We can do a lot, with just a little

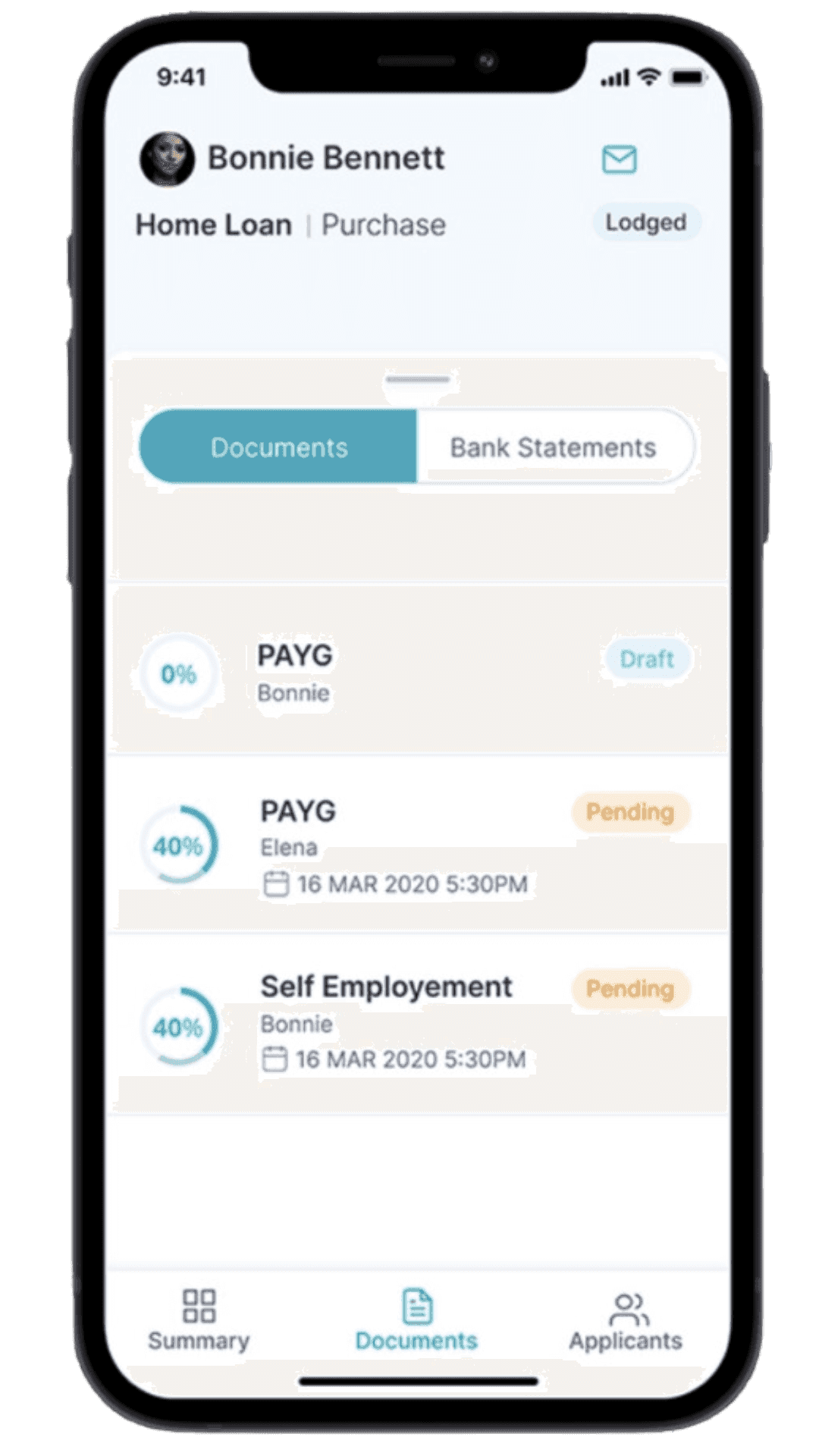

By answering a couple of simple questions about you, we can

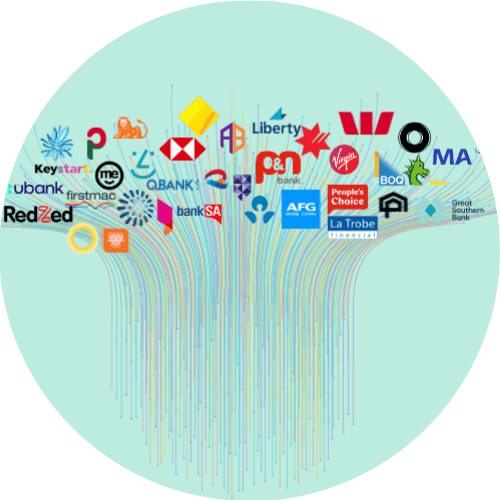

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Refinance Mortgage 101: A Complete Guide By Craggle

Ever wondered what ‘refinance mortgage’ is? We’ve got you covered.

Craggle is here with an informative guide on refinancing your mortgage. Here, you’ll learn what a mortgage refinance is, what the home loan refinance benefits are, when to start a refinance application, and more. Stick around and see how we can help you land some stellar deals. Read on!

Refinance mortgage: What does it mean?

Thinking about your financial goals and that monthly household bills? You’ve likely had a friend or two tell you about refinance mortgage offers. But what’s that all about? What’s the difference between a refinance vs. home equity loan, anyway?

Let’s break it down: You have a mortgage in place, but over time, situations and market conditions change. That’s where refinance mortgage options come in. You opt for a new mortgage, possibly with a better interest rate, a different loan duration, or adjusted monthly payments. It could mean lower monthly payments, a more favourable interest rate, or even accessing the equity value in your home.

So, when you refinance, you’re trading in your old mortgage terms for new ones that might align more closely with where you are now financially.

What’s the main reason people refinance their mortgages?

Many people looking up ‘refinance mortgage’ are finding a smoother financial path, much like taking a detour for a better drive. Some of the main reasons savvy homeowners choose to refinance their home loans are because they want to:

Get lower rates

It’s all about getting the best deal. By refinancing to a lower interest rate, homeowners can enjoy reduced monthly payments and ultimately save a significant amount in interest throughout the loan. This helps free up sufficient funds to make it possible to do necessary renovations, buy a new car, or invest in a new property.

Accelerate the payoff

Some people want to shed their mortgage faster. By adjusting to a shorter loan term, they’re on the express lane to full ownership, saving some interest money on the side.

Accessing home equity

Refinancing can allow homeowners to tap into the built-up equity, converting it into cash for various uses, be it home improvements, debt consolidation, or even a little holiday.

Every homeowner has their own reasons for seeking refinance mortgage deals, and yours might be different from the ones we’ve shared above. If you’re still unsure if refinancing is right for your intended purpose, you might find the next section helpful.

Assessing your mortgage: When to consider refinancing

Deciding whether to go for the refinance options you have on the table is a strategic call. So, when’s the right time to refinance with an online lender? Here’s what to consider:

Long-term plans

If you’re thinking about refinancing, ask yourself: How long do you plan on staying in your home? Refinancing is an investment, and to truly reap its benefits, it’s often best suited for those planning a longer stay. If you’re in it for the long haul, this might be your jam.

Credit score status

Has your credit score been levelling up? A boost in your credit health can pave the way to favourable interest rates. If you’ve been responsible with those bills and cards, it might be time to finally enjoy the benefits that come with your good financial behaviour.

Home equity progress

You’ve been diligently chipping away at your mortgage, and now you’re sitting on a good amount of home equity. Consider switching gears to a shorter-term loan. Yes, your monthly payments might go up a bit, but you’ll be on the fast track to fully owning your home.

Find better refinance mortgage deals with Craggle

Considering hopping on the refinance mortgage train? Lucky for you, you stumbled upon Craggle!

Craggle isn’t just another name in the game. We’re your partner, front and centre in the hustle of home loan refinance deals. Instead of plunging alone into the mortgage refinance pool, we dive in with you. Together, we gather the combined strength of every individual seeking the best refinance rates, be it reduced monthly payments or a juicy interest rate cut. And yes, that gives us some real leverage!

With Craggle, hunting for a stellar loan deal and the best home loan refinance rates is far from dull. We host ‘Craggle Events’ where the Craggle family comes together, showing off the total power of their loans. And guess what? It works wonders for landing a sweeter deal for you. These events are timed just right – no endless waiting, and banks see the full power of our Craggle tribe.

After accepting an offer, your bank of choice will contact you within forty-eight hours to begin the refinance process. It’s as easy as that – no need for endless searches for terms like ‘mortgage rate refinance’, ‘best home loan rates refinance’, and ‘home loan rate refinance’ anymore.

Frequently Asked Questions (FAQs)

How much cash do you get out of a refinance?

This process is called a cash-out refinance, which means you’re borrowing more than you owe on your current mortgage and pocketing the difference. How much you get depends on your home’s equity and how much you choose to borrow.

But remember, it’s not free money; it gets added to your new mortgage balance along with the other mortgage rates for refinance you need to pay for. So, while it’s a nifty way to access a chunk of change for big projects or consolidate debts, it’s important to think about the long-term implications of your loan.

How do I determine if refinancing will save me money?

To figure out if refinancing will save you some hard-earned cash, start by comparing your current mortgage interest rate with the new rates on offer.

If the new rate is significantly lower, that’s a good sign! Next, factor in the closing refinance mortgage costs, because yes, there are fees involved. Divide the refinance cost by your monthly savings to figure out your break-even point; this tells you how many months it’ll take to recoup the costs.

What are the advantages of a shorter loan term when refinancing?

Opting for a shorter loan term when refinancing can be a smart move for several reasons. First up, you’ll often snag a lower interest rate, which means over the life of the loan, you could save quite a bit of money. Secondly, you’ll own your home outright in less time. Plus, with a shorter term, you build equity in your home at a quicker pace.

Sign up with Craggle now

Jumpstart your mortgage refinance journey with Craggle – it’s quicker than making your morning coffee! Just give us a brief rundown of your goals and rest easy knowing your info is in safe hands. By joining the Craggle crew, you’re not just another member; you’re boosting our collective power to nab fairer home loan deals. Let’s team up and shake up the home loan game.

Sign up now!

Disclaimer: Unless noted otherwise, the views in this article are solely for general information and entertainment. They shouldn’t be seen as financial guidance or endorsements. Opinions may change without prior notice.