We can do a lot, with just a little

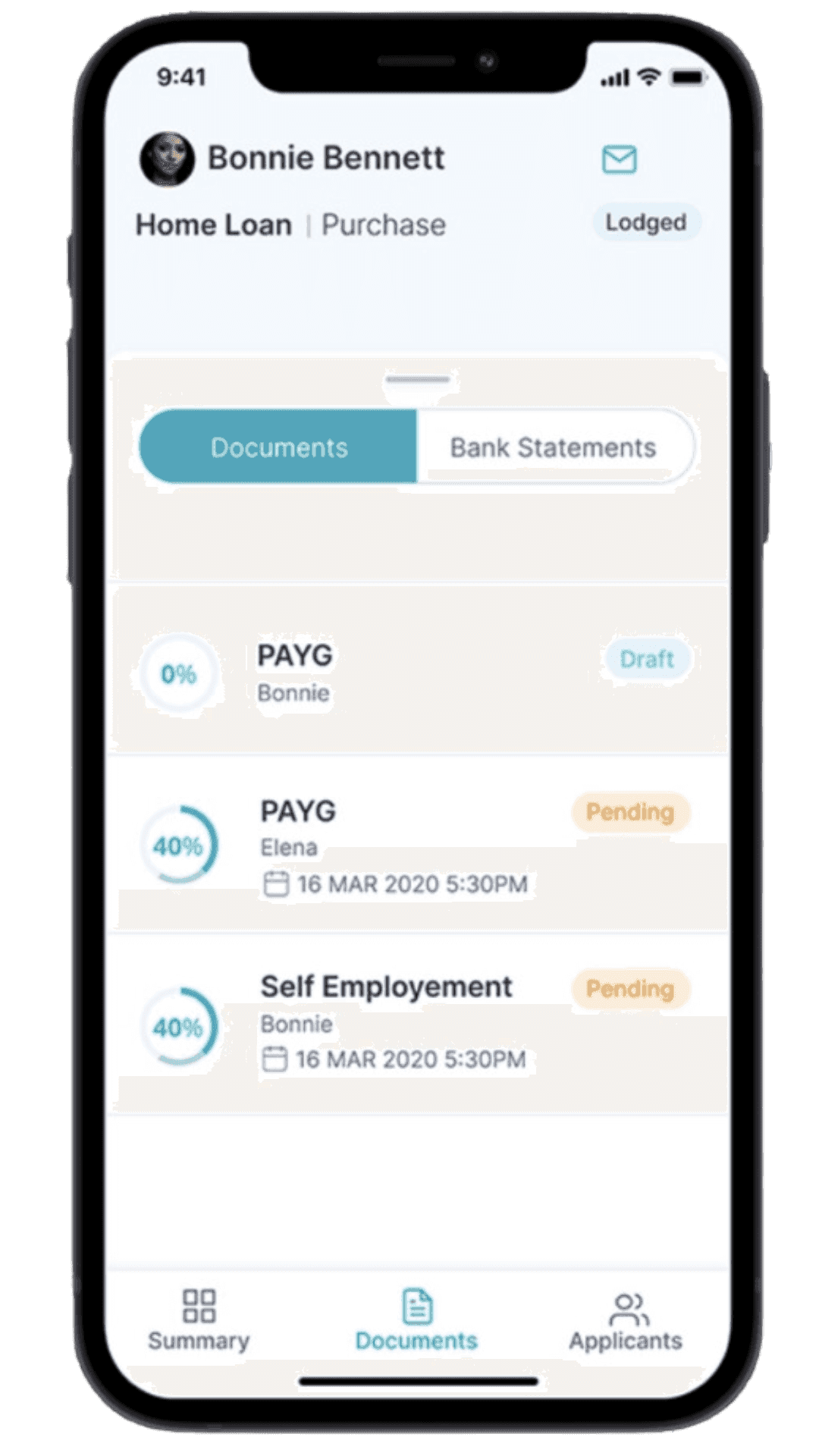

By answering a couple of simple questions about you, we can

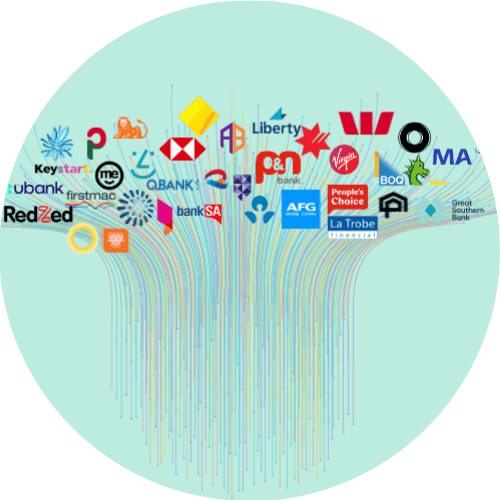

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Unlocking A Better Mortgage Refinance Rate: Craggle’s Community-Powered Approach

Are you ready to unlock a better mortgage refinance rate? Craggle is here to help with our community-powered approach. We understand that the process of refinancing a mortgage can seem intimidating, but there’s no need to sweat it with our help.

With Craggle as your trusted guide, you don’t need to be a finance guru. We’re here to make the journey smooth and fair for everyone. Join us, and let’s make refinancing better together.

How the mortgage refinance rate works

The value of refinancing for homeowners

Homeowners are drawn to home loan refinance options for myriad reasons. High on the list is the potential for finding the lowest refinance rate. Over the course of a loan, this can result in significant savings.

And who hasn’t dreamt of tossing their mortgage papers in the air because it’s all paid off? A mortgage refinance can enable you to shorten the loan’s duration. Conversely, for those who seek more flexibility and breathing room in their repayments, refinancing can also open the door to extending your loan term with lower payments and a spread of the loan over a longer period.

Lenders and market influences in determining rates

Your mortgage refinance rate is priced through a complex interaction between banks/lenders and overarching market forces.

While broader economic factors like inflation and prevailing economic indicators exert influence on mortgage rates for refinance, lenders are just as pivotal. How so?

Well, lenders are typically actively managing the risk of their loan portfolios, assigning different rates to different customers based on their perceived risk to the bank. This is why you typically see lower rates for loans that have more equity, and principal-and-interest repayment loans have better rates than interest-only repayment loans.

That’s why Craggle is here to help bridge the gap between homeowners and lenders. Together, we can help make sure everyone has a fair go.

Maximising the power of refinancing with Craggle

The ace up our sleeve

Our platform offers a convenient way to negotiate loan rates remotely. Instead of individual negotiations, Craggle uses crowd haggling, where we utilise the collective strength of combined loan values to negotiate fairer mortgage rates.

A fair go for both homeowners and lenders

At its core, Craggle is more than just a service; it’s a movement. Our platform was designed for borrowers and lenders to have their cake and eat it too.

When borrowers submit their mortgage details, Craggle uses the power of collective bargaining to source fairer rates. Competing lenders, on the other hand, get an opportunity to attract new customers by presenting attractive options for a refinanced mortgage.

This mutual relationship ensures both parties achieve their desired outcomes – borrowers can enjoy lower home loan rates while lenders benefit from an expanding customer base.

Frequently Asked Questions (FAQ)

How do mortgage refinance rates work?

Your mortgage refinance rate functions similarly to home loan interest rates. When you opt to refinance, lenders present rates for replacing your existing home loan. This swap is typically meant to yield more affordable refinance rates. The new loan takes over the old one, and you commence repayments based on the new terms.

These rates can be fixed, offering stability, or variable, which might fluctuate based on various economic indicators. Your offered rate will hinge on elements such as your credit score, the amount you’re keen to borrow, and the stipulated loan term.

What factors influence mortgage refinance rates?

Curious about what’s behind your mortgage refinance rate? The Reserve Bank of Australia’s (RBA) cash rate is the epicentre of all of it. This rate represents the interest the RBA charges banks for borrowed funds. Shifts in this rate often ripple out, influencing the mortgage refinance rate that lenders provide to borrowers.

Inflation in the economy is another influential factor: high inflation tends to drive rates up, while low inflation does the opposite. Economic conditions, like unemployment rates and GDP growth, also contribute to RBA decisions that may in turn impact your mortgage refinance rate.

Of course, individual credit scores also matter. A favourable credit score often fetches more attractive rate offers. The same applies to the loan-to-value ratio (LVR). The lower the proportion of your loan amount relative to the property’s value, the more competitive the rates you’re likely to get.

And if all this sounds a tad complex, Craggle is here to mediate for you. Regardless of whether you’re renegotiating with your current lender or hoping to find the best refinance rates with other lenders, we’re here to rally the crowd, compare rates, and help you find a fair deal with the power of collective bargaining.

Can I lower my monthly payments with a refinance?

Who doesn’t love a bargain? With the right refinance deal, you can absolutely pare down those monthly payments. If you snag a lower interest rate, you stand to save with every repayment. You can also opt to extend your loan term to reduce your monthly payments, or you can even shorten the term to pay more of it off faster. It all depends on your financial goals and loan terms.

Discover Craggle: powering people to refinance better

Drawing on the ingenious concept of crowd haggling, we at Craggle have reshaped how Australians think about their mortgages and navigate the tricky terrains of the finance market.

Home loan refinance deals have traditionally been a battleground for individual homeowners, who usually fight solo to get the best rates. With Craggle, the game of refinance on mortgage has changed.

By uniting homeowners, we amplify their collective bargaining strength, ensuring a better shot at snagging that elusive great deal. It’s about putting homeowners back in the driver’s seat and steering them towards more favourable rates and terms.

And remember, while we’re spearheading change with mortgage refinance options today, our vision extends far beyond. Our ultimate aim? Making sure every Australian gets a fair deal every time. Sign up now!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendations. Views are subject to change without notice at any time.