We can do a lot, with just a little

By answering a couple of simple questions about you, we can

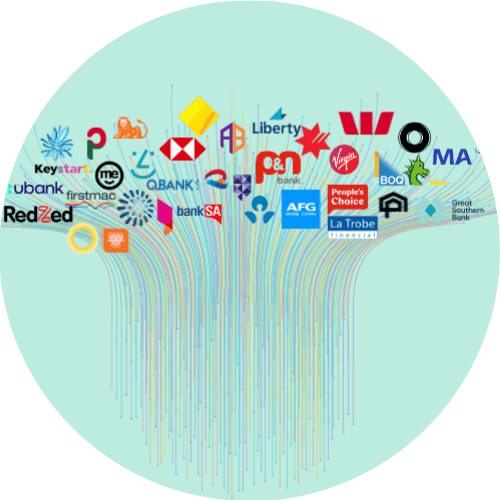

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

How To Make The Most Out Of Your Refinance Home Loan Offer With Craggle

Navigating the intricacies of mortgage rate refinance offers can feel like charting unknown territory. But with Craggle by your side, you’re never alone. We turn the daunting into the doable. At the heart of our approach is the power of crowd haggling, a community effort aimed at ensuring every Australian gets a fair go with a better refinance home loan offer.

A comprehensive guide to refinancing

Navigating the refinance roadmap

Thinking about taking a refinance home loan offer?

Jumping straight into a mortgage refinance without some groundwork is not a good plan. Start by identifying your refinancing goals. It could be to aim for better loan features, change your loan term, or consolidate debt. Setting a clear objective early on can save you a lot of guesswork later.

Next up, scrutinise your credit history for any errors or inconsistencies so you don’t miss out on any sweet deals. The better your credit score, the better your chance of getting a more favourable mortgage refinance rate.

It’s crucial to research and compare loan offers. This is where Craggle comes in! Craggle helps engage in some digital detective work on your behalf. Undertaking the research yourself online could take a lot of time, with many options to try to unpick, whereas for only five minutes of your time to sign up to Craggle, we do a lot of the heavy lifting for you.

Once Craggle puts some options forward to you, you can then decide between a sweetened offer from your current bank or a new rate from a different bank. If you decide to refinance, a Craggle partner will help you get your documentation sorted and dive into the online application. Once approved, the transition phase, known as ‘settlement’, where your new lender coordinates with the old one, becomes a breeze.

Craggle-tastic refinancing benefits

So, why is a home loan refinance the talk of the town? Here’s the scoop from the Craggle crew:

Securing a lower interest rate often translates to substantial savings over the life of the loan. Renegotiating a better deal on your home loan with your current provider not only means you don’t have to refinance (saving you time and effort), but it can also help you expedite the repayment of your home loan or reduce monthly payments courtesy of extended duration.

This way, you might find a tad more wiggle room in your monthly expenses, letting you allocate funds elsewhere or even consider that dream vacation you’ve been postponing.

Plus, if you’re inclined to switch from a variable rate to a fixed one, a refinance home loan offer brings that flexibility to the table. In the vast world of home loan refinance options, it’s reassuring to know that Craggle has got your back.

Our approach to home loan refinancing

The power of collective bargaining

Craggle understands the importance of tapping into community power. Our platform groups borrowers with similar loan values and aspirations for an ideal match. By pooling like-minded customers, we amplify their collective voice, improving their chances of getting a fair deal.

This combined clout gives our community better negotiating power, allowing them to get a lower interest rate, additional features, a different loan term, or greater flexibility in repayments.

Refinancing, the Craggle way

With a platform designed for clarity, we cut through the jargon of getting a refinance on mortgage, enabling customers to easily compare lenders and land a refinance home loan offer that works for them.

Then there’s the Craggle Event, which is where we gather the community’s accumulated loan values to help us negotiate a fairer deal with lenders. These events are timed to provide ample opportunity for lenders to present their best deals without keeping our borrowers waiting too long.

We gather crucial details upfront, ensuring that offers reflect a thorough understanding of each client. In the end, you’ll get a tailor-made offer that works for the most important Craggler – YOU!

Frequently Asked Questions (FAQ)

How long does it take to get approved for a refinance?

The time it takes to approve a refinance home loan application may vary depending on the lender’s policies and the borrower’s situation.

Craggle Events are timed, so you won’t have to wait too long to get a fair deal from a lender. Once you’ve accepted a loan offer through us at Craggle, your chosen bank will reach out to you within forty-eight hours to get you into your new rate.

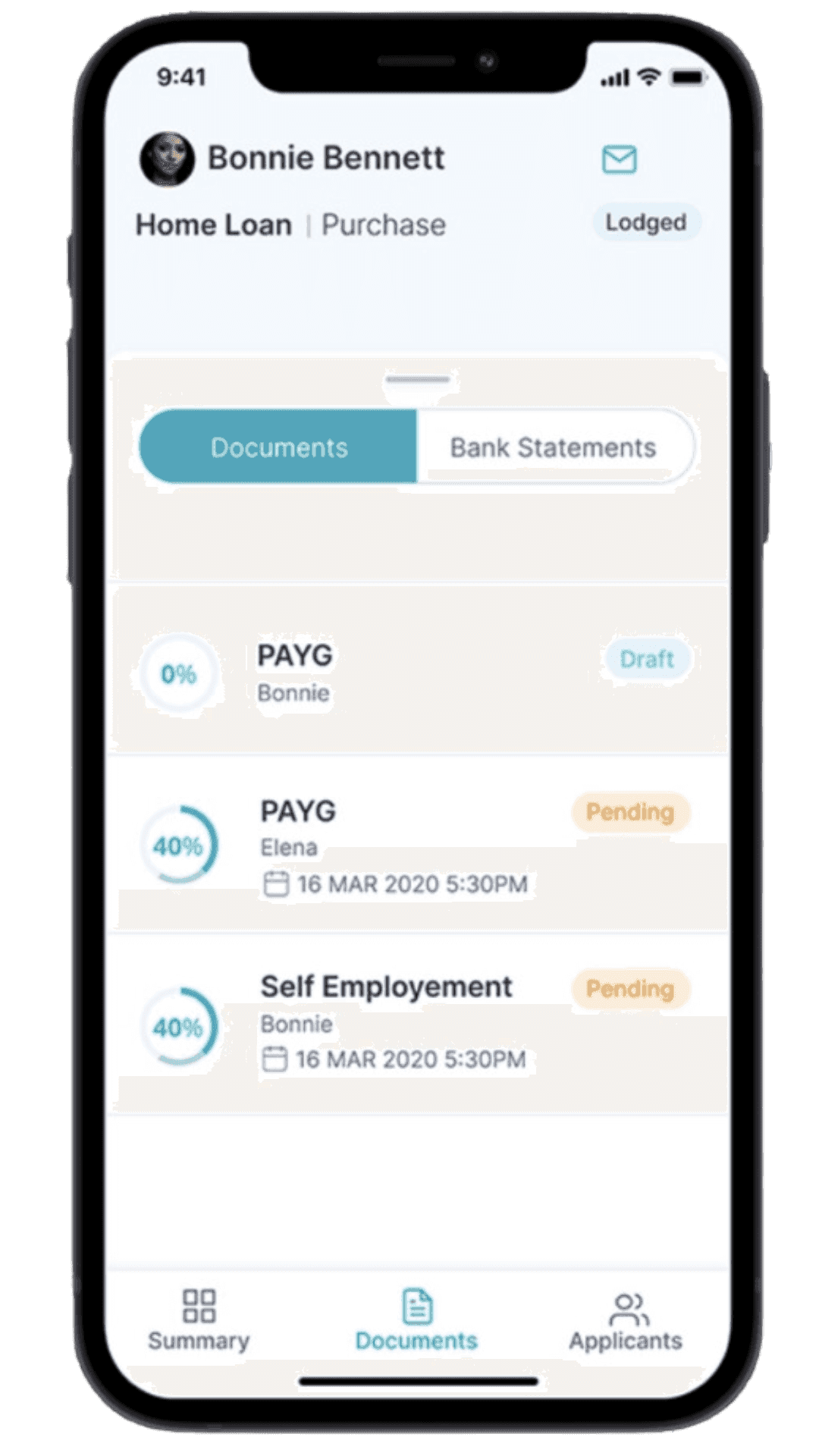

What documents do I need to refinance my home loan?

The specific documents required may vary depending on the lender and the type of loan offer. The general checklist includes:

- a piece of personal identification, such as a driver’s licence, a passport, or even a birth certificate;

- proof of income, like the latest couple of payslips or a letter from your employer acknowledging your earnings;

- a detailed summary of your living expenses; and

- a list of your existing liabilities.

How do I choose the right lender for my refinance?

Selecting the right lender for your refinance is crucial for the long term. To ensure your refinance home loan offer is top-notch, keep these tips under your hat:

- Compare, compare, compare! Cast your net wide when scouring for the best home loan refinance rates.

- Seek a lender with the bells and whistles you desire, be they offset accounts, redraw facilities, or the freedom to make additional repayments.

- Use Craggle to collaborate with other borrowers and negotiate better terms with your current lender or refinance with a new one that better suits your needs.

Craggle: empowering your refinancing journey

As a mediator between you and your lender, Craggle is your ticket to a fair go on your home refinance home loan offer.

We tap into the collective strength of Australians with similar loan values, ensuring you don’t have to wrestle with finding a better mortgage rate for refinancing all alone. Together, we elevate your bargaining capacity. Choose wisely, choose fairness, and choose Craggle.

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.