We can do a lot, with just a little

By answering a couple of simple questions about you, we can

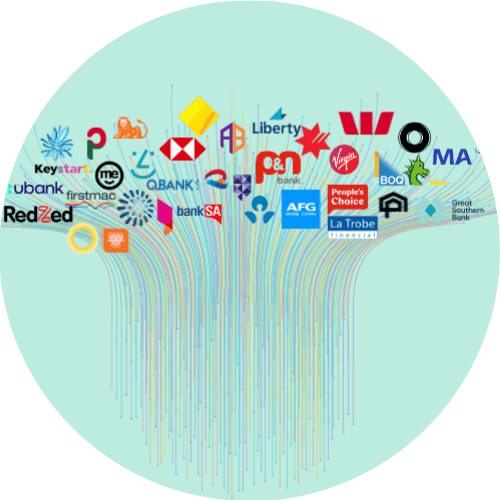

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Negotiate Better Refinance Home Loans Rates With Craggle

Watch your savings grow and experience the thrill of reaching your personal goals sooner – that’s the promise of better refinance home loans rates. Securing the best rates can be tricky, but guess what? You’ve got backup. With Craggle by your side, landing the best refinance deals becomes a team effort.

Read on to find out more about refinance rates and how Craggle can help you land a better deal.

What is home loan refinancing?

You’re at a café, enjoying a cup of coffee that you believe is reasonably priced. Then someone tells you about another café down the street where the coffee tastes just as good, if not better, but costs less. Wouldn’t you consider giving that café a try the next time you’re craving a cuppa? This is what home loan refinancing is like.

Home loan refinancing is all about trading in your existing mortgage for a new one, with better terms and refinance home loans rates that save you money or help you achieve other financial goals.

Reasons homeowners refinance

Now that you’re familiar with the concept of home loan refinancing and refinance home loan rates, you might be wondering, ‘What are the benefits of refinancing my home?’

Well, there are many reasons homeowners opt to refinance, from covering repairs or renovations to upgrading the family car and even investing in their next property. Many homeowners also do it to:

- Lower the interest rates: One of the primary reasons homeowners refinance is to take advantage of lower interest rates. A reduced rate can lead to significant savings on the total refinance home loan cost.

- Adjust the loan term: Sometimes, homeowners wish to either shorten their loan term to pay off the debt faster or extend it to reduce monthly payments. Besides potentially lowering the refinance home loans rates, a home loan refinance can provide this flexibility.

- Access home equity: As homeowners pay down their mortgage and property values rise, they build equity in their homes. Refinancing a home loan can allow them to access this equity, providing funds for various needs, such as home improvements, debt consolidation, update the family car, fund a holiday, or even invest in another property.

In essence, refinancing offers homeowners a tool to better manage their finances, optimise their mortgage conditions, and utilise the value they’ve built in their homes.

Challenges in securing the best refinance rates

Refinancing can be a fantastic financial move when done right. But securing the best refinance home loans rates? That’s a journey all its own, riddled with a few challenges that can feel like navigating through a maze. Here are three of the top challenges you might encounter when trying to land the best home loan refinance rates by yourself:

Limited access to lenders

As an individual borrower, the range of mortgage refinance lenders you have access to can be limited. This limitation could reduce your refinance options and potentially keep you from securing the most competitive refinance home loans rates.

Lack of expertise

The world of refinancing is replete with intricate financial calculations and an evolving mortgage market. Without the necessary knowledge and experience, identifying the best rates, hidden costs, and terms becomes considerably more challenging.

Time-consuming process

Refinancing isn’t just about signing a few documents. It requires research, a comparison of rates, meticulous paperwork, and detailed insights into your income and expenditure including, how much you spend on groceries per week. Handling all these facets on your own can lead to a drawn-out and intricate home loan refinance process.

The Craggle solution

At Craggle, we recognise the value of unity, especially when it comes to mortgage refinancing. Being part of the Craggle community means having a team with you, focused on helping you achieve fairer refinance home loans rates.

Our Craggle Events are occasions where like-minded individuals come together with common financial goals and leverage their collective bargaining power. Instead of having to find local refinance lenders and pursue them individually, our platform has a unique way of drawing them to us, ensuring they present their most compelling offers. Together with Craggle, let’s set a new standard for savings.

Frequently Asked Questions (FAQ)

Is it better to renegotiate my rate with my current lender or refinance with a new one?

Renegotiating with your current lender might be the simpler path because they already know your financial history plus more and more banks are realising the value of their existing customers and are more motivated than ever to keep them through competitive rate discounts. But don’t let familiarity hold you back from considering other options to refinance on mortgage. Exploring new refinanced mortgage lenders might uncover lower mortgage rates or better terms that suit your needs.

Whether you’re aiming to renegotiate the interest rate with your current lender or venturing out to discover a variety of mortgage refinance options with others, Craggle is right by your side. We’re here to help you find fairer home loan deals and better refinance home loans rates, whether it's with your existing bank or a new one.

Can I refinance if I’ve recently changed jobs?

Yes, it’s possible to refinance for a lower monthly payment or get refinancing for home improvement, even with a new job. You may be asked for a bit more paperwork to ensure everything’s good with your new job. But it’s not necessarily a hurdle; it’s just a small step you might need to take.

What is the difference between a refinance and a home equity loan?

Refinancing is about swapping out your current mortgage for a new one, ideally with better terms or interest rates. A home equity loan, on the other hand, lets you borrow against the value you’ve built up in your home. Think of it as a way to tap into your home’s worth without selling it.

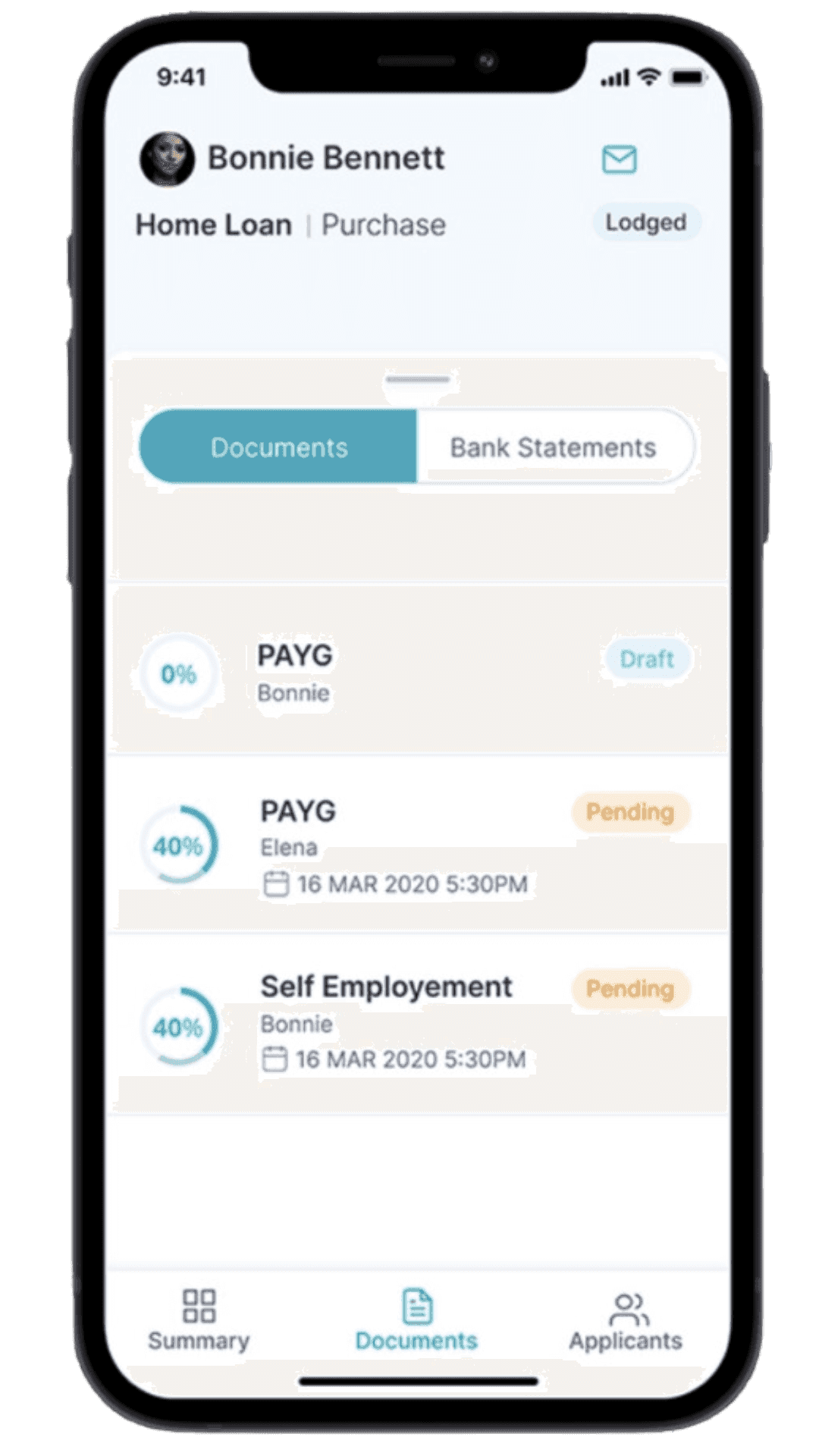

Get started with Craggle

Decided to rally with the rest of the Craggle crowd? Great decision! Start by sharing a bit about yourself in the ‘About You’ section. Then, let us know about your loan, the property details, and your income. By understanding your specifics, we can put our Craggle power to work and help you find your ideal home loan rate, whether it's with your current bank or another.

What’s more, we’ve invested in top-notch security measures to ensure everything you share stays secure. And if you ever wonder about the ins and outs of our data handling, our privacy policy on the website spells it all out.

With Craggle, everyone gets a fair chance at getting the best refinance deals. Sign up today!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.