We can do a lot, with just a little

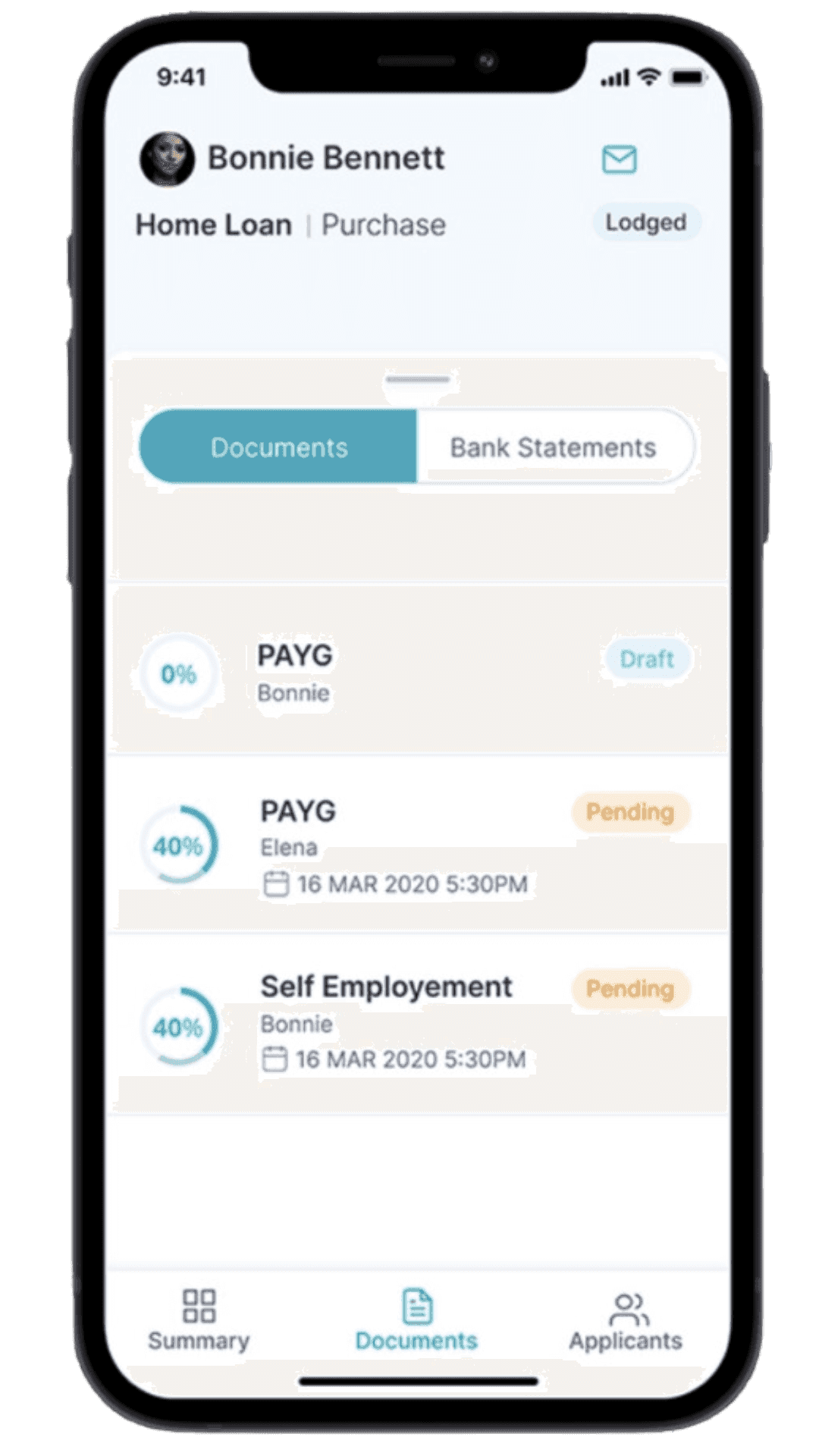

By answering a couple of simple questions about you, we can

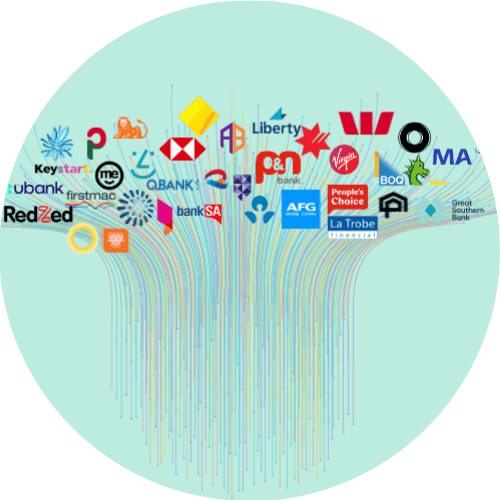

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Get Better Mortgage Rates For Refinance Offers The Craggle Way

Navigating the fluctuating world of mortgage rates for refinance offers can seem like a lot to handle on your own. With market tides constantly shifting, knowing when and how to refinance becomes more and more important.

At Craggle, we’re not just here to offer guidance; we draw upon the collective strength of Australians to secure fairer deals. Read on to see how Craggle is reshaping the refinancing landscape and empowering homeowners like never before.

Navigating the refinancing journey

Does timing matter?

Trying to refinance mortgage can be a bit like catching the right wave. Market conditions and their fluctuations often determine the height and force of those waves. When these rates are swaying in your favour, you may want to catch them to get the best mortgage rates for refinancing.

It helps to stay informed and be on the lookout for opportunities to reduce your refinance home loan cost. But that’s not all you should consider.

What’s your financial situation?

Market conditions are out of your control, but your personal financial situation is just as important.

Lenders use factors like your credit score and debt-to-income ratio as indicators of your financial stability and risk of defaulting on a loan. Keeping them in good shape increases your negotiating leverage for getting affordable refinance rates.

Ultimately, when it comes to the best time to refinance, the decision to refinance should be based on your individual circumstances and financial goals rather than waiting for ages for the ‘perfect’ mortgage rates for refinance.

Strength in unity

Harnessing collective power

With Craggle, you’re not just another individual borrower; you become part of a powerhouse community. We’re rallying all the troops together for a sweeter deal on mortgage rates for refinance offers!

By connecting you with borrowers with similar loan values and financial goals, Craggle amplifies everyone’s voice. Through our pooling system, we’re taking the old adage ‘strength in numbers’ to a whole new level, enabling you and your fellow community members to leverage combined loan values to snag fairer mortgage rates for refinance offers.

Safe and secure

While we’re all about boosting bargaining power, we always play it safe where it matters most: your personal data. Even though we’re leveraging the combined value of everyone’s home loans as a group, you can rest easy knowing that none of your private details will be shared with others.

Our platform is constructed using AWS Well-Architected best practices, ensuring top-notch security and efficiency. We’ve built a fortress where your data’s confidentiality stands unshaken and security events are caught faster than you can say ‘refinance!’

Frequently Asked Questions (FAQ)

How do I know if it’s a good time to refinance?

To hit the sweet spot in mortgage refinance, consider a few refinancing tips.

First, identify your financial goals. Whether it’s better rates or changing your terms, you need to know what you want and why. Compare the current refinance interest rates with your existing rate. Check for any errors in your credit history, as a good credit score is helpful for negotiating a fairer mortgage rate for refinance offers.

If you’re juggling high interest loans, prioritise paying them off to boost your credit score and make top lenders see you in a favourable light. And always remember: refinancing might come with closing costs. Be sure to weigh them, along with mortgage rates for refinance offers, against potential mortgage savings.

Is refinancing possible without incurring costs?

Refinancing with no associated cost may be a viable option that some lenders offer that allows you to get a new loan without paying upfront fees. However, it’s important to remember that even though you may not be charged costs outright, they are typically included in the loan or offset by slightly higher mortgage rates for refinance.

Do I need a valuation to refinance my home?

Typically, yes. A property valuation is like a trusty seal of approval, providing lenders with a credible valuation of your property. However, a select few lenders might do a desktop valuation, meaning they don’t need to visit your property.

Empower your home loan journey with Craggle

At Craggle, we understand that the journey to get the best home loan rate can sometimes feel like a lonely uphill battle. But why go it alone when you can harness the might of collective bargaining?

Drawing from the age-old wisdom that we’re stronger together, Craggle introduces the innovative concept of crowd haggling. It’s not just about finding another refinance home loan offer; it’s about creating a movement for the community.

By pooling together Aussies with similar refinancing goals, we amplify your voice and negotiating power when it comes to securing that ideal home loan rate refinance.

Lenders are also given an equal chance to reach out with their best offers. This dual-benefit approach means that whether you’re keen on renegotiating your rate with your current lender or hoping to refinance on mortgage with a new lender, Craggle is your ultimate mediator.

Join the revolution, and let’s redefine the home loan journey, one Crowd Haggle at a time.

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.