We can do a lot, with just a little

By answering a couple of simple questions about you, we can

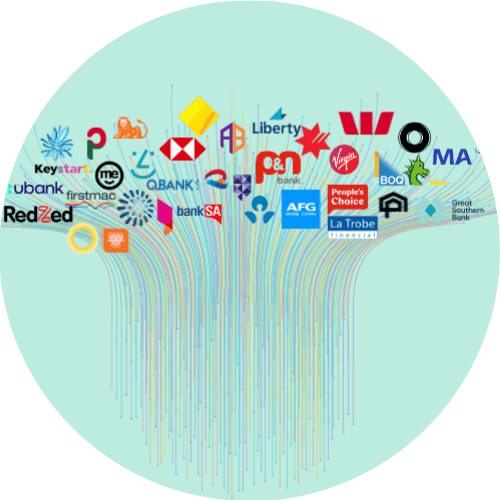

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Refinance On Mortgage: How Collective Bargaining Unlocks Golden Deals

Getting a refinance on mortgage can be a tricky task for many homeowners. The struggle to come up with a better deal with your existing financial provider or explore the wider market can prove challenging.

As an independent mediator, Craggle empowers you to join forces with other Aussies and leverage your combined loan value. By harnessing the clout of the collective, you can painlessly navigate your mortgage refinance negotiation. With us, you can confidently pursue a refinancing option that brings you closer to your financial goals.

The refinancing rundown

Define your refinancing goals

Before diving into the deep end of how to refinance on mortgage, it’s crucial to know why you’re taking the plunge. Do you want to do it to gain some mortgage savings, enhance your loan’s features, or switch up your loan term? Understanding your reasons sets the course for smoother sailing.

By getting a refinance on mortgage and securing a new loan with a lower interest rate, you can potentially save a substantial amount of money over the life of the loan. These savings can then be redirected towards other financial goals, such as building an emergency fund, investing in retirement, or funding other major expenses.

Plus, switching loan terms can provide greater flexibility and potentially allow borrowers some breathing room on their repayments to help them achieve their financial goals more efficiently.

Check under your financial hood

Considering a refinance on mortgage without first understanding your personal financial situation is like embarking on a road trip without checking the fuel gauge. Your financial health impacts the terms you may qualify for, including interest rates, loan features, and repayment options.

First, take a good look at how much equity you’ve built in your home – that’s a key bargaining chip. The greater the amount of equity you have, the more leverage you’ll have in negotiating a refinancing deal. The same applies to your credit score. The better it is, the sweeter the home loan refinance deals you could snag.

Get those documents and apply

Once you’ve assessed your own situation, it’s time for paperwork. Prepare any essential documentation like your government ID, recent payslips, details about your living expenses, outstanding liabilities and other property details. With these in hand, you’re all set to make your application.

With Craggle in your corner, the refinancing process doesn’t have to be intimidating. We rally the community around each other, ensuring you’re not just a number but a valued member who gets a fair shot.

Refinancing your mortgage with Craggle

Championing collective bargaining

In the business of mortgage refinance, there’s power in numbers. At Craggle, we bring borrowers together, helping you connect with peers who have similar refinancing goals. With the power of combined loan values, your solitary voice becomes part of a resounding chorus of influence. Together, you stand to secure lower interest rates and sweeter refinance deals.

We bring a fresh twist to the age-old strategy of negotiation. You can get started in just five minutes. Just provide answers to a few questions regarding yourself and the home loan for which you are seeking a better deal, and you can be on your way to better mortgage rates for refinance.

A secure platform for your refinance needs

Embarking on the home loan refinance journey requires trust. And at Craggle, your details are safe with us. While our approach thrives on harnessing the power of collective home loan values to get you fair offers for refinance on mortgage, all information about you remains private.

Following the stringent guidelines of AWS Well-Architected practices, our system is built to ensure data confidentiality, system protection, and proactive detection of security events.

Frequently Asked Questions (FAQ)

Can I refinance my mortgage to lower my monthly payments?

A refinance on mortgage can effectively decrease monthly payments by opening you up to lower interest rates, extending your loan duration, or in some cases, doing away with your mortgage insurance.

On the other hand, if you switch from a longer to a shorter loan term on your refinanced mortgage, your monthly payments might go up, but the benefit is that your interest payments will be lower over the course of your loan.

The best option for you will depend on your personal circumstances, so bring out the refinance calculator, look at different offers, and choose the option that fits your needs.

Is it possible to refinance a rental property or holiday home?

Fancy a lower rate for that holiday house or rental property? Whether it’s a beachside house or a city apartment, refinancing opportunities await.

You should note, however, that both your refinance eligibility and refinance options can differ depending on the state of the property. You also need to be able to show ample equity in your property to get the green light. Most lenders prefer a loan-to-value ratio (LVR) of 80% or less for investment properties.

How can I get the best interest rate on my refinance?

If you want to nab the cream of the refinance crop, start by looking at your credit history, identifying any errors, and taking other steps to improve your credit score. The higher your score, the more negotiation power you have when seeking a better interest rate. Likewise, consider evaluating the equity of your property. Having more equity means you have more leverage in negotiations for better rates.

If this all feels a tad overwhelming, fret not. You can seek an independent advisor to guide you through the maze. You can also let Craggle be your mediator for refinance on mortgage, helping you compare offers and nudging you towards those golden deals. Whether you’re renegotiating with your current lender or looking for new ones, Craggle’s got your back.

Discover Craggle: your ticket to fair refinance rates

At Craggle, we’re more than just a platform; we’re a movement that’s placing you in the driver’s seat. If you’ve felt the frustration of seeking a better deal alone, those days are in the rearview mirror with Craggle. By harnessing the collective might of Aussies, we could help you get closer to the best refinance deals for your situation.

Whether you want to negotiate refinance mortgage rates with your current lender or explore refinance home loan options with a new one, with our signature process, we rope in offers tailored for you.

At the end of the day, it’s not just about loans or rates. It’s about fairness, community, and ensuring every Aussie gets a fair go. Join the Craggle revolution today!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.