We can do a lot, with just a little

By answering a couple of simple questions about you, we can

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Your Ultimate Guide To Refinance Home Loan Cost

Don’t worry; not all is lost when you’re stuck worrying about the refinance home loan cost.

Here at Craggle, we’ll tackle the benefits of getting a suitable refinance home loan offer, what you could do with the potential savings, and why you should consider us as a partner when looking for an option that could work for you. Additionally, we’ll also talk about the difference between closing costs and refinance costs, as well as the concept of home inspections.

The allure of a better deal

The result of refinancing

A lot of Australians look at the overall refinance home loan cost because it could potentially provide them with savings they can make use of in other ways. Generally, the process involves a borrower searching for lower mortgage rates for refinance or a more suitable loan term. However, they could also look past savings and opt for better repayment flexibility, greater features, and more.

Far from home

But what do people do once they factor in the refinance home loan cost and potential savings?

While having a piece of property you can call home is a feat in and of itself, others would also continue on with similar goals. For instance, some people may want to work on thrilling renovations or repairs supporting an increase in their property's value, some may explore purchasing an investment property, while others may be excited to exchange their old car for a new one.

At the end of the day, the choice should always be yours.

Come consider Craggle

If you’re thinking about the general refinance home loan cost and refinance mortgage offers as a whole, consider signing up with Craggle.

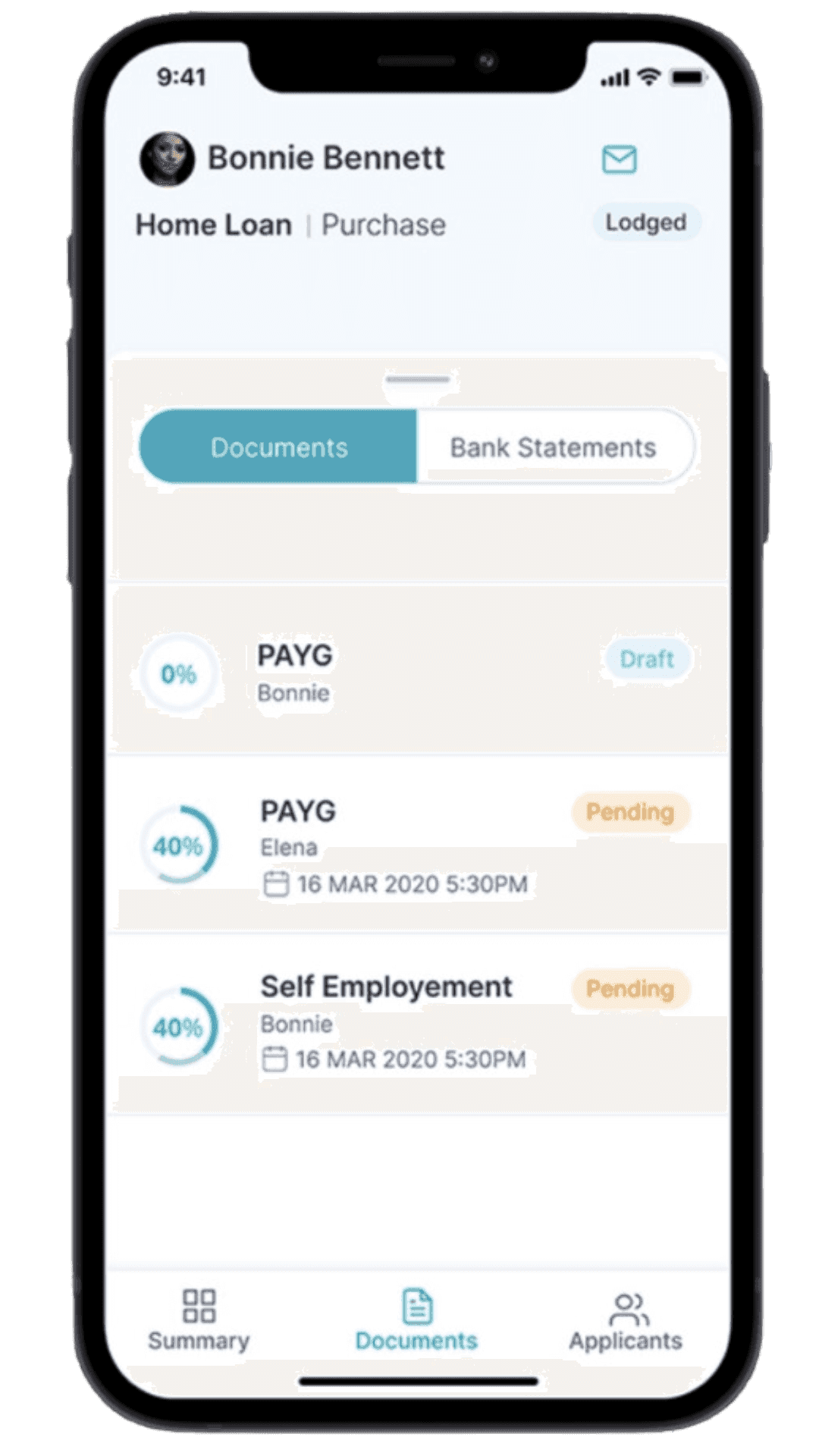

Here, we’re all about ‘crowd haggling’, and that means that we’ll take your individual voice and amplify it with other borrowers who want fairer deals just like you. With our timed and recurring Craggle Event, everyone’s bargaining power can be combined, all so you can have a better chance of negotiating with financial institutions and receiving a mutually beneficial agreement. Options will then be presented to you, and you can choose whether to stay with your current bank or try something different from another lender. If you decide to stay with your current lender, your new rate will be applied automatically within five business days, if you selected to explore refinance opportunity with another lender one of their representatives will connect with you within forty-eight hours. Selecting an offer doesn't lock you in, you hold all the power and are free to explore other options.

Sign up now; it only takes five short minutes!

Frequently Asked Questions (FAQ)

What is the difference between closing costs and refinance costs?

When thinking about the general refinance home loan cost or mortgage cost, it’s important to differentiate between closing costs and refinance costs. This becomes simple if you think of them as ‘old’ and ‘new’ charges, where closing costs are the charges you’ll have to pay for closing your old loan down while refinance costs are what you’ll have to pay for your new loan.

- Closing costs: These closing fees are handled when a borrower would like to complete the property transaction, whether that’s by paying off their current mortgage deal over time or paying off their current mortgage deal immediately through another home loan. A typical closing cost is the mortgage discharge fee.

- Refinance costs: These refinance fees are charged when a borrower wants to take out another home loan to pay for their current mortgage deal. This typically happens when borrowers find a better mortgage rate for refinance (leading to potential mortgage savings) and other benefits. Typical refinance costs include, but not limited to loan submission fee, establishment fee, property valuation and rate lock fee.

Do I have to pay for a home inspection when refinancing?

When browsing affordable loan refinancing options, one of the factors to consider to calculate the total refinance home loan cost is the valuation fee. In some cases, a home inspection may be required by the lender to confirm if the property fulfills its loan to value ratio (LVR) requirement.

An LVR is how a lender typically determines the risk of the loan. It is calculated by the value of the loan divided by the value of the property. For example, a $200,000 loan for a property valued at $250,000 represents a 80% loan to value ratio.

How do I choose the right lender to minimise refinance costs?

Reducing mortgage refinance costs means that borrowers should find a lender and offer that can provide a lower interest rate, a different loan term, additional features, or greater flexibility in repayments.

Traditionally, you could choose the right lender and lower your refinance home loan cost by spending hours compiling eligibility requirements, quotes for home loan refinance fees, and crunching numbers on an online refinance calculator. However, wouldn’t you rather have suitable options presented? This is where we at Craggle come in. Through our mediation and facilitation, we can leverage your bargaining power and pool it with other like-minded homeowners in a similar situation. This way, lenders can see the collective value of a community of borrowers and then get the chance to provide you with fairer deals. All that’s left for you now is to choose which option suits your current situation the best.

Craggle: shaking up contemporary systems

In the fast-paced and vast world of finance, borrowers often feel overwhelmed and alone, especially when trying to secure suitable home loan refinance deals. But what if there was a way to level the playing field with an impartial mediator you could trust?

At Craggle, we aim to revolutionise the way Australians look for new mortgage offers to cover their old ones. Not just focused on refinance rates or the general refinance home loan cost, we want to give you and many others a chance to take back control, utilising the strength of our ‘crowd haggling’ approach.

Disclaimer: Unless specifically stated otherwise, the opinions shared on this platform are exclusively intended for general informational and entertainment purposes. Furthermore, they should not be construed as individualised financial advice or recommendations of any kind. It’s also important to note that the opinions presented in this article may be subject to change without prior notice at any time.