We can do a lot, with just a little

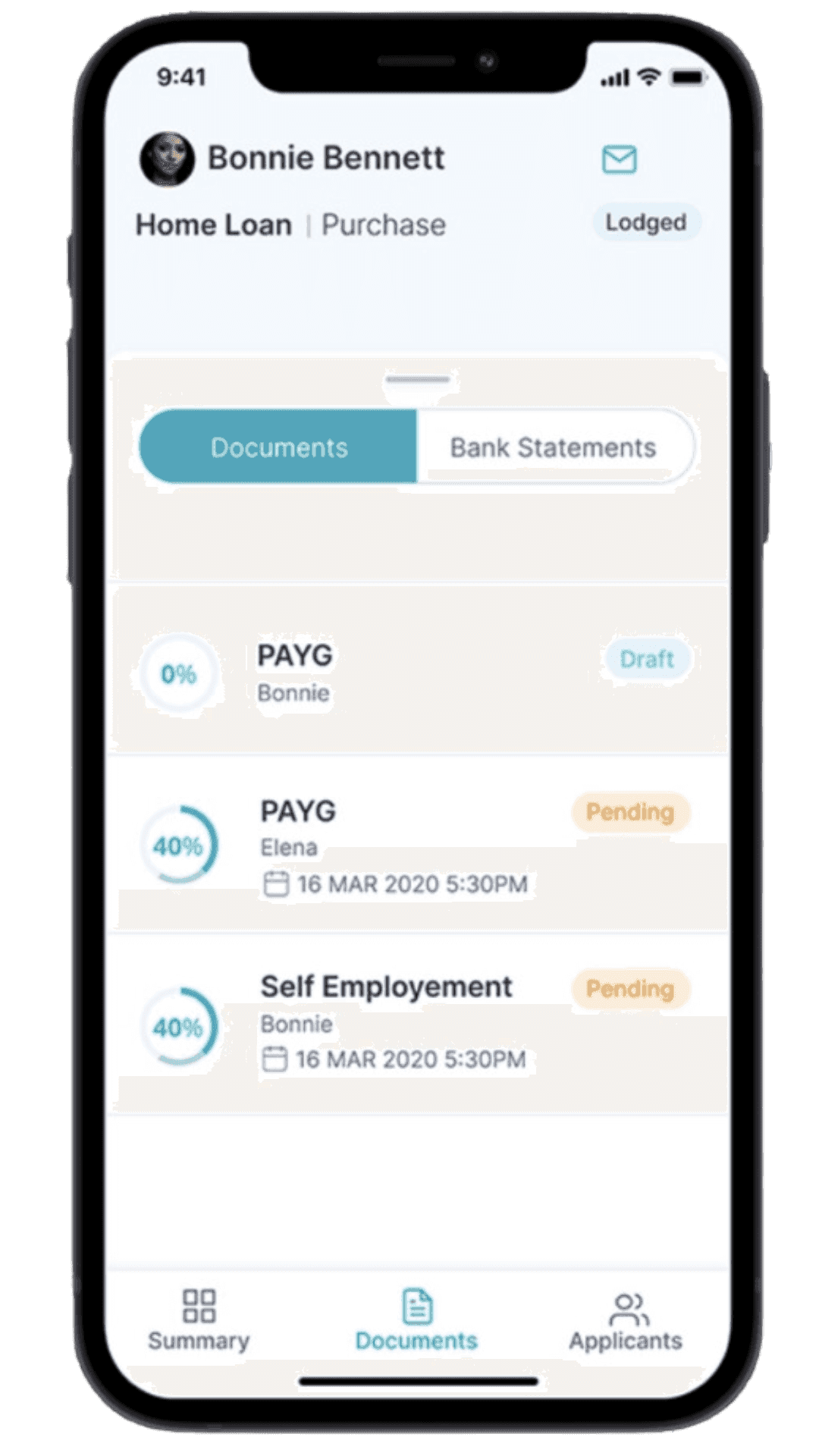

By answering a couple of simple questions about you, we can

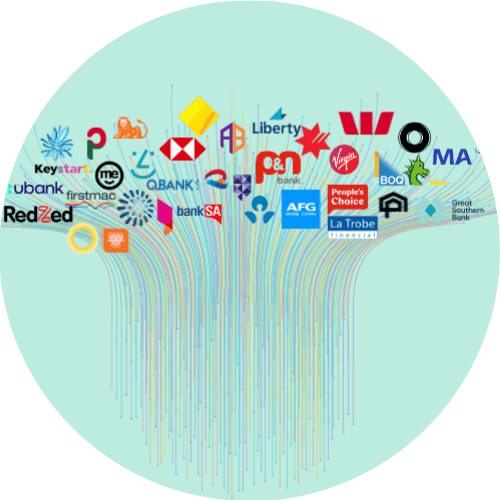

Compare Thousands of Loans Across 50+ Lenders

Show Best Rate Options that Suit Your Needs

Save Time, Paperwork and Stress

Expert Lender Advice, Anytime You Need

Compare >7,700 loan options across 50+ lenders to find the right loan for you

RECOGNITION AND FEATURES

Westpac

Westpac is one of Australia’s largest and oldest financial institutions, founded in 1817 as the Bank of New South Wales. Headquartered in Sydney, Westpac provides a full range of financial services, including retail, business, and institutional banking, as well as wealth management and insurance products. With millions of customers across Australia, New Zealand, and the Pacific Islands, Westpac is a key player in the country’s banking sector. The bank is known for its strong focus on innovation, customer service, and community engagement.

Key Features

Access

Westpac offers customers access to its services through an extensive network of branches and ATMs across Australia, as well as its state-of-the-art digital banking platform. Customers can manage their accounts, transfer funds, and access a wide range of financial services through the Westpac mobile app and online banking portal, which provide 24/7 accessibility. Westpac’s mobile app is highly rated for its ease of use, offering features like biometric login, bill payments, and instant payments via PayID.

Security

Security is a top priority at Westpac, which employs advanced technologies to protect customer data and financial transactions. The bank utilises multi-factor authentication, encryption, and real-time fraud monitoring to safeguard its digital banking platforms. Additionally, Westpac offers a Fraud Money Back Guarantee, ensuring that customers are reimbursed for any unauthorised transactions, providing peace of mind in both digital and in-branch banking.

Customer Service

Westpac is renowned for its strong customer service, offering support through multiple channels, including in-branch service, phone support, and digital options like live chat and social media. The bank’s customer service teams are known for being responsive and helpful, providing tailored financial advice and assistance. Westpac also has a dedicated accessibility program to ensure that customers with disabilities can access banking services easily and conveniently.

Community and Environmental Initiatives

Westpac is deeply committed to corporate social responsibility, actively supporting community and environmental initiatives. The bank engages in a range of programs aimed at improving financial literacy, supporting social enterprises, and contributing to disaster relief. Additionally, Westpac is a leader in promoting environmental sustainability, financing renewable energy projects and reducing its own environmental footprint. Through its Westpac Foundation, the bank also supports community organisations that focus on social and economic well-being.

Key Services

Westpac offers a wide array of financial products and services, including:

- Home Loans: A variety of home loan options, including fixed-rate, variable-rate, and split loans, catering to first-time buyers, investors, and refinancers.

- Personal Loans: Flexible personal loans for debt consolidation, home renovations, or major purchases, with competitive interest rates.

- Credit Cards: A selection of credit cards offering rewards, low-interest rates, and balance transfer options to suit different spending habits and financial needs.

- Savings and Transaction Accounts: High-interest savings accounts and everyday transaction accounts designed for easy money management and growth.

- Business Banking: Tailored financial solutions for small to medium-sized businesses, including business loans, merchant services, and cash flow management tools.

- Insurance: Comprehensive insurance options, including home, car, life, and health insurance, ensuring customers have the coverage they need.

What makes Westpac different

What sets Westpac apart from other banks is its combination of heritage, innovation, and community focus. As Australia’s oldest bank, Westpac has built a legacy of trust and reliability while continuously adapting to modern banking needs through its cutting-edge digital platforms. Westpac’s dedication to customer service, particularly through its accessible digital and in-person offerings, positions it as a bank that values convenience and support for all customers. Furthermore, Westpac’s commitment to sustainability and community development underscores its role as a socially responsible institution that not only serves its customers but also gives back to society. This balance of tradition, innovation, and social responsibility makes Westpac a leader in the Australian banking landscape.

Other Westpac Brands

|  |  |

|---|

Other Major Bank Alternatives

Australia's big banks with extensive branch networks across the country that provide a comprehensive range of services.

|  |  |

|---|

Non-Major Alternatives

Regional and Digital banking institutions that offer financial services.

|  |  |

|---|---|---|

|  |  |

|  |  |