income, employment history, expenses and credit score. Even if you’re getting an improved rate with your current bank (i.e. you don’t have to refinance home loan), it pays to have these ready should they need a refresher on details. It could be a good opportunity to consolidate debt, or even consider additional lending to finance investment opportunities.

A new beginning

Last, but not least, it’s time to look back at your old loan. Here’s where you’ll sign on the dotted line to finalise the switch, but take note that you should keep all the memories. This also means storing copies and details connected with your previous deal, so you can reference factors like a mortgage rate for refinancing in the future.

Frequently Asked Questions (FAQ)

What is a mortgage refinance?

Just like trading in your old car, mortgage refinance deals can help you smooth over old bumps in your old loan. With the right offer, you can expect something that’s more comfortable and tailor-fitted to your preferences.

Through factors like a more suitable mortgage rate for refinance loans, you could begin saying goodbye to your old loan and hello to potential savings. In addition to this, the benefits of refinancing your mortgage could even go beyond snagging low mortgage rates (compared to what you had previously).

Think of it as your mortgage’s update, where a better rate could save you thousands in interest or help reduce your loan term. Plus, the other advantages you could unlock include new loan features, equity access, and the chance to bundle everything together into one neat debt consolidation package.

Can I refinance multiple times to get better rates in the future?

Yes, you can! Variable rate refinance is possible whenever you like, subject to the usual requirements, such as completing an application and providing your financial information. Fixed rate mortgage refinance can be tricky and can come with some daunting fees – so it’s best to consider all of the implications before going down this route.

Of course, if your fixed rate is maturing shortly, you can start looking at your options – including renegotiating your rate with your current provider. After all, who wouldn’t want fairer terms, like a more suitable mortgage rate?

Seeking out the best refinance rates multiple times can be a crafty strategy to keep saving as your financial situation evolves. This could simply involve using a refinance calculator every now and again to see if you’re actually going to spend less time and money.

Just remember that you should always keep some refinance mortgage best practices in mind, such as weighing the costs of potential closing fees against potential savings.

What’s more, you should also look ahead and determine whether you’re going to stick around in the same house for long. If you plan on selling the property in the immediate future, then you should consider the kind of profit you’ll make if you take advantage of your equity.

How can I compare different refinance offers from lenders effectively?

Comparing offers in hopes of finding the best lender for refinance loans might feel like a trek through a spiral maze, especially if you’re looking to refinance with bad credit. While you could go the traditional route, manually searching around for providers and allotting hours of your free time just to compare refinance rates, you could opt for a mediator service instead and get a recommendation fast.

If you’re someone who’s been wanting assistance when it comes to terms like a mortgage rate for refinance loans, then it’s time to call on your trusted ally, Craggle! We rally the power of Aussies, demonstrating the combined power of their loan values. This is so we can help you negotiate a fairer deal with the banks you already know and love.

Plus, with our exclusive Craggle Event, you won’t be left twiddling your thumbs waiting for the best time to refinance your mortgage. It’s timed perfectly to give you a chance to get a fair mortgage rate for refinance loans and more from a bank, all while giving them an adequate processing period to see the value of all you Cragglers.

Crowd haggle your way to fair home refinance loans

Aiming to revolutionise the way people secure home loan refinance deals around the country, Craggle wants nothing more than for you to gain more control over your financial future. Here, we firmly believe in the power of the crowd haggle, a concept that harnesses the collective bargaining capabilities of everyday Australians, all so that they can secure a fairer mortgage rate for refinance loans and more.

But remember that we’re not merely about getting you a lower interest rate; it’s about giving you a fair chance! We want negotiation to be at your fingertips, providing a platform where you don’t have to secure a suitable offer by yourself.

Although we’re starting with options like a refinance on a mortgage plan, our mission is to provide the easiest way to a fair deal everywhere. Together, our collective strength enables us to open up new opportunities, so join us today and let’s keep the power where it belongs – with the people!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.