We can do a lot, with just a little

By answering a couple of simple questions about you, we can

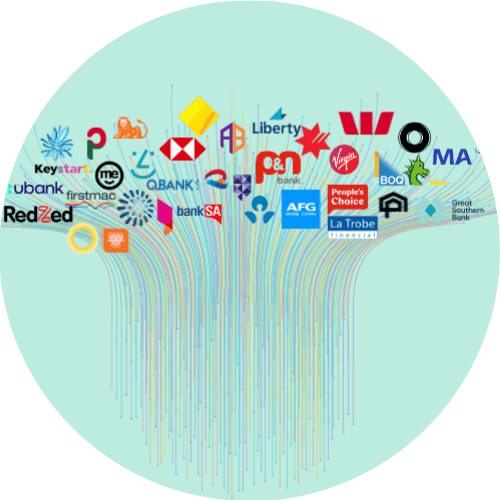

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Craggle’s Easy Approach to Helping Out With A Refinanced Mortgage

Are you exploring a refinanced mortgage, seeking more favourable terms amidst the intricate landscape of home loans? The world of mortgages can be a daunting maze of financial terminology, but you’re not alone.

With Craggle championing your cause, we’re dedicated to ensuring you receive the fairest refinancing deals available. Dive in with us to unravel the potential refinancing benefits and see how it can be a key step in optimising your home loan.

Craggle: Your Companion in Home Loan Refinancing

Craggle’s Unique Flair: The Crowd Haggle Advantage

Welcome to Craggle’s revolutionary world of refinanced mortgage through crowd haggling, where we embrace the spirit of unity to get the best home loan refinance deals. This is done through Craggle Event, where we aggregate the combined loan values of all Cragglers, presenting a compelling case to banks on behalf of its community.

This strategic approach is timed perfectly: giving banks the necessary window to evaluate the cumulative power of the Craggle community while ensuring you aren’t left waiting for too long.

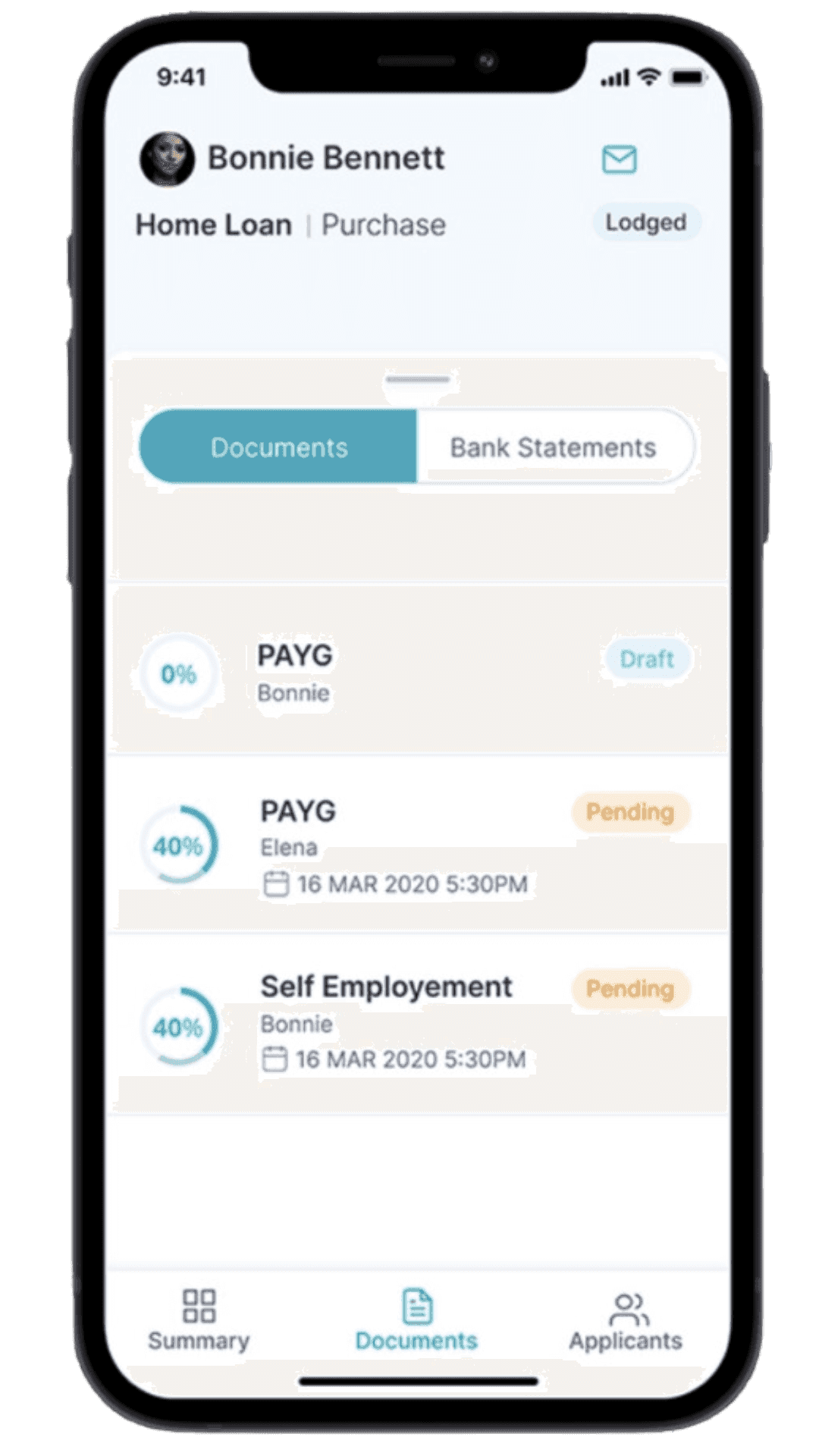

Step-by-Step with Craggle: From Signup to Empowered Decisions

Joining the Craggle community and making your way to a refinanced mortgage is a breeze. The process begins with a simple signup on our user-friendly platform, where you can safely share your home loan information confidentially.

Think of Craggle as your steadfast negotiator, working to secure refinance options with the most favourable terms from a mortgage lender. When the deal is offered, you have the power to say yes or no. Choose to say ‘yes’, and we’ll handle the nitty-gritty, transforming one of those refinance quotes into your new refinanced mortgage.

Home Loans with Assured Trust: Choose Craggle

With Craggle, you’re not just tapping into an innovative approach to secure better rates for a refinanced mortgage but also partnering with a trusted ally. Our commitment to data security is rock-solid, backed by a stringent privacy policy. Plus, our accreditation with the Australian Credit Licence, under ASIC’s watchful eye, ensures utmost credibility.

Frequently Asked Questions (FAQ)

How does a refinanced mortgage work?

In many ways, refinance mortgage rates are like refreshing your home loan. Imagine swapping your current mortgage for a better one, perhaps with a lower interest rate or more flexible terms. In doing so, you replace your old loan with a new one, continuing repayments but with improved conditions.

Refinancing your mortgage presents several compelling advantages. By leveraging the equity in your home, you can often secure a low-interest mortgage rate, leading to more manageable monthly payments. This not only reduces long-term interest costs but also empowers homeowners with better negotiation leverage. It’s also possible to transition to a shorter term by refinancing your mortgage.

Beyond these benefits, tapping into your home’s equity through refinanced mortgage provides the means to fund various endeavours – be it home improvements, a new vehicle, or even a subsequent property purchase. In essence, refinancing can be both a strategic financial move and a gateway to fulfilling pressing needs and aspirations.

What is the role of my home’s appraisal in refinancing?

A home appraisal is like a report card for your property, crucial in the world of refinancing. Why? Lenders want to know your property’s current value. This figure not only showcases the equity backing your home but also influences the approval of refinance deals.

If your home’s value has risen since you first bought it, Craggle could help you access better mortgage rates for refinance. The more equity you have in your home, the more leverage you have in negotiations to secure a favourable refinanced mortgage rate, leading to even greater refinance savings. Additionally, having at least 20% equity in your home can help you dodge Lenders Mortgage Insurance on your new loan.

Is it possible to refinance a second mortgage?

Refinancing a second mortgage is feasible, but it comes with its own unique set of challenges as you’re managing two loans. In some cases, the rate on the second loan may not be as attractive as the rate on your first loan – you therefore need to consider the overall savings across your portfolio of loans.

Getting mortgage rate refinancing is appealing, yet it requires discerning thought. Not only should one factor in potential fees that could diminish savings, but also the projected duration of residence; the process often favours long-term occupants. Your credit score, a mirror of your financial history, shapes the offers you’ll encounter.

It’s essential to assess various offers and grasp the subtleties of the home loan refinance world. With Craggle’s guidance, you can navigate the complexities of second mortgage refinancing confidently. After all, we’re here to make sure everyone plays fair with competitive rates for our Cragglers.

Whether you’re looking to renegotiate the interest rate with your existing lender or venture into new territories with a mortgage refinance, we’re your guide.

Craggle: Powering People’s Home Loan Dream

At Craggle, we believe there’s strength in numbers, and our Crowd Haggle system is living proof. Ever imagined having the reins of your home loan right at your fingertips? Craggle makes that dream a reality. By leveraging the collective force of Aussies, we’re championing the cause of securing the best home loan refinance rates for everyone.

With Craggle, you’ve got an army by your side, ensuring you get a fair shake at a great deal with your refinanced mortgage. And it’s not a one-sided love affair. Thanks to our unique model, banks too can join the jamboree, showcasing their offers and giving everyone a fair go. We’ve kicked off with home loans, but our eyes are set on revolutionising every deal out there. Sign up now!

Disclaimer: Unless otherwise specified, the opinions expressed in this article are strictly for general informational and entertainment purposes only and should not be taken as financial advice or recommendation. Views are subject to change without notice at any time.