We can do a lot, with just a little

By answering a couple of simple questions about you, we can

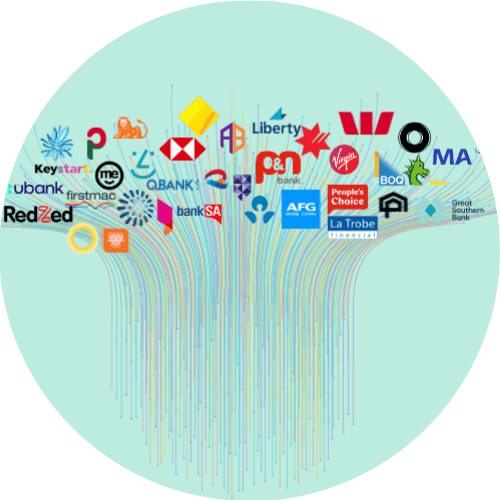

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Mortgage Rate Refinance Made Easy With Craggle

Understanding the nuances of mortgage rate refinance strategies can feel like a journey taken alone, with challenges and complex terms at every turn. But imagine having the collective strength of others guide you to the best deal.

With Craggle by your side, you’re no longer on your own. We bring together voices from all over, magnifying yours, ensuring you’re not only listened to but also valued when it comes to mortgage rate refinance.

The Essence of Mortgage Rate Refinance

What is a Mortgage Rate Refinance?

A mortgage rate refinance is the process of trading in your current home loan for a new one. The new loan may offer a lower interest rate, additional features, a different loan term, or greater flexibility in repayments.

Top Reasons to Consider Refinancing

- Cost-effective Payments: Homeowners who refinance often secure a lower interest rate, which significantly reduces their monthly expenses.

- Swift Repayment: If you opt for a home loan refinance, you can accelerate your mortgage-free journey by opting for a shorter loan term.

- Stable Payments: When you refinance on mortgage, you may switch from an adjustable-rate mortgage to a fixed-rate mortgage and expect consistent, predictable monthly payments.

- Capital for Needs and Wants: Your home's equity can be accessed by refinancing, allowing you to finance renovations or other pressing financial purposes. Among them are home improvements, home repairs, updating your family car, and even financing your next property purchase.

Discovering Craggle and the Ease of Crowd Haggle

What is Craggle and why does Crowd Haggle matter?

Having trouble making sense of mortgage refinance offers? Let Craggle be your guide. We’re not just another platform; we’re the collective voice of Aussies like you. Our mission is to ensure lenders really listen. This is accomplished by uniting homeowners to boost our bargaining power, aiming for better, fairer deals on home loans with mortgage lenders.

The Craggle Event

A Craggle Event is our signature approach to harnessing the collective might of the Craggle community. During this strategic period, we pool the combined loan values of Cragglers, showcasing to banks the formidable power of our united front.

Each Craggle Event is meticulously timed: ensuring you don’t linger in limbo while giving banks just the right window to recognise the immense value of our consolidated force and respond with a just and fair offer.

Frequently Asked Questions (FAQ)

How do I know if I’m eligible for a mortgage rate refinance?

Eligibility for mortgage rate refinance isn’t a one-size-fits-all answer. Typically, lenders look at the usual refinance approval requirements: credit score requirements, the balance of your income to your debts, and the equity you’ve built up in your property. These factors act as your financial fingerprint, helping lenders make the call on your refinance application.

Like other mortgage brokers, our approach to securing better rates requires access to your personal information. But rest assured, our unwavering commitment to data security and a stringent privacy policy ensure utmost confidentiality. Plus, with our accreditation under the Australian Credit Licence by ASIC, we’re dedicated to upholding the highest industry standards.

Do I need an appraisal for a mortgage rate refinance?

Absolutely! Think of an appraisal as your home’s moment on the runway, showing off its value. It’s essential because it offers your lender a professional’s view of what your property’s worth, determining how much you can borrow for a refinance.

The more equity you have in your home, the more leverage you have in negotiations to help secure a better mortgage rate refinance. Additionally, you can avoid paying Lenders Mortgage Insurance for your new loan by having at least 20% equity in your home.

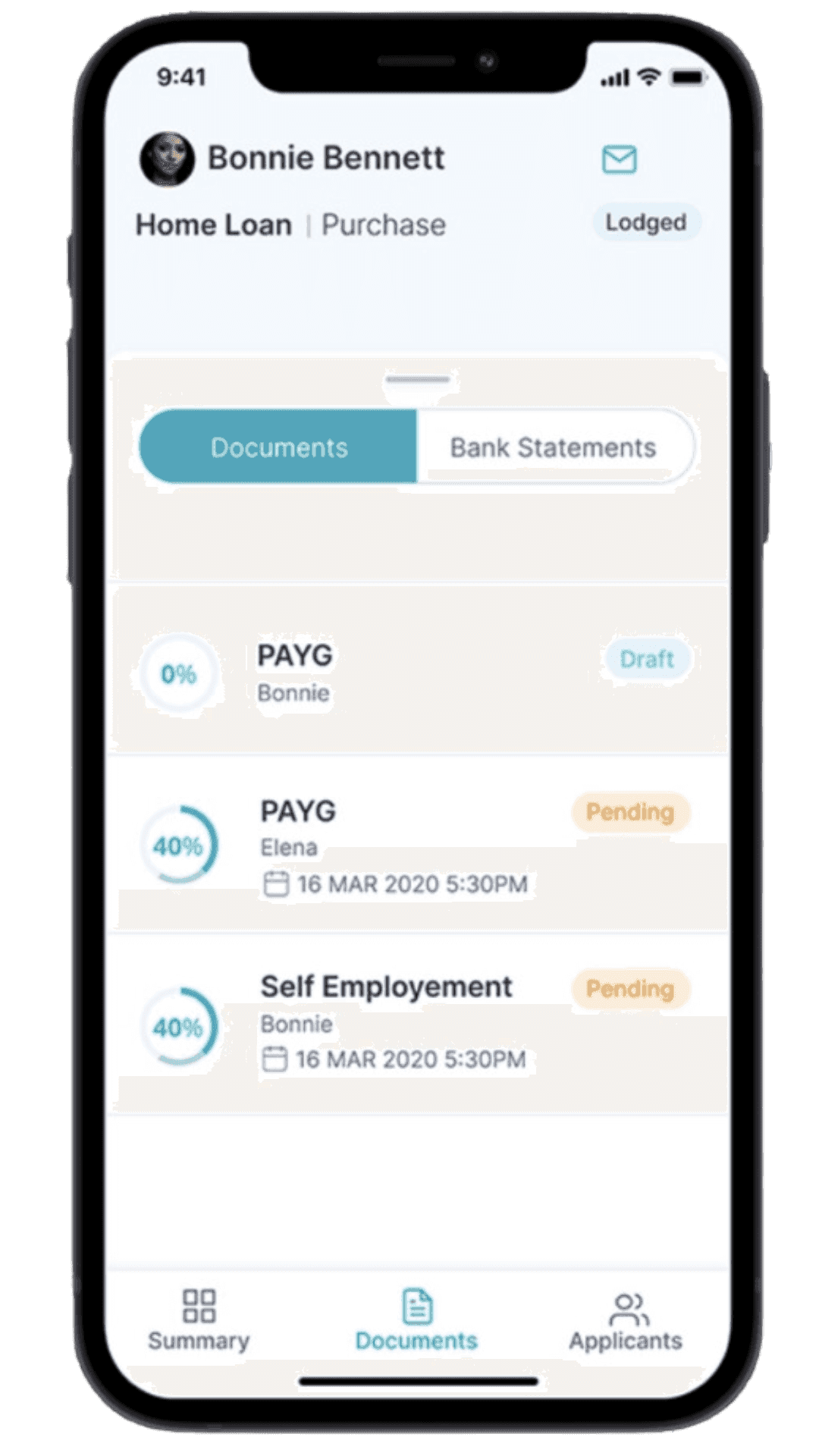

Joining Craggle is a breeze, and you’ll quickly see the benefits of mortgage rate refinance deals with us! Start by sharing a bit about yourself, then dive into your loan specifics. Next, provide a rundown of your property, followed by your income details. By the end, you’ll get a quick summary to review all the information.

What’s the role of a mortgage broker in a refinance?

Imagine a mortgage broker as your personal home loan concierge. Once you choose your preferred rates with Craggle, we may get a broker partner to help submit your application for the best mortgage rates you’ve selected. Craggle helps you sift through various lenders and cherry-pick the finest deals. We, in conjunction with our partners, also take some weight off your shoulders during the application rigmarole.

We’re here to make sure everyone plays fair, with competitive rates for our Cragglers. Whether you’re looking to renegotiate the interest rate with your existing lender or venture into new territories with a mortgage rate refinance, we’re your trusted guide. Decisions remain in your court, whether to continue with your existing provider or venture into new terrain.

If you choose a third-party offer that provides the mortgage refinance rates you like, the provider will reach out to you directly, and this will likely involve an application process and a formal credit assessment.

Craggle: The Powerhouse of Fair Home Loan Deals

Craggle isn’t just a name; it’s a movement for those craving a fair go with their mortgage rate refinance strategies. Through the might of Crowd Haggle, we merge the voices of many, ensuring a competitive refinance home loan offer comes to light. And for lenders? Craggle opens a window to showcase their best refinance rates to a ready audience.

While we’re making waves with home loans now, our vision extends to championing fair deals universally. With Craggle, it’s about ensuring every refinance home loan offer counts. Dive in, and let’s shape the future together. Sign up now!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.