We can do a lot, with just a little

By answering a couple of simple questions about you, we can

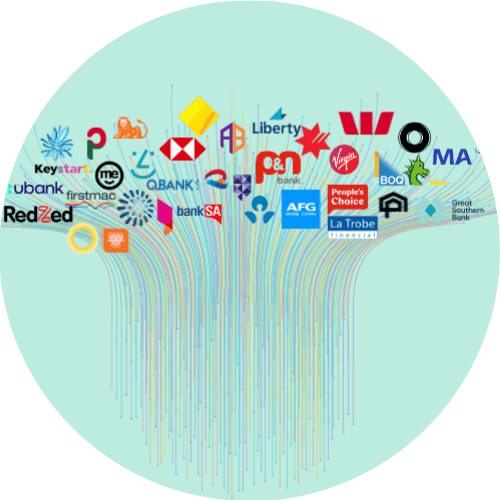

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Refinance Mortgage Rates

Is your home loan making you feel stuck? Craggle is here to help you explore mortgage rate refinance options. Australian people-power enables us to negotiate a fairer deal for all. Today, we’ll explain how you can refinance a mortgage in Australia, but more importantly, we’ll discuss the advantages of refinancing and how to find fair refinance mortgage rates.

The Aussie refinancing dilemma

Why you may want to refinance

Are you curious about how to refinance mortgage rates but don’t know where to begin?

There are Australians who look up mortgage refinance and online refinance rate quotes because of the potential benefits: by swapping out your current mortgage for a new one, you stand to secure one with better home loan rates that can save you money.

Also, accessing home equity would allow you to channel funds elsewhere, such as for repairs or renovations, upgrading the family car, or even your next property purchase. Keep in mind as well that the more equity you have in your home, the more leverage you have in negotiations to help secure better rates.

Prep work before taking the plunge

You shouldn’t just commit to a home loan rate refinance without a thorough assessment of your financial plan and options.

First, you’ll want to figure out why you want to refinance mortgage rates in the first place. Is it only because you’re looking for competitive refinance rates that give you more breathing room? Do you want to change your loan term to improve current rates? Or is debt consolidation a priority?

Examine the terms of your current home loan, like interest rates, repayment duration, and how you’re paying it back. The more you understand them, the better you’ll be able to determine whether or not you’re in a good position right now.

You’ll also want to comb through your credit history and immediately dispute any inconsistencies or errors. The higher your credit score, the higher your likelihood of securing more favourable terms when you eventually refinance mortgage rates.

Once Craggle has done some homework on the top lenders for refinance and done the hard work of looking into refinance rates by loan type or refinance points and rates on your behalf, it’s time to start your online application. If your application is approved, the settlement phase, which is when your new lender coordinates with the old one, should be easy.

But if you’re looking to refinance mortgage rates and feel overwhelmed by all your options, know that we at Craggle are by your side to help you secure the best deal.

How Craggle can help

Many Aussies struggle to find the best home loan refinance rates or figure out the best time to refinance mortgage rates. Our goal at Craggle is to help you negotiate a refinance deal so that it works for you.

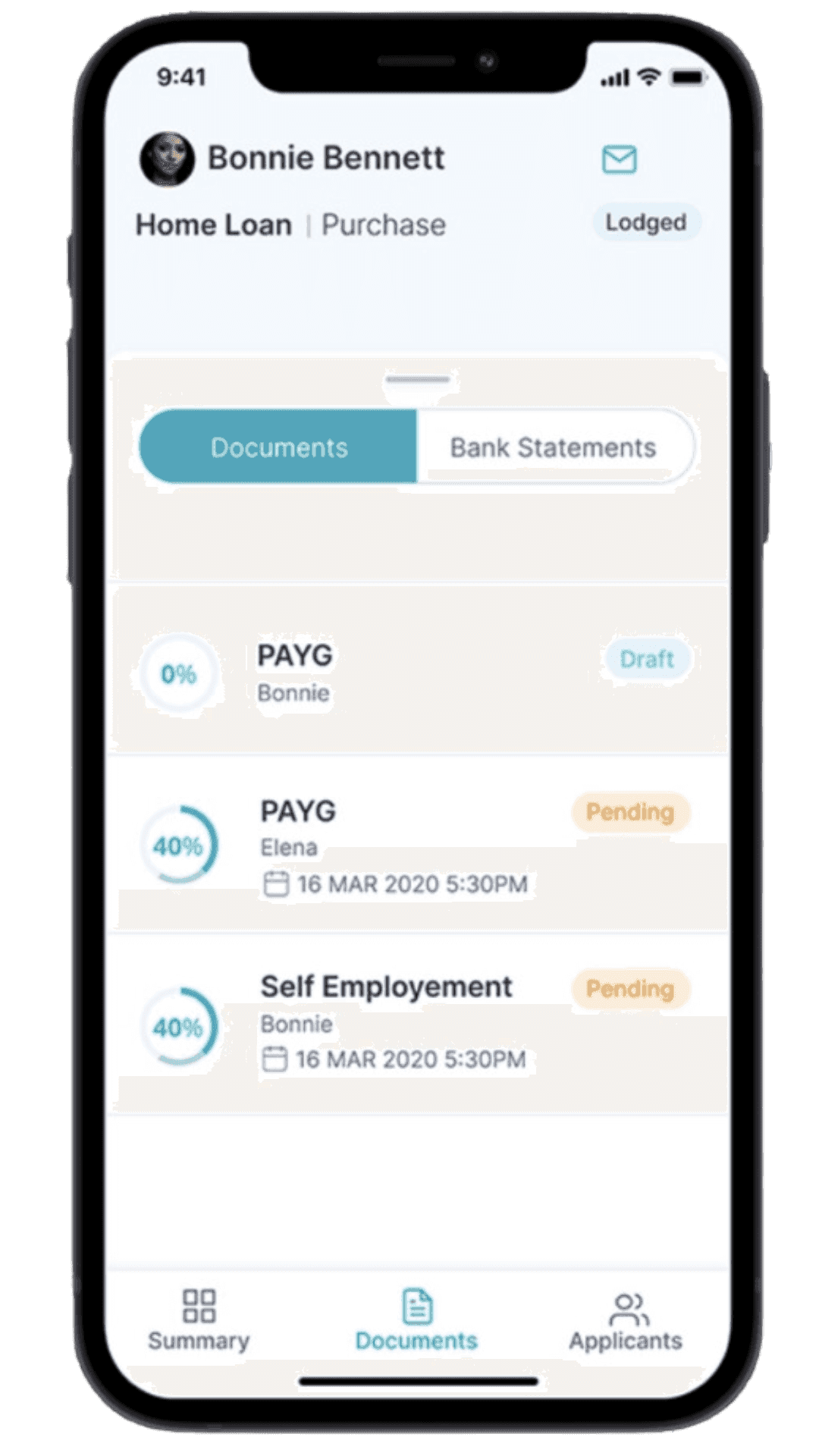

Craggle is super easy to join – it only takes five minutes! We’ll simply ask you a few questions about you and your refinance plans.

Choices, choices and more choices

After you get in, you’ll get access to a Craggle Event. But this isn’t like any other event. We’ll show you home loan refinance offers that are tailored just for you. If your current provider is joining the fray, you’ll see a retention refinance home loan offer from them. But now, you’ll also see brand-new offers from third-party providers to expand your options.

Basically, you’ll have a bevy of refinanced mortgage rates to choose from, and you have a few business days to make your decision about the presented offers. If you choose a third-party offer, the provider will reach out to you directly, and this will likely involve an application process and a formal credit assessment.

Meanwhile, if you decide to stick with your good old current provider by choosing the retention offer, your new rate will be applied within five business days.

With Craggle, you can compare home loan refinance rates and possibly even score cash-out refinance benefits. Our mission isn’t just to deliver a service, but to create a community where everyone gets a fair shot. So trust Craggle to be your guide on your home loan refinancing journey!

Frequently Asked Questions (FAQ)

Is it better to refinance with a shorter or longer loan term?

This highly depends on the reason you’re refinancing your mortgage and your current financial situation. With a shorter loan term, you’ll typically pay less interest over the life of the loan, but the interest rate and monthly payments may be a bit higher than a longer-term loan.

On the other hand, spreading the loan over a longer period usually results in lower monthly payments. If building home equity is a priority, it will take more time with a longer loan term since you’re paying down the principal at a slower rate. Assess your situation carefully and figure out which option is better for you.

Should I use an online calculator to estimate refinance savings?

When comparing loan offers, be sure to check the fine print. For example, one offer may claim to give you low refinance rates or the best refinance rates, but it could have a higher overall balance compared to another offer. You can use a refinance cost calculator for rough estimates to guide you.

How often do refinance mortgage rates change?

Depending on market conditions, refinance mortgage rates can change over weeks and months, or they could change as often as multiple times a week. That’s why, when you secure a loan offer with a rate and terms that are suitable and beneficial for you, make sure you accept it as soon as possible.

Harness the power of the crowd haggle with Craggle

Everyone deserves a fair go, especially when it comes to home loans. Enter Craggle, a revolutionary platform designed to put you back in control and bring fairness to every household. How? By leveraging the collective strength of Australians through the innovative concept of the Crowd Haggle.

For too long, individuals have grappled with the challenge of securing better rates on their own. Craggle changes the game by negotiating on behalf of everyone, ensuring a fairer deal for all. And it’s not just about the borrowers. Banks also benefit from our platform since they have the unique opportunity to reach out and offer competitive rates to a vast audience.

And when it comes to your financial well-being, we at Craggle understand how important trust is. We’ve taken the steps to ensure your information is secure, as we have implemented top-tier data security measures. The security of your data is our top priority, as evidenced by our stringent privacy policy, which is available on our website.

Whether you’re looking to rekindle the spark with your current lender or explore new horizons, Craggle paves the way, ensuring transparency and fairness in every transaction. Imagine a world where the power of collective bargaining ensures everyone gets the best deal possible. That’s the world Craggle envisions. Sign up today!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.